PAST WEEK'S NEWS (June 03 – June 07, 2024)

The Bank of Japan is expected to reduce its purchases of Japanese government bonds, which are currently above 6 trillion yen per month. This reduction in bond purchases is seen as a softer form of monetary tightening compared to outright rate hikes. Although some analysts predict another rate hike to counter the depreciation of the Japanese yen, UBS argues that currency market management falls more under the purview of the Ministry of Finance. UBS forecasts the BOJ to hike rates by October to 0.25%, but a surprise hike in July cannot be ruled out due to recent wage data for April that show promising signs of improved consumption and higher inflation. The gains in base pay are expected to spread to employees of smaller firms, but workers' earnings are still lagging behind rising costs.

The May U.S. jobs report showed a gain of 272,000 payrolls, far exceeding estimates. Hiring was widespread across industries like leisure/hospitality, government, and professional services. The unemployment rate ticked up to 4%, but labour force participation for prime-age workers hit a new record high driven by women. Immigration continues boosting workforce growth though border policies may change this. Recent months show more people exiting the labour force than entering, a softening signal. With jobs and wage growth so strong, the Federal Reserve is now less likely to cut interest rates soon unless upcoming data significantly weakens.

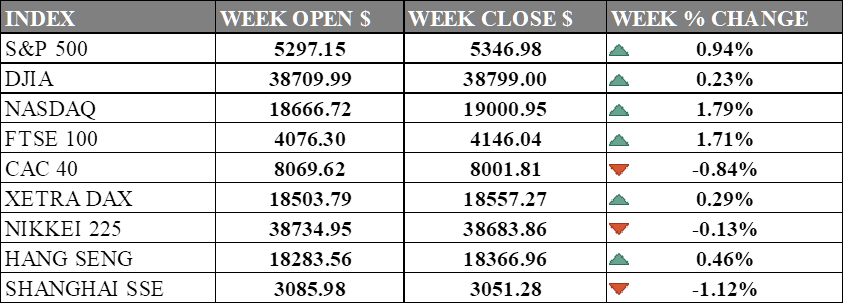

INDICES PERFORMANCE

The major U.S. stock indexes rose last week. The S&P 500 gained 0.94% to close at 5346.98 from its open of 5297.15. The Dow Jones Industrial Average (DJIA) increased 0.23% to finish at 38799.00 compared to its opening level of 38709.99. The Nasdaq also climbed 1.79% to close at 19000.95 after opening the week at 18666.72. The index closing above 5,340 confirms a new upward trend in the ongoing bull market, supported by positive technical indicators like declining put-call ratios, strong market breadth, and a low VIX level. Healthcare and Tech companies like Nvidia contributed to last week gain as the company split its stock at $3 trillion valuation.

In Europe, results were mixed. The UK's FTSE 100 rose 1.71% to close at 4146.04 compared to its open of 4076.30. Germany's XETRA DAX increased 0.29% closing at 18557.27 from its starting point of 18503.79. France's CAC 40 declined 0.84% to end the week at 8001.81 after opening at 8069.62. European market reacted to French President Emmanuel Macron's call for a snap election following gains by the far-right in European Parliament voting. French stocks and banks led the losses across Europe with political uncertainty taking head.

Asian markets saw divergent performances. Japan's Nikkei 225 dipped 0.13%, closing at 38683.86 versus its open of 38734.95 as losses in the shipbuilding, insurance, and banking sectors weighed. Hong Kong's Hang Seng gained 0.46% finishing off at 18366.96 from its starting level of 18283.56. China's Shanghai Composite posted a loss of 1.12%, ending the week at 3051.28 compared to an opening figure of 3085.98. China market became riskier as U.S. lawmakers pushed to ban Chinese battery firms with ties to Ford and Volkswagen from exporting to the United States despite data showing growth in China's exports for a second month in May and at a faster pace.

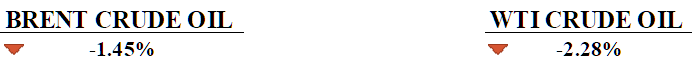

CRUDE OIL PERFORMANCE

Brent crude oil prices faced a decline to a four-month low last week due to OPEC's output decision and disappointing U.S. economic data. However, prices have since recovered, and an upward trajectory is expected in the coming days as the market overreacted and market cycle points toward stagnation until August. OPEC+ has a plans to gradually increase oil production starting in October, but it will react to market conditions. Despite reversing the voluntary output cuts, the market is likely to remain undersupplied in the second half of the year, leading to a rise in prices in the medium term. Commerzbank expects Brent crude to reach $90 per barrel by the end of 2024 and 2025, down from its previous forecast of $95 per barrel.

OTHER IMPORTANT MACRO DATA AND EVENTS

Japan's economy shrank 1.8% year-over-year in Q1, less than the initial 2% estimate, as capital spending declined less than expected. However, the economy still contracted due to weak private consumption hit by high inflation and a weak yen.

The European Central Bank delivered its first interest rate cut since 2019, lowering its deposit rate to 3.75% from 4%. While the ECB cited progress on inflation as the reason for the cut, the move confused investors given recent stronger-than-expected wage and price data.

What Can We Expect from The Market This Week

Fed Interest Rate Decision: Federal Reserve is expected to maintain the federal funds rate at 5.25% to 5.5%, continuing its strategy against inflation and never giving in to trends unless inflation is actually under the 2% target. However, the Fed has also announced a slowdown in quantitative tightening, signalling a cautious approach to dwindling growth.

US CPI May: Last month figures showed a 0.3% monthly increase, with a 3.4% rise over the past year, reflecting higher costs in shelter and gasoline. The data indicates a slight deceleration in annual inflation, with energy prices up 2.6% and food prices up 2.2% over the year, not enough to warrant a rate cut, although it does provide some guidance.

German CPI May: Last month's figures indicate a 2.4% year-on-year inflation rate, with a notable 1.1% decrease in energy prices and a 3.0% core inflation rate. While inflation is still far from 2%, the ECB has seen a cutting rate by a quarter basis point to 3.75%.

BoJ Interest Rate Decision: The Bank of Japan held its key interest rate at 0%, maintaining the rate set after a historic rise in March, which marked the end of the negative interest rate policy initiated in 2016. Japan's government plans to work closely with the central bank and flexibly adjust policies due to weak consumption and inflation uncertainty. The draft calls for policies to boost wages faster than inflation to move away from deflation.

UK GDP April: Economic growth in the UK shows an increase of 0.6% in Q1 with a 0.4% increment just in March, signalling a strong rebound from the previous quarter’s contraction and a trend of increasing growth. It is explained by a strong services sector and increased household spending, although the construction sector saw a decline.