PAST WEEK'S NEWS (JULY 10 – JULY 14, 2023)

US headline inflation in June rose at a slower pace than expected, with the consumer price index increasing by 3.0% annually, down from 4.0% in May. Core CPI, which excludes volatile items, cooled only to 4.8% yearly. Despite headline inflation nearing the Fed's target, the lower core figures have fuelled speculation of an interest rate hike later this month. Energy prices declined by 16.7% year-over-year, but consumer related items like food and services rose by 5.7% and 6.2%, respectively, pressuring average households. The market still expects the Fed to raise interest rates by 0.25% and predicts that a recession will be triggered by year's end, according to economic projections.

China's economy is in a shaky state due to sluggish consumer spending, a worsening property market, and flagging exports. These strains are starting to impact global commodity prices and equity markets. China's growth target of 5% this year may not be impressive when considering the low base of comparison due to COVID-19 restrictions in 2022. The country is also grappling with the risk of deflation and a decline in domestic travel and consumer spending. Government intervention to curb property speculation and reduce debt levels may limit their ability to implement significant stimulus measures. As a result, China's economic growth may remain weak, akin to Japan's, potentially hindering its progress in surpassing the US as the world's largest economy.

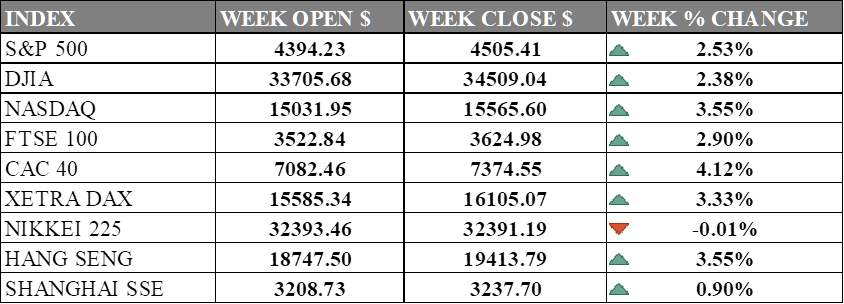

INDICES PERFORMANCE

The S&P 500 rose 2.53% for the week, closing at 4505.41. This gain was driven by strength in bank earnings after JPMorgan Chase, Wells Fargo, and Citigroup reported better-than-expected Q2 earnings. A Fed officials said moderating inflation is "promising" but still too high, adding the Fed is on a "golden path" to taming inflation without causing a recession. The Dow Jones Industrial Average climbed 2.38% for the week to end at 34509.04 with UnitedHealth jumping by more than 7% on Friday after lower expenses reported. The tech-heavy NASDAQ composite posted the largest weekly gain of 3.55%, finishing at 15565.60 with Salesforce surging 9% on a price hike and Nvidia hitting a record high. The chip index reached an 18-month peak but pared gains after hitting the 50% mark for the year.

In Europe, the UK's FTSE 100 rose 2.90% for the week to 3624.98, the French CAC 40 gained 4.12% to 7374.55, and the German XETRA DAX added 3.33% to end at 16105.07. Investor sentiment was lifted by hope that price pressures may moderate without a big spike in joblessness, signalling the Fed could end its tightening cycle soon.

Asian indices were mixed. Japan's Nikkei 225 index edged down 0.01% for the week to 32391.19, weighed down by the yen strengthening against the US dollar and the Bank of Japan's upcoming policy meeting has fuelled speculation it could tweak its ultra-loose monetary policy. Hong Kong's Hang Seng jumped 3.55% to 19413.79. China's Shanghai Composite added 0.90% to close at 3237.70.

Overall, global markets rallied this week as strong corporate earnings and easing outlook on Federal Reserve monetary policy boosted investor risk appetite. The US indices hit record highs while European and some Asian markets also posted solid gains. However, concerns over disinflation and central bank end of tightening cycle remain in focus going forward.

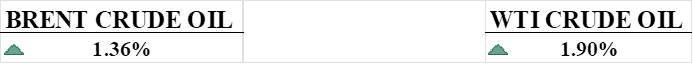

CRUDE OIL PERFORMANCE

China's economic rebound is slowing, threatening oil demand despite strong diesel production and imports. Refiners may have overestimated China's recovery and expanded output too much. Lower Chinese oil demand could weigh on prices that have rallied for 3 weeks. WTI crude rose 1.9% this week to $75.22 per barrel, while Brent gained 1.36% to $79.63. However, oil faces resistance approaching $80-$85 and remains vulnerable to slowing Chinese growth.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. consumer sentiment jumped to its highest level since September 2021 in July as inflation slowed and the job market stayed strong, according to a University of Michigan survey that saw the overall index climb to 72.6 from 64.4 in June. Sentiment rose for most groups except lower-income consumers as one-year and five-year inflation expectations edged up slightly.

The U.S. government posted a $228 billion budget deficit for June, up 156% from a year earlier, as revenues continued to weaken and July benefit payments were accelerated into June, according to the Treasury Department. For the first nine months of the 2023 fiscal year ending September 30, receipts fell 11% and outlays rose 10% compared to the same period last year, driven by higher interest costs, individual tax refunds, and social security payments.

U.S. producer prices barely rose in June and posted the smallest annual increase in nearly three years as supply chain bottlenecks ease and demand for goods slows, further evidence that the economy has entered a period of disinflation even though the labor market remains tight. The slowing inflation readings will likely move the Federal Reserve closer to ending its aggressive interest rate hikes that were intended to curb high inflation.

What Can We Expect from The Market This Week

US Retail Sales: Retail sales measure the total receipts of retail stores. The latest data shows that US retail sales rose 0.3% month-over-month in May and are expected to rise 0.5% in June. This indicates continued consumer spending despite high inflation.

US Industrial and Manufacturing Production: Industrial production measures the output of factories, mines, and utilities. US industrial production fell 0.2% last month, while manufacturing activity was slightly higher by 0.1%.

UK and Eurozone CPI: The CPI measures inflation. UK CPI rose 8.7% year-over-year in May, while Eurozone CPI rose 6.1%. High inflation squeezes consumer purchasing power in both regions. The BoE and ECB are expected to continue raising interest rates to combat inflation, though higher rates could also slow economic growth.

US Building & Housing: US housing starts surprised with a 21.7% gain month-over-month in May. Although rising mortgage rates are thought to have cooled housing demand, new asset creation is at its highest since 2016.

Canada Manufacturing and Retail Sales: Canadian manufacturing sales were 1.2% higher last month. However, Canadian retail sales rebounded slightly, by 1.1%, indicating resilient consumer spending.