PAST WEEK'S NEWS (June 30 – July 04)

After weeks of shell and missile strikes on nuclear sites and scientists, Iran’s president has signed a law suspending cooperation with the nuclear watchdog, International Atomic Energy Agency (IAEA), according to state media. This move blocks international inspectors from monitoring Iran’s nuclear activities, making it harder to determine the country's nuclear development and intentions, further straining relations with the West and neighbouring countries. The decision comes after violent Israeli attacks on Iranian nuclear sites and growing geopolitical tensions. While some experts suggest Iran may be seeking leverage in future negotiations, others warn it could signal a step toward developing a nuclear weapon, which could push Gulf states to start smuggling weapons of their own to match the power balance. The U.S. called the suspension "unacceptable", urging Iran to return to compliance and diplomacy.

Deals are being sealed at the eleventh hour, with threats of steep tariffs looming over those who remain uncertain. With July 9 being the deadline, only Britain and Vietnam shook hands, while the EU, India, and Japan quake in fear. South Korea begs for more time in this race, as Thailand offers U.S. goods ever greater market space. Indonesia scrambles to strike its critical minerals pact, even as the dollar dives with no bottom intact. Nations continue to diversify ties to shield against a weaponized dollar, forging new alliances by day and night. In time, multipolar trade environment may collapse old hegemonies and reveal a more decentralized one where trades are no longer made under one nation currency, but cooperation-based money.

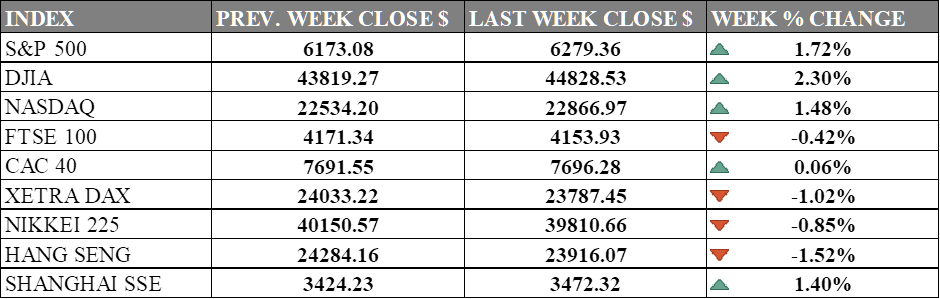

INDICES PERFORMANCE

Wall Street continued its strong performance last week, with major indices posting solid gains as market sentiment improved. The S&P 500 advanced by 1.72%, closing at 6279.36, leading broad market gains. The Dow Jones Industrial Average (DJIA) delivered the strongest performance with a notable gain of 2.30%, finishing at 44828.53. The Nasdaq also showed positive movement with a 1.48% increase, closing at 22866.97, as tech stocks participated in the rally. The positive trading activity reflected improved investor confidence and market optimism toward rate projection that is expected to be cut by 7 times next year.

European markets faced mixed conditions during the period, with modest declines across most major indices. The UK's FTSE 100 fell by 0.42%, closing at 4153.93. France's CAC 40 remained essentially flat with a minimal gain of 0.06%, ending at 7696.28, while Germany's XETRA DAX declined by 1.02%, closing at 23787.45. European markets continued to face uncertainty as the United States may no longer taken Ukrainian side and offering peace at a steeper price than what it could have been.

Asian markets displayed mixed performance with notable regional variations. Japan's Nikkei 225 posted a decline of 0.85%, closing at 39810.66, reflecting some profit-taking after recent gains. Hong Kong's Hang Seng Index declined by 1.52%, finishing at 23916.07, while mainland China's Shanghai Composite Index showed strength with a 1.40% gain, ending at 3472.32, as domestic economic data provided some support to investor sentiment.

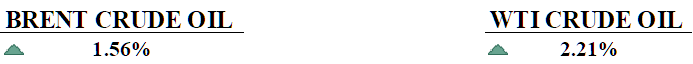

CRUDE OIL PERFORMANCE

OPEC+ agreed to increase oil production by 548,000 barrels per day in August, accelerating its output hikes following a period of price volatility triggered by geopolitical tensions. Price still notched a slight gain after the worst week since March 2023, a small recovery that could have been triggered by speculation of OPEC’s decision. This decision marks a reversal from the group’s production cuts since 2022 and reflects efforts to regain market share, partly in response to U.S. pressure to lower gasoline prices. The increase will be contributed by eight key members, including Saudi Arabia, Russia, and the UAE, bringing total released output since April to nearly 1.9 million bpd from the 2.2 million bpd cut. OPEC+ cited strong market fundamentals and low inventories as reasons for the move, though internal tensions arose due to overproduction by some members like Iraq and Kazakhstan. The adjustment comes amid rising global supply and concerns about economic slowdowns and potential U.S. tariffs, contributing to recent declines in oil prices. With additional layers of cuts still in place, totaling 3.66 million bpd, the group remains poised to manage output as needed ahead of its next meeting on August 3.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. jobless claims fell to 233,000 last week, the lowest in six weeks, but continuing claims remained unchanged at 1.964 million, the highest since 2021, indicating rehiring challenges.

The U.S. added 147,000 jobs in June, beating forecasts, while unemployment fell to 4.1% and wage growth slowed.

What Can We Expect from The Market This Week

RBA Interest Rate Decision: The Reserve Bank of Australia is widely expected to cut the official cash rate by 25 basis points to 3.6% at its July 8th meeting, which would mark the third rate cut this year as the central bank responds to slowing economic growth. Markets are pricing in the possibility of up to four additional rate cuts through early 2026 as the RBA seeks to stimulate household spending and support the economy.

RBNZ Interest Rate Decision: The Reserve Bank of New Zealand had cut its Official Cash Rate by 25 basis points to 3.25% in May 2025, marking the sixth consecutive reduction in an easing cycle that began in 2024. The RBNZ has hinted that rates may reach 2.92% by Q4 2025 and 2.85% by Q1 2026, suggesting the easing cycle is approaching its neutral zone, though there is no expectation for another cut this meeting.

German CPI: Price inflation in Germany hit its target at a 2.0% annual rate in June 2025, down from 2.1% in May and below market expectations of 2.2%, a figure not seen since October 2024. This suggests that price pressures in Europe's largest economy are stabilising, providing the ECB with more flexibility in its monetary policy decisions.

FOMC Meeting Minutes: The Fed held rates again during its June meeting, with the minutes expected to provide insights into policymakers' discussions about future rate decisions. Fed Chair Jerome Powell has indicated that the central bank would have begun cutting rates by now if not for the fear of tariff-induced inflationary pressures from volatile trade policy.

China CPI: China's consumer prices fell by 0.2% in May, marking the fourth consecutive month of deflation as the country continues to struggle with weak domestic spending, showing ineffective government stimulus measures. Overcapacity issues and sluggish consumer spending are the main barriers for the recovery efforts, as Chinese resilience in withholding spending is stronger than thought.