PAST WEEK'S NEWS (June 27 – July 3, 2022)

The major indexes surrendered a portion of the previous week’s strong gains as concerns about economic growth, earnings growth, inflation, and central bank rate hikes remains front and center for consumers and policymakers.

Inflationary pressures continue to mount, prompting central banks to embark on aggressive monetary policy tightening and exacerbating fears of a global economic slowdown.

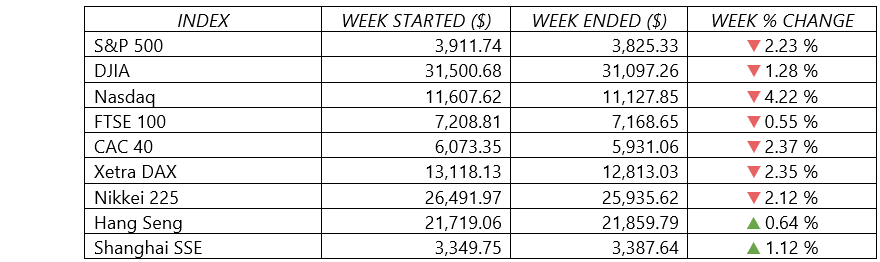

Indices Performance

U.S. stocks couldn’t maintain their positive momentum from the previous week’s rally, as the major U.S. indexes fell around 1% to 4%. The S&P 500 and the NASDAQ recorded 11th negative weekly result out of the past 13.

As June concluded, the S&P 500’s closing level on Thursday was down 21.0% from the start of the year, marking the index’s worst first-half performance of any year since 1970. As for June’s monthly result, the index was down 8.4%, the worst June performance since 2008, according to S&P Dow Jones Indices.

Shares in Europe also fell on fears that soaring inflation and rising interest rates could hit earnings and tip economies into a recession.

In Asia, Chinese stocks advanced on the back of strong factory data and easing coronavirus restrictions for travellers.

Crude Oil Performance

Oil prices traded rangebound for the week as lingering fears of a recession demand weighed on sentiment, amid supply tightness concerns.

The Group of Seven nations promised to tighten the squeeze on Russia's finances with new sanctions that include a plan to cap the price of Russian oil. Another prospect of more supply tightness also looms after the United Arab Emirates' energy minister said the nation is producing near capacity, countering expectations that it could help boost supply in a tight market. The UAE and Saudi Arabia have been seen as the only two countries in the OPEC with spare capacity available to make up for lost Russian supply and weak output from other member nations.

OPEC+ gave no surprise, despite U.S. pressure to expand quotas, saying it would stick to its planned oil output hikes in August, Previously, OPEC+ decided to increase output each month by 648,000 bpd in July and August, up from a previous plan to add 432,000 bpd per month.

Inventory data in the U.S. however, did provide some sense of improving fuel supply. Stockpiles of gasoline for the week ending June 24 rose by 2.9 million barrels and distillate fuel supplies increased by 2.6 million barrels, according to market sources citing American Petroleum Institute figures on Tuesday. However, crude inventories fell 3.8 million barrels.

Meanwhile the Energy Information Administration reported that U.S. crude inventories fell last week even as production hit its highest level since April 2020. Crude inventories fell by 2.8 million barrels in the week to June 24, far exceeding analysts' expectation for a 569,000-barrel drop. The gasoline and distillate stockpiles meanwhile climbed.

Other Important Macro Data and Events

The U.S. dollar continues to remain a flight-to-safety asset. The DXY trade-weighted dollar index is now near a 10-year high, close to 105 track for its best week in four, as investors weighed the boost from tighter Federal Reserve policy and the risks of a U.S. recession.

The Fed has lifted the policy rate by 150 basis points since March, with half of that coming last month in the central bank's biggest hike since 1994. The market is betting on another of the same magnitude at the end of this month.

Prices of U.S. government bonds climbed for the third week in a row, sending the yield of the 10-year U.S. Treasury bond down to 2.89% on Friday from 3.13% at the end of the previous week. As recently as June 14, the yield climbed as high as 3.48%—a level not seen since April 2011. The yield on the 2-yr note sank 23 basis points to 2.83%.

Those moves were catalysed by some disappointing economic data that included a weaker-than-expected Consumer Confidence Index for June that featured the lowest reading for the Expectations Index (66.4) since March 2013 and a bump in the year-ahead inflation expectation to 8.0% from 7.5%.

That news was followed later in the week by the Personal Income and Spending Report for May, which featured a 0.4% decline in real personal spending and a still elevated 4.7% year-over-year change in the core-PCE Price Index, and the softest ISM Manufacturing PMI reading for June (53.1%) since June 2020.

Fed commentary during the week still leaned to the hawkish side. San Francisco Fed President Daly (not an FOMC voter this year) started things on Monday with an acknowledgment that she sees scope for additional tightening beyond the neutral rate. Cleveland Fed President Mester (FOMC voter) said she supports a 75-basis point rate hike at the July meeting if conditions remain the same.

Fed Chair Powell, meanwhile, told an ECB Forum that the importance of fighting inflation is worth the risk of slowing economic activity too much since failing to restore price stability would be the bigger mistake.

The annual inflation rate in the eurozone climbed to 8.6%, the highest level recorded since the creation of the euro currency in 1999. Data released on Friday by Eurostat, the European Union's statistics agency, showed that nearly half of the 19 countries in the eurozone now have double-digit annual inflation, in part due to high energy prices.

Selling pressure continued to weigh on cryptocurrencies, as the value of Bitcoin fell below $20,000, hurt by the U.S. Securities and Exchange rejecting a proposal to list a spot bitcoin exchange-traded fund by Grayscale, one of the world's biggest digital asset managers. The world’s largest cryptocurrency by market capitalization was down from a record high of more than $65,000 in November 2021.

Gold at weekly loss, as it also faced its worst quarter since early 2021 as a remarkable showing from the dollar kept investors away, while also pressured by top central banks adopting aggressive tactics against stubborn inflation. Bullion's performance in the second quarter erases gains made earlier in the year as a spiralling Ukraine-Russia conflict lifted demand for the safe haven, with prices back around levels they started 2022 at — just above the $1,800 mark.

What Can We Expect from the Market this Week

The economic calendar includes the factory orders report on July 5, the JOLTS job openings release on July 6, and the employment report on July 8. A monthly U.S. labor market update due out on Friday will show whether the strong—but moderating—jobs growth recorded in recent months extended into June. In May, the economy generated 390,000 new jobs—the smallest monthly gain since April—while the unemployment rate stayed unchanged at 3.6%.

FOMC minutes will also be released next week and there will be a smattering of Fed speakers as the guessing on the central bank's tightrope walk with inflation and interest rates continues. Traders will pore over the minutes from the last FOMC meeting as they assess the trajectory of interest rate increases. Bank of America's latest forecast is for the Fed to deliver another 75-point rate hike at the July meeting, followed by a 50 point increase in September. Following that, the firm expects the Fed to move in more traditional 25-point increments.