WHAT IS RSI INDICATOR

Relative Strength Index is a technical indicator that measure the magnitude of price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. RSI is one of the leading indicators used in analyzing the market. It is an indicator that precedes a price move. In a lot of cases, RSI will turn around before the market, performing a so-called divergence, which warns about the potential reversion of the market.

History of RSI

This indicator was created by J. Walles Wilder Jr. in 1978 and reviewed in his book entitled ‘New Concepts in Technical Trading System’.

This indicator is typically used for:

- Identifying the momentum strength of price movement.

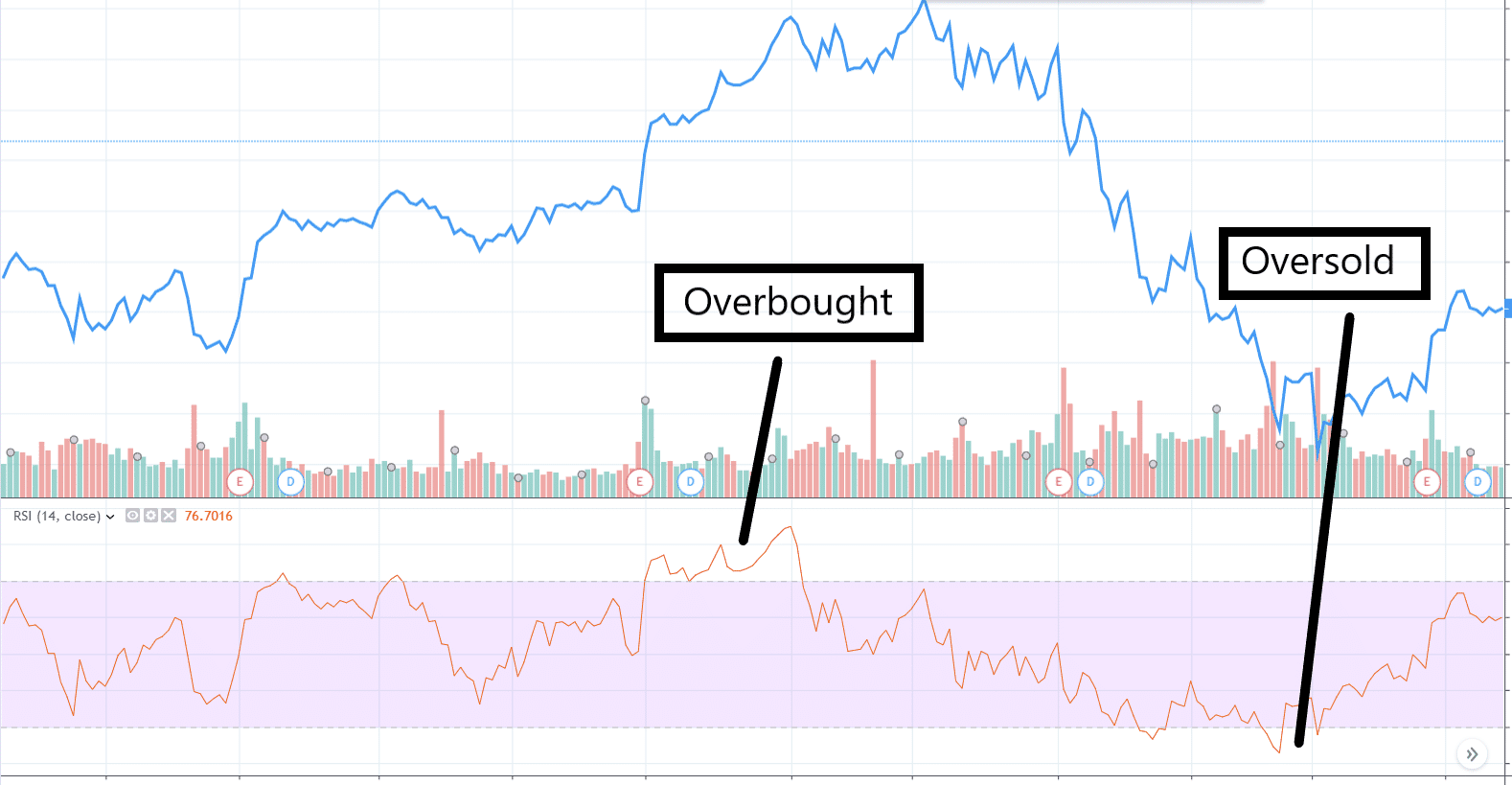

- Knowing the market is overbought or oversold. Over 70% are overbought and below 30% are oversold.

RSI Setting

By default, the setting used is 14 which is an estimate for 14 days as a short term.

Big Concept

Prices below 30 - Traditional interpretation and usage of the RSI is that an RSI reading of 30 or below indicates an oversold or undervalued condition. Expect sales, causing the price to be too cheap (under-priced).

Prices above 70 – RSI values of 70 or above indicate that a security is becoming overbought or overvalued and may be primed for a trend reversal or corrective pullback in price. Many purchases causing the price to be too high (overpriced).

Generally, when the RSI reaches overbought or oversold, the momentum will decline and there will bound to be a price reversal.

Figure above showing the RSI indicators of oversold and overbought. As we can see, the right time to buy is in the oversold area as at this time the buyer is dominating the market. Later, as the price is pushes up, the price becomes too high, graph reverses, and the indicator turned overbought. Overbought is when the seller dominates the market which causes the price to fall.

Uses of RSI

Sell Signal - The overbought area is used as an indicator to make a sale (Sell).

Buy Signal - The oversold area is used as an indicator to make a purchase (Buy).