PAST WEEK'S NEWS (JANUARY 22 – JANUARY 26, 2024)

The FTC is flexing its muscles, demanding information from big tech and generative AI startups to delve into their complex partnerships. Driven by fears of stifled competition, potential security threats, and market manipulation, the agency seeks to dissect deals between Microsoft, Google, and Amazon and AI powerhouses like OpenAI and Anthropic, scrutinizing how these billion-dollar investments and cloud credit offerings influence strategy, pricing, and resource access. This inquiry sends a clear message: the industry is under the microscope, and potential future enforcement actions are on the table.

Alarmed by a $4.4 trillion stock market plunge, Chinese authorities are launching a multi-pronged rescue mission. State-owned firms will be incentivized to improve performance; regulators vow to crack down on manipulation and stabilise markets; and targeted interventions like limiting short selling offer immediate support. Though scepticism lingers, Beijing's resolve and attractive valuations are drawing cautious optimism, with some investors like Bridgewater seeing potential opportunity in the turmoil.

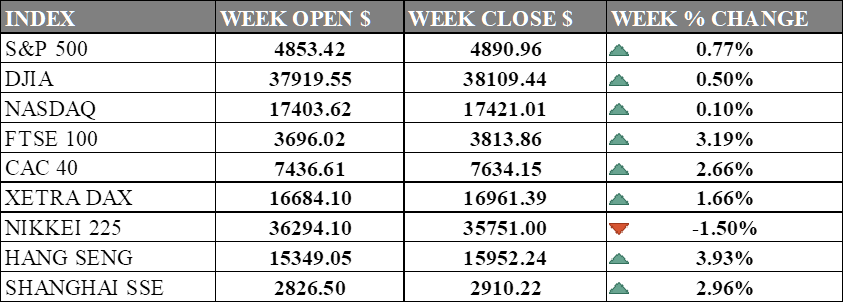

INDICES PERFORMANCE

The major U.S. stock indexes ended mostly higher last week, breaking above resistant establishing new all-time high albeit slowing growth. The S&P 500 advanced 0.77% to close at 4890.96, up from its open of 4853.42. The Dow Jones Industrial Average rose 0.50% to finish at 38109.44 compared to its starting point of 37919.55. The tech-heavy Nasdaq jumped 0.10% to 17421.01 after opening the week at 17403.62. Investors await the Fed's Wednesday policy meeting for hints on potential interest rate cuts, while Friday's jobs report and tech giants' earnings, such as Microsoft and Amazon, will offer insights into the sustainability of market gains that is dominated by the magnificent 7.

In Europe, the major indexes were mixed. The UK's FTSE 100 rose 3.19% to close at 3813.86 compared to its open of 3696.02. France's CAC 40 climbed 2.66% to end the week at 7634.15 after opening at 7436.61. Germany's XETRA DAX advanced 1.66% to settle at 16961.39 from its starting point of 16684.10. Blue-chip German shares closed higher in its recovery from recession, driven by corporate updates during the earnings season. The positive performance was led by Sartorius, which reported a 10% increase and expressed optimism for 2024. However, economic indicators point to a drop in consumer sentiment for Germany in February and a gloomy outlook for the German export industry.

Asian indexes were also mixed on the week. Japan's Nikkei 225 fell 1.50%, closing at 35751.00 versus its open of 36294.10 after a decline in crucial inflation measure that occur faster than predicted, dropping to 1.6% in January from 2.4%. Hong Kong's Hang Seng rose 3.93% to finish at 15952.24 from its starting level of 15349.05. China's Shanghai Composite climbed 2.96% to close at 2910.22 compared to its open of 2826.50. Strong weekly performances were driven by Beijing's supportive policies, which included significant reductions in bank reserves, measures to alleviate liquidity crunch for property developers, suspension of short selling, and reports of a 2 trillion-yuan offshore fund rescue package.

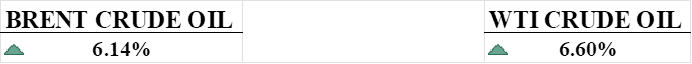

CRUDE OIL PERFORMANCE

Oil's bullish rally extended for a second week, reaching two-month highs for multiple factors. China's stimulus plans and robust US economic data expected to be main demand driver, while supply gluts on Houthi blocks and tight prompt supply along with longer shipping time. WTI and Brent both surged over 6% weekly, the strongest since October's Gaza conflict, as US inventory drawdowns, Ukrainian refinery strikes, and rising rig counts further ignited the price surge. However, bets on delayed US rate cuts and rising US drilling tempered gains, hinting at potential near-term headwinds.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. price growth increased by 0.2% in December, with the core PCE price index rising 2.9% year-on-year, suggesting a gradual return to the Federal Reserve's 2% inflation target. Despite signs of inflation easing, financial markets are pricing in around 50% chance of a quarter-basis point reduction in May, and the Fed's cautious approach is seen as effective in achieving a "soft landing”. The U.S. economic growth also exceeded expectations, growing at a 3.3% annual rate in the fourth quarter, driven by strong consumer spending.

The UK economy showed signs of strength in January, with the S&P Global/CIPS UK Composite PMI reaching its highest point in seven months at 52.5. While the services sector grew, the manufacturing sector faced challenges due to inflationary pressures from Red Sea tensions, potentially causing the Bank of England to delay interest rate cuts in its meeting this week.

What Can We Expect from The Market This Week

Fed Interest Rate Decision: A meeting conducted by the Federal Reserve involves choices to increase, decrease, or maintain interest rates, impacting borrowing, lending, and overall economic activity. Rate cuts are not expected for this meeting but for the meeting after it in March, with an almost 50% chance of a soft rate cut.

German GDP Q4: Germany's DIW economic institute revised its growth forecasts downward for the next two years, anticipating a slow recovery from recession for the country's largest economy. The revision is attributed to budget cuts in industry aid, with the German economy expected to contract by 0.3% in 2023, grow by 0.6% in 2024, and 1.0% in 2025.

CB Consumer Confidence: A monthly survey of 5,000 U.S. households was used to gauge consumer confidence in the economy. The recent increase to 110.7 in December 2023 reflects a notable upturn in consumer confidence, potentially impacting future economic growth and spending in a positive direction.

BoE Interest Rate Decision: The meeting involves announcing changes in the interest rate, a vital tool for controlling inflation and stabilising the economy for the UK's Sterling Pound. The BoE has seen a series of interest rate hikes, rising from 0.25% in December 2021 to 5.25% in August 2023 and holding, driven by concerns over inflation and aimed at maintaining price stability and supporting the UK economy, although prices stabilised at 4%.

US Nonfarm Payrolls: A monthly report by the Department of Labour measures job changes in the US economy, excluding farming, which saw 216K jobs added and expected 173K for this month. As a crucial economic indicator, it influences global markets, currencies, and the Federal Reserve's monetary policy, reflecting the strength of the world's largest economy.