PAST WEEK'S NEWS (September 09 – September 13, 2024)

U.S. businesses in China are seeing a drop in optimism, with only 47% having a positive five-year outlook, the lowest since 1999, according to an AmCham Shanghai survey. Key challenges include geopolitical tensions, China's slowing economy, and tough domestic competition, contributing to record-low profitability. The uncertain U.S.-China relationship and regulatory hurdles are causing 40% of U.S. firms to shift investments, mainly to Southeast Asia and India. Meanwhile, China plans to gradually raise the retirement age starting in 2025 to address demographic challenges, though public concerns remain given the economic slowdown.

The headline inflation rate came in lower, as expected, dropping to 2.5%, its lowest level since February 2021, while core inflation (excluding food and energy) stood at 3.2% and remained far from the 2% target. Previous bets of a larger cut recede, with majority market participants looking at 25 bps cut. The Fed is projected to continue cutting rates for at least 18 months to two years. Diving deep, the report showed year-over-year energy inflation at -4.0%, food inflation at 2.1%, services inflation at 4.9%, and shelter inflation at 5.2%. Federal Reserve officials, including presidents from Chicago and Atlanta, have indicated support for rate cuts, pointing out major inflation slowdowns and fears of possible labour market disruptions.

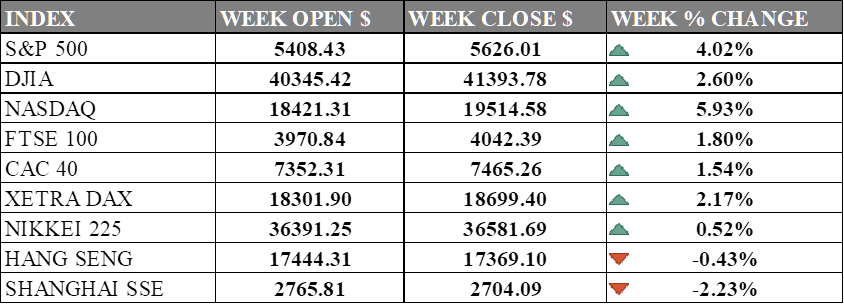

INDICES PERFORMANCE

Wall Street experienced a significant upturn this week, with all major indices recording substantial gains. The S&P 500 rose 4.02% to close at 5,626.01. The Dow Jones Industrial Average saw an increase of 2.60%, finishing at 41,393.78, while the tech-heavy Nasdaq performed the best, surging 5.93% to close at 19,514.58. These market gains are largely attributed to growing optimism about the economic outlook, with investors showing confidence across all sectors, particularly in technology stocks.

Across the pond, European markets also experienced moderate gains. The UK's FTSE 100 rose 1.80%, closing at 4,042.39. France's CAC 40 saw a 1.54% increase, closing at 7,465.26. Germany's DAX experienced a 2.17% climb, ending at 18,699.40. European markets reflected the positive sentiment in global equities, with various sectors contributing to the overall gains.

Asian markets presented a mixed picture, with gains in Japan but losses in China and Hong Kong. Japan's Nikkei 225 saw a modest increase, rising 0.52% to 36,581.69. Hong Kong's Hang Seng Index posted a slight loss of 0.43%, closing at 17,369.10. The Shanghai Composite in mainland China experienced a more significant decline, falling 2.23% to close at 2,704.09.

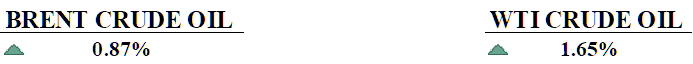

CRUDE OIL PERFORMANCE

Last week, crude oil prices gained on expectations that the U.S. Federal Reserve would cut interest rates, while ongoing disruptions in Gulf of Mexico oil production due to Hurricane Francine further supported prices. With about 25% of oil production and 28% of natural gas output still offline, and political instability in Libya hampering its oil production, these factors drove a modest rise in prices. However, a bearish market sentiment limited gains, and weak economic data from China—its industrial output growth slowing to the lowest pace in five months—cast a shadow over global oil demand. This has led to heightened expectations that China may implement stronger stimulus measures to support growth. Analysts remain divided on the Fed’s next move, with many expecting a 25-basis point rate cut, but some predicting a more aggressive stance. Moving into next week, the market will be closely watching the Fed's decision and any signals of additional stimulus from China, which could further shape oil price trends.

OTHER IMPORTANT MACRO DATA AND EVENTS

China's new home prices dropped 5.3% in August, the fastest since 2015, as the property sector struggles despite supportive measures. Deep debt, incomplete projects, and weak buyer confidence continue to strain the market, threatening economic growth.

U.S. consumer sentiment improved slightly in September, with the index rising to 69.0 amid easing inflation, though caution persists ahead of the November election. One-year inflation expectations dropped to 2.7%, the lowest since 2020, while the five-year outlook edged up to 3.1%.

What Can We Expect from The Market This Week

Fed Interest Rate Decision: The Fed is likely to cut interest rates soon, with investors betting on a 0.25 to 0.5 percentage point, with many experts projecting a 2-percentage point cut over the next year. Although inflation has eased, mortgage rates remain relatively high, and job growth has slowed.

BoE Interest Rate Decision: The Bank of England is expected to hold its interest rate at 5%, but attention is shifting to the pace of quantitative tightening (QT), which could significantly impact fiscal policy. With a decision on active bond sales pending, adjustments could affect the government’s financial flexibility, potentially freeing up billions for fiscal rules.

BoJ Interest Rate Decision: The Bank of Japan will likely hold interest rates steady at the upcoming meeting, after two rate hikes earlier this year. However, economists anticipate further rate increases later this year or early in 2025, with candidates in Japan’s ruling party being cautious about pressuring the BOJ to change its ultra-easy policy.

UK CPI August: The upcoming CPI report is expected to show inflation steady at 2.2%, but core inflation could rise to 3.6% mainly due to previous higher service costs.

PBoC Loan Prime Rate: China's central bank loan prime rate of 1-year and 5-year at 3.35% and 3.85%, respectively, is expected to see additional cut as there is weakness in the economy, along disinflation.