Gold has undoubtedly rewarded its investors in recent years. Since 2023, the metal has gained more than 140% in value, reflecting rising U.S. tariffs on key trading partners, concerns over the long-term fiscal stability of the United States, and the weakening of the dollar.* This rally has traditionally led to further interest among investors, as confirmed by a World Gold Council report. During the second quarter of 2025, global demand for gold increased by 3% year-on-year in volume terms to 1,249 tons, while in value terms it rose by 45% to USD 132 billion.

Gold price performance over the past five years

Currently, the price of the yellow metal hovers around the key USD 4,000 per ounce level, and Bank of America projects that gold could reach USD 5,000 as early as 2026.

The Powering Force of the Future

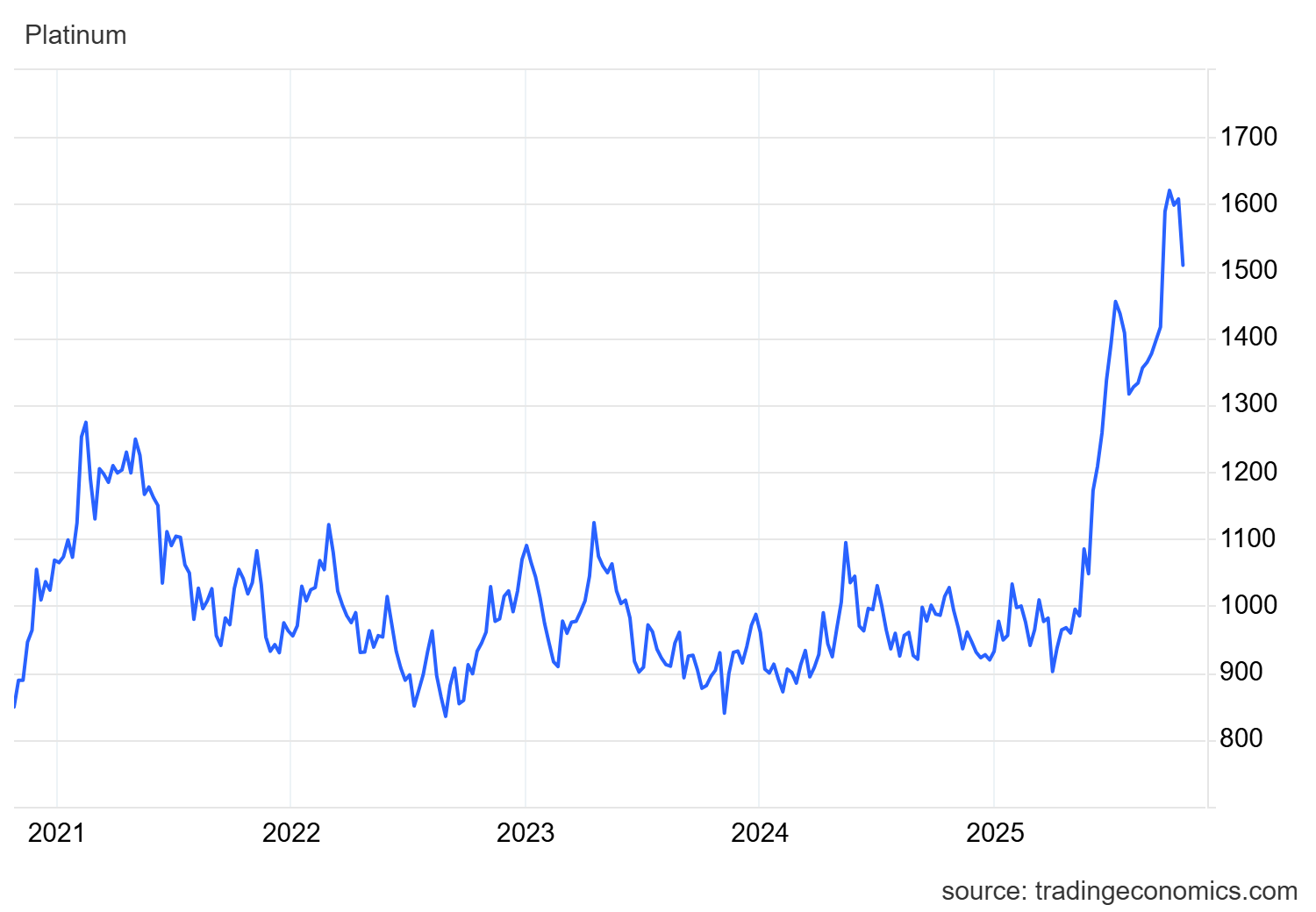

On the other hand, there is the rapidly expanding world of rare industrial metals – now an inseparable part of technological progress. These include platinum, copper, lithium, and neodymium, among others. According to a report by Strategic Metals Invest, these metals could outperform gold in terms of returns by 2035. Notably, as of October 2025, platinum has already outpaced gold, bringing investors gains exceeding 90%, while gold rose by roughly 65% over the same period.*

Platinum price performance over the past five years

Furthermore, analysts from Goldman Sachs and other major banks warn that the ongoing shift toward industrial consumption, from pure investment to technical applications, is changing the market paradigm. Metals that are integral components of high-tech devices are likely to experience growing demand and, consequently, a long-term structural growth story.

How to Use This in a Portfolio

For investors, this ultimately leads to a simple yet important conclusion. Gold and rare industrial metals do not have to compete within a portfolio – they can play complementary roles. If your goal is to protect against economic or geopolitical uncertainty, gold remains a reliable hedge. However, if you believe in the future of technology, innovation, and the expansion of AI infrastructure, then exposure to rare industrial metals ensures you are directly participating in that transformative trend.

* Past performance is no guarantee of future results.

Sources:

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q2-2025

https://nypost.com/2025/10/13/business/bank-of-america-hikes-gold-forecast-to-5000-an-ounce/