PAST WEEK'S NEWS (July 5 – July 11, 2021)

SGOCO Group stock is trending up, although there has been no news about the company in recent weeks. The huge jump possibly caused by Reddit's WallStreetBets forum collectively push back against a potential short-squeeze. SGOCO Group is Hong Kong-based penny stock that manufactures phase change storage systems, among other items. Meanwhile Pop Culture Group plummeted as the Chinese hip-hop company continues to give back last week’s 1,200% post-IPO surge.

Stocks Performance (U.S. Stocks)

The major benchmarks closed mixed last week, with large-caps and growth stocks outperforming for the second consecutive week. Although the headliner was the move in interest rates, which have pulled back notably from their highs earlier this year.

The major driver of sentiment during the week appeared to be the steep decline in U.S. Treasury yields, with the yield on the benchmark 10-year Treasury note hitting a nearly 5-month low on Thursday. Equity investors appeared to welcome the decline early in the week, as falling bond yields typically improve the relative appeal of equities by implying a lower discount on future earnings and by making corporate dividends more attractive in comparison.

Perspectives however seemed to shift on Thursday, with equity investors worrying that further fall in yields also signalled expectations for slowing global growth. The rising uncertainties around COVID-19 Delta variants and their implications for global growth also appeared to dim the outlook, especially for travel-related companies.

From a sector perspective, advancing sectors were led by Retail Trade sector at 1.90%, followed by Non-Energy Minerals at 1.50%, Electronic Technology (1.10%), and Commercial Services at 0.54%.

Meanwhile, Energy stocks fared worst on concerns that disagreements among major oil producers would result in some violating output restrictions, down -3.68%, followed by Consumer Durables at -2.02%, Transportations (-1.26%), and Consumer Services sector (-1.24%).

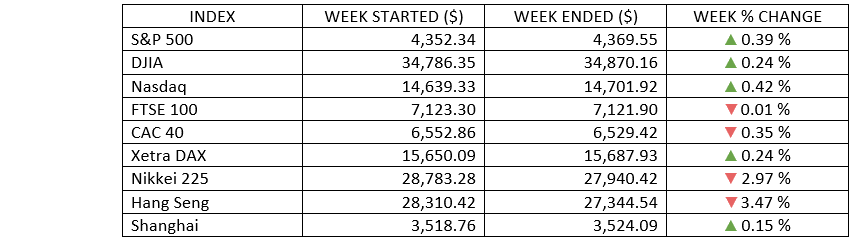

Indices Performance

The U.S. trading week was shortened to four days in observance for U.S. Independence Day, with the week's action started on Tuesday when the S&P 500 snapped a streak of seven straight record closes. All the major indices eked out small gains and ended the week in record territory.

Shares in Europe ended little changed, recovering from a sharp pullback following the concerns of surge in COVID-19 cases.

Japan’s stock markets registered sharp losses for the week. Sentiment was dampened by decision of the government to place Tokyo to be under fourth state of emergency, over concerns of spread of the Delta variant of the coronavirus starting on July 12 and last throughout the Olympics until August 22. The declaration means that the Games will be held without spectators in the capital—health experts, including the government’s top COVID-19 adviser, have repeatedly warned that the event could trigger a surge in infections.

China’s Shanghai Composite Index edging slightly higher. Selling was noticeable in technology stocks amid heightened regulatory risk on reports that Beijing will tighten oversight of U.S.-listed Chinese companies, many of which are in the tech sector, as well as the government’s continued crackdown on domestic tech companies.

Oil Sector Performance

Crude oil was weak amid anxiety about a rise in supply after talks among producers collapsed. Talks between OPEC and its oil-producing allies were postponed, with no new date is set to resume. OPEC+ ministers called off oil output talks on Monday after clashed the week before when the UAE rejected a proposed 8-month extension to output curbs, meaning no deal to boost production has been agreed. Saudi energy minister Prince Abdulaziz bin Salman had called for "compromise and rationality" to secure a deal after two days of failed discussions.

The prices steadied on Wednesday after the EIA reported its seventh-straight weekly inventory draw. U.S. crude inventories fell by 6.9 million barrels last week to 445.5 million barrels, higher than a 4 million drop analysts expectation. Gasoline stocks fell by 6.1 million barrels in the week to 235.5 million barrels.

Market-Moving News

Indices Edging Higher

The S&P 500, the NASDAQ, and the Dow all posted weekly gains of less than 0.5%, adding slightly to their record highs set in the previous week. Within the major indexes, growth stocks extended their recent run of outperformance versus their value counterparts.

Flip-Flop Market

The major U.S. stock indexes fell nearly 1% on Thursday, the biggest daily decline in nearly three weeks and the first big move in the latest holiday-shortened week. Although stocks rebounded on Friday, recovering the previous day’s losses and then some.

Small-Cap Slump

An index of U.S. small-cap stocks lagged its large-cap counterpart by a wide margin for the third week in a row, erasing small caps’ year-to-date performance edge. From June 11 through Friday’s close, the Russell 2000 Index has declined 2.3% versus a 2.7% gain for the large-cap Russell 1000 Index.

Bond Price Rally

The U.S. government bond prices accelerated, sending the yield of the 10-year U.S. Treasury bond below 1.30% in intraday trading on Thursday—the lowest in nearly five months. As recently as late March, the yield was 1.74%.

Earnings Optimism

Entering earnings season this week, Wall Street analysts are expecting the biggest quarterly earnings growth rate in a decade, according to FactSet. As of Friday, Q2 earnings for companies in the S&P 500 were forecast to jump an average of 69%ꟷin part owing to a favorable comparison relative to the depressed earnings from last year’s Q2 amid the pandemic.

Oil Rally Interruption

U.S. crude oil prices fell modestly, breaking a string of six consecutive weekly gains that had lifted oil above $75 per barrel in the previous week—the highest level since October 2018. The latest price movements come amid uncertainty as major oil-producing countries remain at odds about whether to cut future supply levels.

Euro Inflation Target

A new policy framework introduced by the European Central Bank aims to give policymakers more flexibility to deal with economic shocks. The approach aims to keep eurozone inflation at 2% over the medium term, instead of the current target of just below 2%, and would allow room to overshoot that target in some circumstances.

Price Check

A U.S. government report scheduled to be released on Tuesday will show whether a monthly spike in prices in May carried over into June. The CPI report released last month showed that prices surged 5.0% for the 12-month period that ended in May—the most in any 12-month period since 2008.

Other Important Macro Data and Events

Economic reports miss expectations, which may have helped push both equities and Treasury yields lower. The ISM gauge of service sector activity in June came in lower than expected, and the IBD/TIPP Economic Optimism Index fell back to its lowest level since February. Weekly jobless claims ticked higher, while May job openings rose a bit less than expected.

The 10-year Treasury note yield sank to 1.25% in intraday trading on Thursday before partially retracing earlier moves. FOMC minutes meeting released Wednesday, seemed to evoke little reaction from market participants. The meeting summary revealed that policymakers do not believe the economic recovery has yet reached their goal of “substantial further progress” and suggested that most committee members are not eager to begin tapering the Fed’s asset purchases.

The Fed’s meeting minutes that reconfirmed policymakers’ uncertainty on tapering seemed to have a muted impact on sentiment. But the high yield and broader risk markets later experienced weakness, given increased global growth concerns.

In the European region, the ECB adopted a new 2% inflation target over the medium term—abandoning the previous objective of “below, but close to, 2%”—after reviewing its strategy.

UK economic growth unexpectedly slowed to 0.8% between April and May. While the German industrial production defied forecasts for an increase in May, falling 0.3% sequentially due to a drop in production of capital goods and energy. Production rose 17.3% on the year compared with 27.6% in April.

On Friday, the People’s Bank of China unexpectedly announced that it would cut its reserve requirement ratio (RRR), the amount of cash most banks must hold in reserve at the central bank. The move will unleash about RMB 1 trillion of long-term liquidity into the economy, according to Bloomberg, and effectively allow banks to increase lending to smaller companies hurt by rising costs.

What Can We Expect from the Market this Week

The first half of 2021 were closed as summer came full swinging. It was a strong start for the economy and the stock market, but the investment landscape is changing as the recovery has transitioned into expansion. Growth will likely slow as the economic cycle moves from recovery to expansion. But it will remain robust in our view, supporting the case for improved performance of cyclical sectors and value-style investments.

The arrival of strong Q2 earnings reports the following week is expected to be the catalyst for markets movement to follow. Analysts polled by both FactSet and Refinitiv are currently expecting overall earnings for the S&P 500 to have expanded by nearly two-thirds over the year before—albeit from a low base, given the shutdown of much of the economy last spring.

Important U.S. economic data being released this week including the CPI & PPI index, imports & exports prices, weekly unemployment claims, and retail sales.