The year 2020 will go down in history as one of the most memorable and unpredictable years of our lives. The pandemic and resulting health crisis upended everyone, creating unique challenges for individuals, businesses, and governments. From a financial-markets perspective, 2020 was a year of unprecedented change but eventual resiliency.

In this new year, we hope that the light at end of the tunnel is brighter for economic recovery with ongoing rollout of coronavirus vaccines and hopes of bigger fiscal and monetary supports. Major market indexes are trading near record highs, reflecting a positive 2021 outlook, an outcome that was hard to envision during the early days of the pandemic.

While it is tempting to want to forget this year, the change of the calendar presents an opportunity to reflect and review some of the milestones of 2020. The summary done below is of course, not enough to cover all of 2020 market, but here are some highlights of the up and down that defined the economy and the markets over the past 12 months.

STOCK MARKET

2020 was a year that was weighed down by a pandemic and a tumultuous year that marked both the end of the longest bull market and the shortest-lived bear market ever, nevertheless ended positive overall for the stock market.

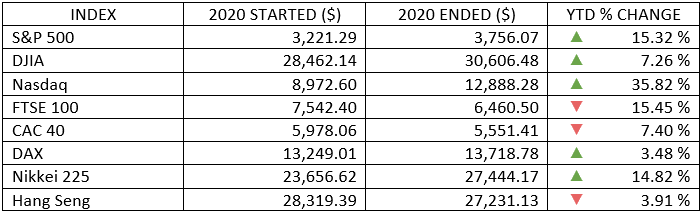

Wall Street's major indexes rounded off 2020 with strong gains as a wave of monetary stimulus and promising developments on the vaccine front helped the indexes recover from their sharpest contraction in decades.

The tech-heavy Nasdaq, which was the first among Wall Street's main indexes to turn positive for the year, noted its best yearly performance since 2009, with majority of gains led by FAANG stocks (Facebook Inc, Apple Inc, Amazon.com Inc, Netflix Inc and Alphabet Inc).

The S&P 500 index is on the cusp of a nearly 16% annual gain, after trillions of dollars in unprecedented monetary and fiscal stimulus measures, along with positive vaccine developments have helped the S&P 500 bounce back more than 70% from its late-March trough.

Japan's Nikkei share, meanwhile, on its last trading day of 2020 jumping to a 30-year high on Tuesday.

Shares in Europe and the UK slipped for the year, partly due to the uncertainty of the Brexit trade accord and the increasing number of the coronavirus cases in the regions. The UK market also edged lower as England extended its toughest coronavirus restrictions as the new variant of the virus emerged in the country.

The see-saw year marked by the worst selloff since the 2008 financial crisis and then the second-best annual advance of the past decade, as the MSCI benchmark gauge for emerging-market stocks is trading at a record-high valuation, to end the year about 14% higher, having surged almost 68% since its March low.

2021 sector outlook - Looking ahead, many Wall Street analysts have a positive view of three equity sectors: energy, healthcare, and information technology. Those are the sectors that had the highest percentages of “buy” ratings from analysts, as of late December, according to FactSet. Those with the lowest percentages of buy ratings were real estate, consumer staples, and financials.

OIL SECTOR

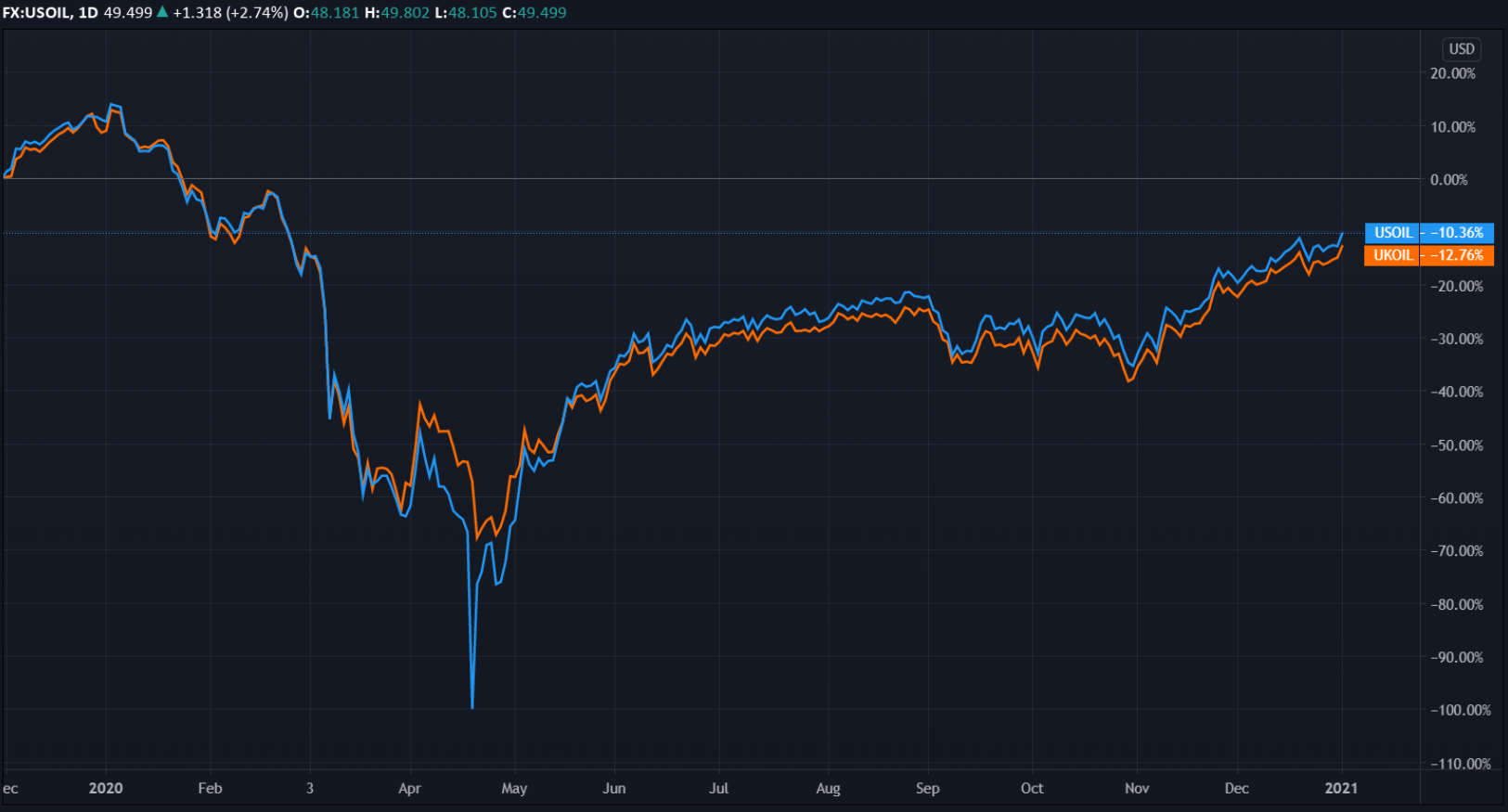

Global crude oil markets have lost about a fifth of their value in 2020 as strict coronavirus lockdowns paralysed much of the global economy, but prices have rebounded strongly from their lows as governments rolled out stimulus. Though, the rebound still left Brent down around 21.5% for the year, and WTI 20.5%.

Brent and WTI have more than doubled from decade-lows seen in April, marking the steepest drop since the Gulf War in 1991, putting past a year which marked the first negative prices for WTI that shocked investors globally when countries went under lockdown to curb the spread of COVID-19. The recovery from the pandemic will accelerate once a vaccine is widely available, further supported by ongoing fiscal and monetary stimulus from governments around the world.

CURRENCIES

Against a basket of currencies, the dollar index was last around 89.50, having touched its 2-1/2-year lowest since April 2018. That left it down more than 7% on the year 2020, and no less than 13% on the 102.99 peak hit during the market mayhem of mid-March. The next target for the index is at 89.277 and then 88.251, which was the absolute low in 2018.

Many investors are already looking ahead to a new government under Biden when he is sworn in on Jan. 20. A Democratic and Joe Biden win in the 2020 U.S. election expected to further trigger dollar weakness, as investors assume it would lead to higher stimulus spending which would in turn boost market sentiment and weigh down on the dollar.

Another negative factor for the greenback is expectations that the U.S. Federal Reserve will keep interest rates low for an extremely long time, as announced in the last November FOMC meeting. In contrast, the European Union runs a huge current account surplus, largely thanks to Germany, so there is a natural inflow to euros through trade.

The prospect of a brighter 2021 drove higher on the non-dollar currencies, and with that, set the dollar on a downward course, slipping broadly as it sold for just about everything else, pushed several currencies, as well as Bitcoin to milestone highs.

Bitcoin accelerated its Q4 surge as the price jumped around 16% for the week and eclipsed $34,800 on Sunday for the first time. Bitcoin roughly quadrupled in price in 2020, as it started the year at around $7,200, amid surging interest from larger investors who variously see the cryptocurrency as a hedge against the threat of inflation, a risk-on asset, and a future payment method. The digital currency trades on numerous exchanges, the largest of which is Coinbase, itself preparing to go public to become the first major U.S. cryptocurrency exchange to list on Wall Street.

GOLD

Gold, regarded as a hedge against inflation and currency debasement, has risen over 24% in 2020 with the dominant government stimulus globally and vaccine narratives is in the driver’s seat.

The price of gold surged to an all-time high on August 1, to $2,070.48. The spike in the price was as investors were looking for safe havens to park their money, linked to the worsening of U.S.-China trade and political tensions, and the growing investor concerns that an economic recovery from the coronavirus pandemic might be weakening in the U.S. and elsewhere.

Looking back, 2020 is one of the most unpredictable years of our lives. The COVID-19 pandemic is leaving a long-lasting effect on individuals as well as on businesses. In terms of the equity markets, the year started with a global fear of recession, but eventually showed resilience and is looking to end 2020 on a high, reflecting a positive 2021 outlook.

Going into 2021, some key learnings from 2020 should prove to be useful. Firstly, markets are always forward-looking. While current economic conditions are still affected from the COVID-19 pandemic, investors will always discount future expectations into the capital markets. Secondly, fear creates opportunities. As the volatility index reached a record high in March 2020, the market plunge was immediately followed by strong returns. Periods of indiscriminate selling usually create long-term opportunities to enter the market. Lastly, the power of keeping a disciplined, long-term approach. Systematic investing and rebalancing helped investors navigate volatility this year without having to time the market. Aligning investment decisions with long-term goals rather than the headlines will help investors keep a level head.

With that, we bid farewell to 2020, and we wish all happy investing for 2021.