PAST WEEK'S NEWS (August 19 – August 23, 2024)

Canadian National Railway and Canadian Pacific Kansas City have locked out approximately 10,000 unionised workers in an unprecedented concurrent work stoppage that has halted most rail freight operations in Canada. It's expected to have far-reaching effects on North American supply chains, potentially costing over C$341 million per day, according to Moody's, affecting various sectors, including agriculture, mining, and manufacturing, with about a third of the traffic crossing the U.S.-Canada border. While the rail networks south of the border will continue to operate, the incident threatens to cripple shipments of essential commodities like grain, potash, and petroleum products. The alternative, trucking industry, which faces surging demand and rising freight rates, lacks the capacity to fully replace rail distribution, posing a significant risk to both the Canadian and U.S. economies.

The People's Bank of China (PBOC) maintained its benchmark loan prime rates unchanged in August, aligned with expectations even after a surprise cut in July. The one-year LPR remains at 3.35%, and the five-year LPR is at 3.85%. China's efforts to support economic growth through ultra-loose monetary policies have seen minor success. The PBOC's approach is constrained by shrinking interest margins at lenders, while economists believe additional policy measures, including potential reserve requirement ratio cuts and policy rate reductions, will support growth and achieve the government's targets. In response to the PBOC's decision, Chinese and Hong Kong stock markets showed minor declines in its already down trending markets, with investors hoping for further policy easing to stimulate growth in the world's second-largest economy.

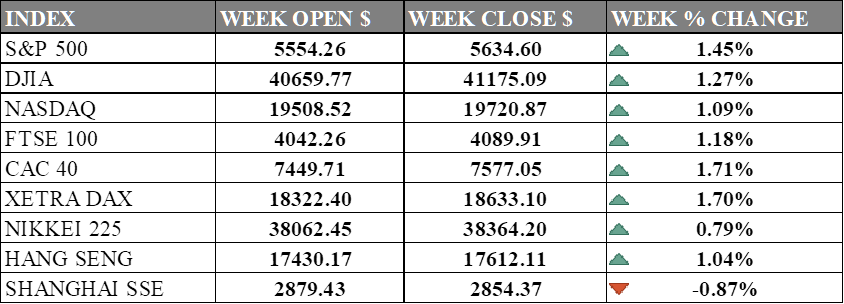

INDICES PERFORMANCE

Wall Street wrapped up a positive week, with all major U.S. indexes ending in positive territory. The S&P 500 was the top performer among U.S. indices, rising 1.45% to close at 5,634.60. The Dow Jones Industrial Average saw a solid increase of 1.27%, finishing at 41,175.09, while the tech-heavy Nasdaq gained 1.09% to close at 19,720.87. These market upturns are largely attributed to continued optimism in the overall economic outlook, with investors showing confidence in stocks' resilience amid current market conditions.

Across the pond, European markets also enjoyed positive momentum. France's CAC 40 led the gains with a 1.71% increase, closing at 7,577.05. Germany's DAX saw a similar rise of 1.70%, ending at 18,633.10. The UK's FTSE 100 experienced a 1.18% gain, closing at 4,089.91. European markets benefited from the positive sentiment in global equities, with various sectors contributing to the overall gains.

Asian markets presented a mixed picture, though with generally positive results. Japan's Nikkei 225 saw a modest increase, rising 0.79% to 38,364.20. Hong Kong's Hang Seng Index posted a gain of 1.04%, closing at 17,612.11. However, the Shanghai Composite in mainland China experienced a slight decline, falling 0.87% to close at 2,854.37. The market was hoping for another stimulus, but PBoC decided that it was not the right time and keep the rate unchanged.

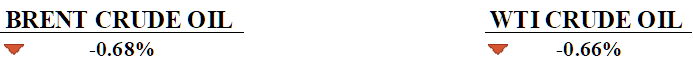

CRUDE OIL PERFORMANCE

Crude oil prices were volatile last week, with Brent closing at $79.59 per barrel and WTI at $75.51, driven by hints from U.S. Federal Reserve Chair Jerome Powell about potential interest rate cuts. Earlier in the week, prices hit lows due to recession concerns sparked by revised U.S. job data, but Powell's comments provided a boost. Geopolitical tensions in the Middle East, particularly stalled ceasefire talks between Israel and Hamas, added to supply concerns. Production cuts in Libya also contributed to tightening supply and higher prices. The weakening U.S. dollar further supported oil prices by making crude cheaper for foreign buyers. Overall, the market remains sensitive to both economic signals and geopolitical risks.

OTHER IMPORTANT MACRO DATA AND EVENTS

New U.S. single-family home sales jumped 10.6% in July, hitting their highest level since May 2023, as lower mortgage rates boosted demand. With the Federal Reserve potentially cutting interest rates soon, future sales could see further gains.

Euro zone consumers' inflation expectations remained steady at 2.8% for the next 12 months, according to a July survey by the European Central Bank. The survey also showed a slight increase in long-term inflation expectations and a more negative outlook on economic growth, with GDP expected to contract by 1.0%.

What Can We Expect from The Market This Week

US PCE Price Index is a key measure of inflation that tracks changes in the prices of goods and services consumed by households. In June 2024, the PCE Price Index showed a slight decrease in price growth at 2.5% compared to 3% a year ago, a gradual easing trend.

German CPI August: last inflation data point towards a rate of 2.3% year-on-year, slightly up from 2.2% in June 2024 and expected to dip lower to 2.1%. This increase was primarily caused by rising service prices, albeit lower energy prices, which helped to moderate the overall inflation rate.

US GDP Q2: U.S. economy reportedly grew at an annualised rate of 2.8% in the preliminary data, surpassing expectations of 2.1%, due to strong consumer spending, government expenditures, and private inventory investment. Other economies growth rates are also expected this week.

CB Consumer Confidence: The Consumer Confidence Index remained the same even with a worsening outlook for the broader economy. The index held steady at 100.2, suggesting continued consumer worries about inflation and interest rates. This stability in consumer confidence suggests that while consumers are cautious about the future, their current economic sentiment remains relatively stable.

US Durable Goods Orders: new orders for manufactured durable goods in the US plunged to negative 6.6% month-over-month, marking a significant decline after four consecutive monthly slight increases. This drop was primarily driven by a 20.5% decrease in transportation equipment orders, including a sharp fall in non-defence aircraft and parts.