PAST WEEK'S NEWS (Jan 3 – Jan 9, 2022)

Stocks Performance

The first week of 2022 saw heavy selling in the growth stocks, a rotation into value stocks, and a sharp rise in long-term interest rates. The growth-stock weakness was mostly linked to the rise in the 10-yr yield, which hit 1.80% on Friday after starting the week at 1.51%.

Sentiment took a notable turn on Wednesday afternoon following the release of minutes from the Federal Reserve’s mid-December policy meeting. The minutes revealed that policymakers had discussed faster and more aggressive rate hikes, with the first quarter-point hike in the official short-term rate coming as soon March. Officials also discussed taking steps to reduce the Fed’s balance sheet soon after lift-off.

The energy and financials sectors rose more than 5.0%, amid higher oil prices and a steepened yield curve, while growth sectors like information technology, discretionary, healthcare, and real estate underperformed.

Indices Performance

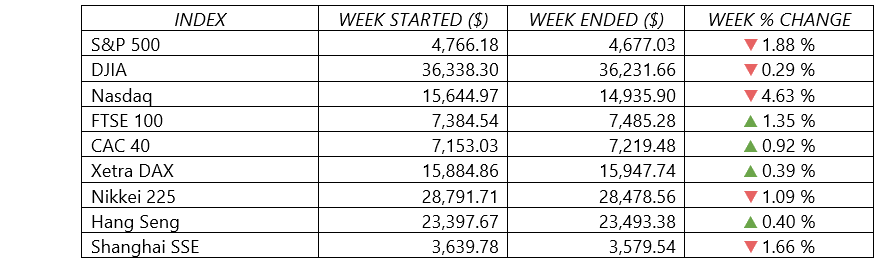

Each of the major U.S. stock indexes retreated to start 2022 and the NASDAQ sustained the biggest blow by far, which suffered its biggest weekly decline in months.

The main equity indexes in Germany, France, and Italy advanced. The UK’s FTSE 100 Index gained more than 1% as banks and energy industries that include some of the index’s largest stocks rallied.

Surging COVID-19 cases weighed for the Japan and Chinese stocks. Investor sentiment was dampened by the spread of the Omicron variant the countries.

Crude Oil Performance

0il prices rose for the week, with prices at their highest since late November 2021. Escalating unrest in Kazakhstan and supply outages in Libya supported prices, despite OPEC+ boosting production and U.S. fuel stockpiles surging amid declining demand.

Investors had concerns about limited production following a state of emergency in Kazakhstan, a major oil producer, following protests against an increase in fuel prices, while production in Libya has dropped to 729,000 bpd, down from a high of 1.3 million bpd last year, partly due to pipeline maintenance work.

The OPEC+ on Tuesday meanwhile agreed to add another 400,000 bpd of supply in February, as it has done each month since August. The U.S. crude oil stockpiles meanwhile fell last week while gasoline inventories surged more than 10 million barrels, the biggest weekly build since April 2020, as supplies backed up at refineries due to reduced fuel demand.

Other Important Macro Data and Events

Wednesday’s release of minutes from the U.S. Federal Reserve’s most recent policy meeting triggered much of the anxiety that rippled across markets. Fed officials last month discussed the possibility of an accelerated timetable for raising interest rates this year—potentially as soon as March—and expressed concerns about persistently high inflation.

The December jobs report also offered a mixed bag for the Fed. While the headline figure of 199,000 nonfarm jobs added was a disappointment (expectations were for 400,000 jobs), the average hourly earnings figure exceeded consensus estimates, coming in at 4.7% year-over-year, versus forecasts of 4.1%. This combination of softer employment and higher wage growth points to signs of a tight labor market in the U.S. – where demand seemingly continues to outpace supply. Meanwhile, the unemployment rate fell to 3.9%, as labor participation remained stagnant at 61.9%.

Government bond prices tumbled, sending the yield of the 10-year U.S. Treasury bond briefly touched 1.80%, its highest level since the onset of the pandemic. The latest yield surge marks a big jump from the previous week, when the 10-year Treasury’s closing yield was 1.51%.

Core eurozone bond yields also rose with U.S. Treasury yields and eurozone inflation data. UK gilt yields broadly tracked core markets.

An unexpectedly big increase in the inflation rate across eurozone countries put more pressure on the European Central Bank to consider raising interest rates. CPI rose 5.0% in December compared with the same month a year earlier—the highest on record in the eurozone. German inflation meanwhile came in near a 30-year high, prompting Finance Minister Christian Lindner to announce that the government was considering financial aid for lower-income households to pay for rising heating bills.

The week’s Omicron news also impacted on markets. The U.S. and Europe posted record levels of coronavirus infections, while Hong Kong reinstituted a new lockdown. In France, daily cases soared above 330,000, prompting hospitals to brace for a crisis. Italy ruled that all university staff and people above age 50 must be vaccinated. Spain moved to make mask-wearing mandatory again, and the army was deployed to help regions increase vaccination. In contrast, Prime Minister Boris Johnson said the UK could “ride out” the omicron-driven wave of infections without further restrictions and kept “Plan B” restrictions in place.

What Can We Expect from the Market this Week

Investors head back for the second trading week of the year with some indications that the valuation reset away from high-growth, high-PE stocks could continue.

On the U.S. economic calendar, a government report scheduled to be released on Wednesday will show whether December marked the seventh month in a row in which inflation topped 5.0%. The CPI released last month showed that prices surged 6.8% for the 12-month period that ended in November—the highest level since 1982.

Another important economic data being released this week include wholesale inventories, business inventories, retail sales, and PPI.

Meanwhile, Albertsons (NYSE:ACI) and Delta Air Lines (NYSE:DAL) head into the earnings confessional with reports that could rattle their respective sectors. At the end of the week, the Q4 earnings season kicks off in earnest with a wave of highly-anticipated reports from big banks – from JPMorgan (NYSE:JPM), Wells Fargo (NYSE:WFC), BlackRock (NYSE:BLK) and Citigroup (NYSE:C).