Cryptos have taken over the contemporary world, with market players enjoying the volatility and public influence on major digital currencies including the infamous Bitcoin, Ethereum, Ripple & Litecoin. But, do digital currencies pose a risk to traditional markets and financial stability?

Once regarded as digital coins with little to no fundamental value, Bitcoin was launched in 2009 as the original crypto which started the whole cryptocurrency movement. Now, traders and non-traders have jumped onto the crypto train amid rising popularity of digital currencies. Some crypto enthusiasts mine, or in other words “gather” digital coins through sophisticated technology, while others purchase them. Typically, cryptocurrency trading incurs low fees on participants, and have huge profit potential, as the market has not cooled down in several years. Not only that, but cryptos are easy to use, transfer, and are typically non-traceable, with many regarding it as the future of money.

It might surprise you that a range of multinational companies have adopted cryptocurrencies as an alternate mode of payment. This includes leaders of the world such as the notorious Microsoft, AMC Theatres, Shopify, Virgin Galactic and Wikipedia. However, the rising popularity and volume of crypto-trading can be detrimental to traditional markets and financial stability.

The Dark Side of Crypto

While digital coins come with many benefits and opportunities, they can instill adverse repercussions in the financial market, and in turn the economic prosperity of many nations. Before diving into the potential issues cryptocurrencies can create on the financial market and its stability, it’s quite important to note the risk of hackingand theftwhich comes with the decentralized crypto trading. In mid-August, around $600 million in cryptocurrency has been stolen from finance platform Poly Network, marking the largest theft in crypto history. Poly Network urged the hackers in a written statement to return the money stolen, which has actually occurred. Yet, this portrays how unstable and decentralized cryptos are in reality, no matter how networks and services boast about their “safety & security”.

Another issue feeding into the risk factor is the volatilityand high-speculation of digital currencies. Unprecedented changes in market sentiment can result in sharp, sudden price movements. Cryptos are quite riskyassets, as they have no body/organization to back, manage and regulate them, unlike national currencies like the Euro. This means that cryptos can remain stable even with crises, but this presents an array of risks. With decentralization comes price manipulation, uncertainty and a greater risk of fraud. When investors are defrauded in the crypto world, they will not have the same legal recourse as traditional fraud victims.

The Musk Effect

Cryptocurrencies are greatly influenced by the public opinion and that of notable figures, such as the well-known Elon Musk. In February this year, the Tesla chief announced that the electric-car king bought $1.5 billion worth of Bitcoin, and the price of Bitcoin surged by 20% in one day. In the same month, Musk tweeted that “Dogecoin is the people’s crypto”. What do you think happened? Just as you thought, the price of the meme coin rocketed by 50% on that day. Such influence of the public is not as strong in traditional stocks and instruments, which have proven for decades to be more stable as they are backed by a governing jurisdiction, putting little to zero risk on trader & investor wallet vulnerability.

Cryptos & Financial Stability

The major pessimistic view of cryptocurrencies is that they loom as a threat to financial stability, in an array of ways. To begin with, the rapid rise of cryptos has the potential to limit the ability of central banks to set monetary policy to control the money supply, particularly in smaller countries. The reason behind this is that if digital currencies become a dominant form of global payments, it will raise concerns of fraud, tax evasion and cybersecurity which come hand-in-hand with such unregulated finance. The decentralized nature of cryptocurrency transactions diminishes the authority of central banks, which are quite vital for economic and financial stability and prosperity, with some believing that they will not be needed anymore.

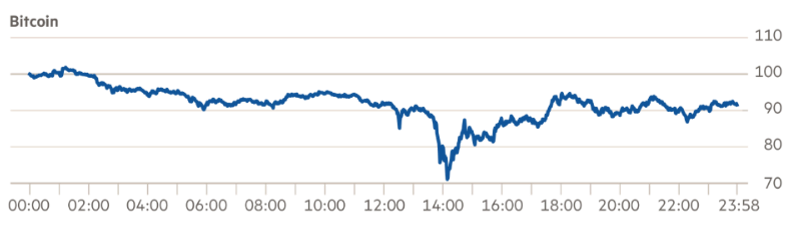

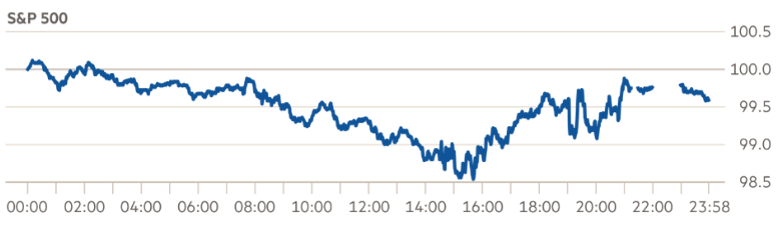

Also,cryptocurrencies turmoil can occasionally bleed into traditional financial markets. For example, in May 22ndof this year, tumbling Bitcoin prices pulled US stock indices lower. This can be seen in the chart provided by Bloomberg, pegging the S&P 500 index to Bitcoin.

Although there is no direct link between cryptos and centralized greenback assets, a crypto drop can trigger investors to withdraw their investments into USD-backed assets, as their risk appetite has been dented. Long-story short, cryptocurrency trading comes with a basket of benefits such as the potential of high and rather quick profitability. These advantages are often vulnerable to many risks, as digital coins are decentralized and can inflict harm on traditional markets and to a wider broad, the financial stability of national economies. No wonder why major countries such as China and Turkey banning the mining of cryptocurrencies.