INTRADAY TECHNICAL ANALYSIS July 27th (observation as of 08:00 UTC)

[EURUSD]

Important Levels to Watch for:

- Resistance line of 1.11315

- Support line of 1.11077

Commentary/ Reason:

1. The price has moved in the observable price channel and reached another peak that may be a sign of pullback.

2. Volatility has been rampant after the fed announced another 25-bps rate hike while in anticipation of ECB rate decision that saw price fluctuated.

3. The upcoming ECB rate decision will be detrimental to the pair while slurry of non-current assets and labour market from the US will shift or boost trends.

4. The price is expected to trade higher but may face resistance at resistance area with expectation that a pullback is likely but not necessary for the price to move higher as USD keep weakening while ECB is determined to raise rate.

5. Technical indicators are positive with mostly buy and some overbought as do moving averages.

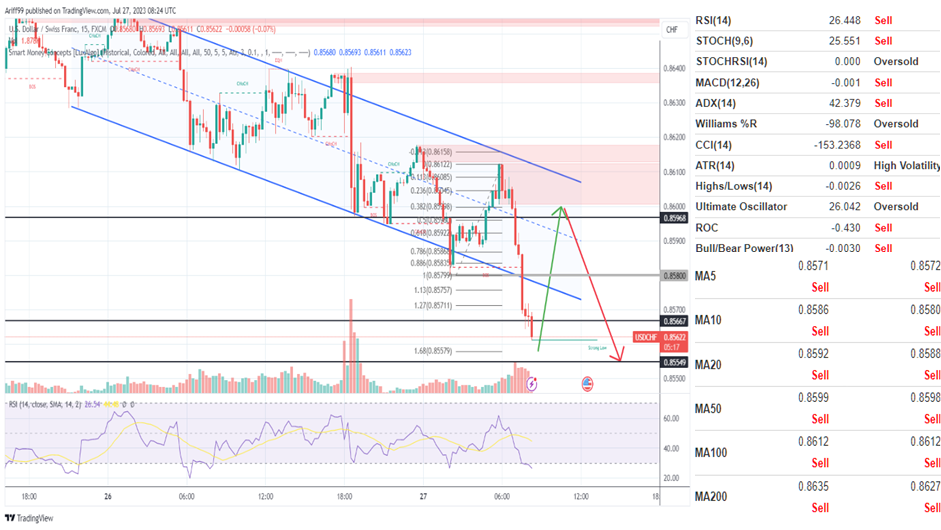

[USDCHF]

Important Levels to Watch for:

- Resistance line of 0.85667

- Support line of 0.85549

Commentary/ Reason:

1. The pair have been falling for quite a while and the latest move is the strongest as USD weakened while the franc stays resilient as there is plan for swiss to raise rate although inflation stays below target.

2. The price was mostly influenced by the fed decision to raise rate by 25-bps while signalling for no further hike and inflation expected to reach goals by 2025.

3. The upcoming ECB may move swiss franc although not directly, many economic ties swiss have with European country is significant enough to move the needle.

4. The price has already break support and expected to continue downward with a slight chance of a rebound before touching the final fibo target of 168% from previous retracement.

5. Technical indicators are mostly sell while all moving averages are also sell as a result from strong downtrend.

[USDJPY]

Important Levels to Watch for:

- Resistance line of 140.180

- Support line of 139.932

Commentary/ Reason:

1. The pair fell on the fed decision to raise rate but regain in prices after expectation that the BoJ will keep the policy unchanged is questioned.

2. IMF advised Japan to change its policy to prepare for future tightening has cause concern among investor as to the pressure mounting on Bank of Japan to move away from its ultra loose policy.

3. BoJ policy meeting is expected to be held the same day ECB rate decision, which will cause a lot of volatility in the market.

4. The price is expected to be sideways as expectation of no further rate hike by the fed is offset by the risk of BoJ moving away from current policy while technically, the price shows sign of a reversal pattern upward which predict the BoJ to change its policy although it’s a huge bet against 20-year old standing policy.

5. Technical indicators are mixed with most indicators stand at neutral as well as moving averages, mixed between sell in the shorter term and sell in the longer term.

[GBPUSD]

Important Levels to Watch for:

- Resistance line of 1.29908

- Support line of 1.29634

Commentary/ Reason:

1. The pair have been moving in the observable price channel and it is now at the peak which indicate the possibility of a pullback before continuing its path uptrend.

2. Sterling is another currency that have its economy tightly related to the European market that will be affected by ECB rate decision, but certainly strengthen for the last few weeks against USD as speculators are betting on UK market.

3. Although the ECB rate decision is later on Thursday, an expectation that the bank of England raising rate next week is also apparent to the volatility of the pair other than slurry of economic data from the U.S.

4. The price is expected to continue upward but it run a risk of pullback if its adhering to the movement of the price channel.

5. Technical indicator is certain with buy although some are already on overbought while most moving averages are on buy.