Trump’s push to bring Japanese-style kei cars to the U.S. could start an interesting market shifts in America’s oversized auto market by introducing cheap, ultra-compact EVs that dominate sales in Japan and China. These tiny vehicles, often priced around $17,000, have become Japan’s best-selling electric models despite their modest range, offering an affordability edge missing in the U.S. EV landscape. If approved, kei cars could undercut America’s SUV-and-truck obsession and appeal to cost-conscious urban drivers, especially as China’s BYD and Japanese brands race to electrify the segment. But Trump’s requirement that they be manufactured in the U.S. may slow rollout, inflate costs, and undermine the very affordability that makes kei cars attractive. The bigger question is whether American buyers that were long conditioned to equate size with safety and value are ready for a radically smaller future on the road.

The job market continues to deteriorate, with unemployment in the states rising to 4.4% in September 2025 and tech layoffs hitting their worst levels since 2009, whilst AI-induced cuts push more than 112,000 workers out of jobs. China’s picture is even darker, with youth unemployment stuck at 17.3% and millions turning to fake work offices or dropping out of the labour force as the economy fails to absorb 12.2 million new graduates each year. Globally, the unemployment rate may look stable at 5%, but the ILO notes deep structural issues, including stagnant productivity, widespread informality, and 240 million workers trapped in extreme working poverty. The root of the crisis is a convergence of rapid automation, weak productivity growth, and stalled structural transformation that is failing to create enough quality jobs. Conditions are likely to worsen through 2026 as AI adoption speeds up, supply chains fragment, and debt pressures force austerity. Without coordinated global action and large-scale investment in reskilling, infrastructure, and inclusive industrial policy, unemployment could climb above 5.5% and youth joblessness beyond 13.5%.

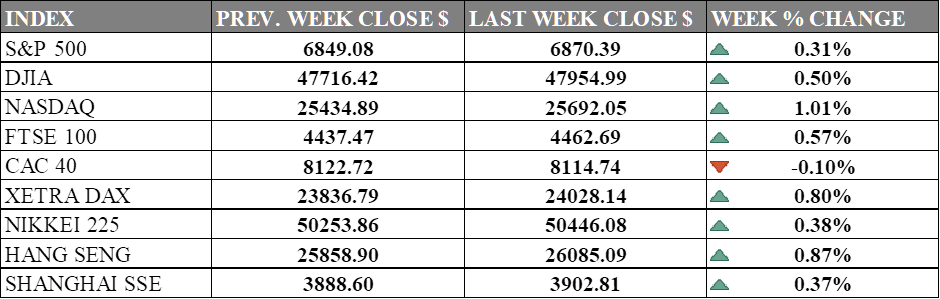

INDICES PERFORMANCE

Wall Street's major indices posted modest gains this week, with advances across most major benchmarks. The S&P 500 rose 0.31% to 6,870.39, while the Dow Jones Industrial Average climbed 0.50% to 47,954.99. The Nasdaq posted the strongest U.S. gain, advancing 1.01% to 25,692.05, as technology stocks rebounded. This strength reflected improved investor sentiment as markets digested corporate earnings, reassessed technology sector valuations, and weighed expectations for Federal Reserve policy decisions in the coming months.

European markets showed mixed performance. The UK's FTSE 100 gained 0.57% to 4,462.69. Germany's XETRA DAX advanced 0.80% to 24,028.14, recovering from the previous week's losses. France's CAC 40 edged down slightly by 0.10% to 8,114.74. European benchmarks reflected cautious optimism as investors balanced concerns about regional economic growth with stabilizing business sentiment and ongoing central bank policy considerations.

Asian markets demonstrated resilience with broad-based gains. Japan's Nikkei 225 rose 0.38% to 50,446.08. Hong Kong's Hang Seng Index advanced 0.87% to 26,085.09, rebounding from recent weakness. China's Shanghai Composite also finished higher, up 0.37% to 3,902.81. These gains were supported by stabilizing sentiment toward the region's economic outlook, signs of policy support from Chinese authorities, and improved risk appetite among investors in key technology and manufacturing sectors.

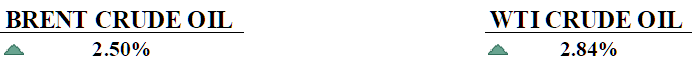

CRUDE OIL PERFORMANCE

Oil prices held steady in early Asian trading after posting weekly gains given stalled U.S.-Russia peace talks over Ukraine and expectations of a Federal Reserve rate cut. Market nerves over supply were heightened as Ukrainian drone strikes disrupted operations at the Caspian Pipeline Consortium and diplomacy with Russia remained deadlocked. Hopes of a Fed rate cut this week boosted demand sentiment, as lower rates and a softer dollar could make crude cheaper for buyers. Meanwhile, Platts’ new rules excluding Russian-derived fuels from European benchmarks effectively shrink the supply pool, adding further upward pressure on prices.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. initial jobless claims fell to a three-year low that can either say labour market is easing on layoffs or low confidence in job market that more people are hanging on to their jobs.

The ADP report suggests the labour market is weakening faster than expected, with private payrolls dropping 32,000 in November and small businesses alone shedding 120,000 jobs, signalling a deeper slowdown ahead.

What Can We Expect from The Market This Week

Fed Interest Rate Decision: The Federal Reserve is widely expected to cut interest rates by 25 basis points, lowering the federal funds rate to 3.5%-3.75%, marking the third consecutive rate reduction. Market pricing reflects approximately 87% odds of this cut, though growing divisions among Fed officials suggest increased uncertainty.

BoC Interest Rate Decision: The Bank of Canada to hold its key policy rate steady at 2.25% at its December meeting, pausing after consecutive rate cuts in September and October, cutting 50 basis points. All 33 economists polled by Reuters predict no change, with the central bank likely to maintain this level through at least 2027 as inflation stabilises around 2.5%.

SNB Interest Rate Decision: The Swiss National Bank is expected to maintain its 0% policy despite recent weakness in inflation and a strengthening franc. Economists believe the SNB will avoid returning to negative interest rates for now, viewing the current zero rate as the "lesser evil" while monitoring economic conditions into 2026.

RBA Interest Rate Decision: The Reserve Bank of Australia last cut was in August and has kept the rate as is at 3.6% and is expected to continue to do so for another month as the central bank assesses inflation trends. However, hotter inflation data has shifted market expectations toward potential rate hikes in 2026 rather than further cuts.

JOLTs Job Openings: The suspended job data is expected to resume where the most recent data for August 2025 showed 7.227 million job openings in the U.S., remaining essentially unchanged from July and representing a job openings rate of 4.3%.