Stocks Performance (U.S. Stocks)

Stocks in the US fluctuated throughout the week in reaction to uncertainty in the U.S. overreaching an agreement for fiscal stimulus before the November 3 presidential election. Equity markets closed the week lower. Although officials in the House of Representatives, the Senate, and the White House, continued to talk after the passing of an earlier deadline imposed by House Speaker Nancy Pelosi, it looked increasingly like a relief package would be not be enacted until after the election.

The earnings reporting season got into full swing during the week, with 91 S&P 500 companies scheduled to report third-quarter results, according to Refinitiv. Intel (INTC) and Netflix (NFLX) were some notable earnings-related laggards.

The health sector was higher as cannabis stocks climbed in reaction to media reports that highlighted the potential positive impact on the companies of a broad win by Democrats in the upcoming election.

By sectors, the most outperformed weekly stocks were led by Finance sector at 1.32%, followed by Industrial Services at 1.30%, Health Services 1.44%, and Energy Minerals at 1.05%. Meanwhile, the weakest sectors were from the Electronic Technology at -1.50%, Commercial Services at -1.42%, Retail Trade (-1.17%), and Transportation sector (-1.40%).

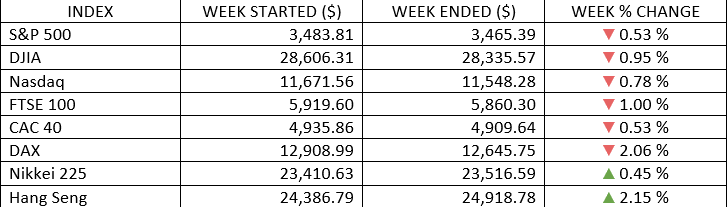

Indices Performance

After three consecutive weekly advances, major U.S. stock indexes closed the week lower, as stocks fluctuated throughout the week in reaction to uncertainty in the agreement for fiscal stimulus before the November 3 presidential election.

Most major stock markets in Europe were lower as daily new COVID-19 infections hit record highs in several countries and new lockdown and stricter limits on gatherings were announced.

Stocks in Japan and Hong Kong managed a small gain after a better-than-expected economic data.

Oil Sector Performance

Crude oil dropped under pressure from higher-than-expected U.S. inventories, surging coronavirus cases globally and concerns on Libya’s plan to boost its output.

Market-Moving News

U.S. Major Index Momentum Shift

After three-week of gains, major stock indexes slipped around 1% entering the busiest stretch of what’s so far been a strong quarterly earnings season. Stocks couldn’t recover from a Monday decline fuelled by a setback in congressional negotiations over a coronavirus relief package.

Yields Surge

The yield of the 10-year U.S. Treasury bond climbed on Friday for a seventh straight trading day to an intraday peak of 0.87%, the highest level in more than four months.

Regaining Strength

A monthly indicator of U.S. economic activity signalled the fastest rate of expansion in 20 months for both the services and manufacturing segments of the economy. However, the survey data from the IHS Markit PMI also showed that companies acted cautiously with coronavirus still spreading and the November 3 election creating further uncertainty.

Delayed Relief

It was another on-again, off-again week on prospects for further congressional aid to deal with the coronavirus’ economic impact. The uncertainty extended into Friday.

Europe's Volatility

While strong earnings results from banks and automakers lifted a European index on Friday, stocks tumbled earlier in the week amid worries about the economic impact of surging coronavirus cases.

China's GDP Comeback

China’s government reported that its economy grew at a 4.9% annual rate in the Q3, extending its recovery from the pandemic. The quarterly gain for the world’s second-largest economy was faster than the 3.2% rate of increase in the Q2, when other major economies were suffering steep GDP declines.

Oil Loses Traction

U.S. crude oil prices slipped back below the $40 per barrel level, recording the first weekly decline in three weeks. Rising coronavirus cases and increasing oil output in Libya were among the factors that weighed on prices.

Other Important Macro Data and Events

Uncertainty looming on the agreement for fiscal stimulus before the November 3 presidential election. Although officials in the House of Representatives, the Senate, and the White House, continued to talk after the passing of an earlier deadline imposed by House Speaker Nancy Pelosi, it looked increasingly like a relief package would be not be enacted until after the election.

The stimulus uncertainty pushed U.S. treasury yields higher and lifted government bond yields globally. The 10-year treasury yield rose to the highest level in four months. The U.S. dollar retreated, gold mostly unchanged, and copper touched a two-year high.

Nonetheless, aside from the speculation about potential election outcomes and policies, economic data for the week was encouraging to the long-term outlook, showing an improvement in jobless claims and continued strength in the housing market.

In Europe, as economic restrictions continued to tighten, consumer confidence measures slipped. In France, the business confidence index fell for the first time since April. Purchasing managers’ data for October indicated that business activity in the eurozone contracted in October, a sign that the economic recovery is faltering. IHS Markit’s Flash Composite PMI fell to 49.4 in October, dragged down by a continuing slowdown in services activity. The services PMI dropped to 46.2 from 48.0, largely due to coronavirus restrictions.

What We Can Expect from the Market this Week

Two forces were in the driver's seat last week: policy and politics. The same elements expected to follow. The race to Oval Office expected to keep a hand on the wheel in coming weeks, and an encouraging release of economic data will likely also be influential to lift global stocks.

Additional fiscal relief also will be one of the indicators pointing toward the health of the economic recovery. A combination of a sustained but gradual economic expansion, an extension of monetary policy stimulus and a rebound in corporate profits will be presenting a tug-of war and set the broader course for the markets.

The Q3 earnings season is in full swing, with almost 40% of the S&P 500 companies reporting earnings throughout the week.

Important economic news released this week including new home sales today, Consumer Confidence Index and durable goods on Tuesday, existing home sales, Q3 GDP, unemployment claims and pending home sales on Thursday, and personal income and consumer spending on Friday.

Thursday’s release of the government’s initial estimate of Q3 U.S. economic growth is expected to be the most closely watched report of the week, as it could produce a record-breaking growth figure for a single quarter. In this year’s Q2, GDP plunged 31.4% amid the pandemic. For the Q3, economists are expecting a sharp reversal, with most forecasting growth of around 30.0%.