PAST WEEK'S NEWS (September 01 – September 05)

Russian President Vladimir Putin and North Korean leader Kim Jong Un held significant strategic talks in Beijing on Wednesday, where they praised their deepening military partnership while Chinese President Xi Jinping hosted commemorations marking the 80th anniversary of World War II's end. Russia's state nuclear corporation, Rosatom, announced it will help China overtake the United States as the world's largest nuclear power producer, with China aiming to exceed 100 gigawatts of installed nuclear capacity compared to the U.S.'s current 97 gigawatts. Meanwhile, China firmly rejected President Trump's call for Beijing to join nuclear disarmament talks with the U.S. and Russia, stating it was "neither reasonable nor realistic" given the vast disparity in nuclear arsenals between the countries. This realignment between Russia, China, and North Korea has strengthened diplomatic relationships significantly, with North Korea having deployed approximately 15,000 soldiers to support Russia's war in Ukraine while receiving advanced Russian military technology in return. This trilateral cooperation represents a clear challenge to Western influence, with analysts predicting that joint military exercises between Russia, China, and North Korea appear "nearly inevitable" as the three nations solidify their anti-Western alliance.

A federal appeals court ruled President Trump unlawfully collected over $70 billion in tariffs on foreign goods by misusing emergency powers, potentially entitling U.S. businesses to massive refunds—but his emergency Supreme Court appeal has frozen repayments and deepened economic uncertainty. The administration’s last-minute challenge, set against an October 14 deadline, leaves companies paralyzed as they struggle to set prices amid supply chain chaos, fearing either sudden refund windfalls or permanent tariff costs. Crucially, the court affirmed that only Congress—not the president—holds constitutional authority to impose taxes, invalidating Trump’s use of the International Emergency Economic Powers Act for sweeping country-based tariffs. Should the ruling stand, businesses may face a bureaucratic gauntlet to reclaim payments, as the administration could force thousands to file individual refund claims rather than issuing automatic repayments. This high-stakes legal battle now threatens both Treasury finances and low-income households, who bear the brunt of these regressive "sales taxes" disguised as tariffs.

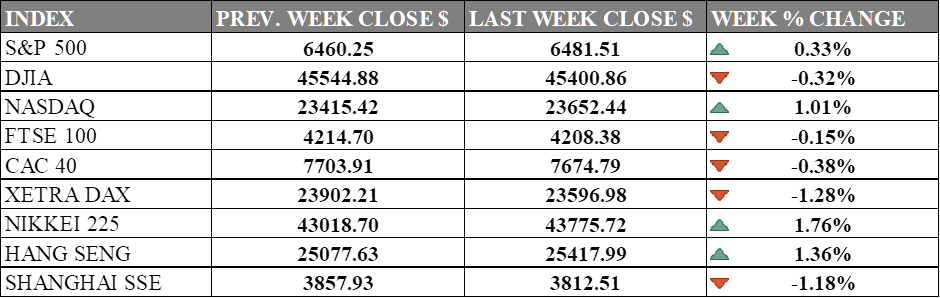

INDICES PERFORMANCE

Wall Street major indices posted mixed results as market sentiment remained sticky on inflation and rate cut expectations. The S&P 500 rose modestly by 0.33%, closing at 6481.51, with steady gains as investors continued to digest recent economic data. The Dow Jones Industrial Average (DJIA) declined by 0.32%, finishing at 45400.86, reversing from previous gains. The Nasdaq posted the strongest performance among major US indices with a gain of 1.01%, closing at 23652.44, as tech stocks attracted renewed investor interest.

European markets posted negative results during the period, with declines across major indices. The UK's FTSE 100 fell by 0.15%, closing at 4208.38. France's CAC 40 declined by 0.38%, ending at 7674.79, while Germany's XETRA DAX showed the weakest performance with a drop of 1.28%, closing at 23596.98. European markets faced headwinds despite some resilience in broader global markets.

Asian markets showed mixed performance across the region. Japan's Nikkei 225 delivered strong gains of 1.76%, closing at 43775.72, reflecting renewed investor optimism in the region. Hong Kong's Hang Seng Index rose by 1.36%, finishing at 25417.99, continuing its positive momentum, while mainland China's Shanghai Composite Index declined by 1.18%, ending at 3812.51, as Chinese markets faced some selling pressure.

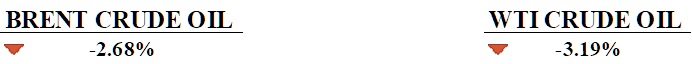

CRUDE OIL PERFORMANCE

Oil prices rebounded sharply Monday, clawing back over 1.9% for both Brent and WTI after shedding more than 3% the prior week, mainly due to OPEC+'s unexpectedly modest October production hike of just 137,000 barrels per day. This cautious supply move provided immediate relief, while tightening geopolitical tensions following Russia’s major air strike on Ukraine amplified fears of potential new U.S. sanctions disrupting Russian crude flows. The rally offset steep Friday losses triggered by a weak U.S. jobs report that stoked demand concerns and contributed to last week’s broader decline amid rising inventories and post-summer fuel demand slowdown. Despite the rebound, underlying pressure persists from expectations of a winter 2024 oil glut and cooling global growth signals, particularly in the U.S. and China, which OPEC+ explicitly cited in its guarded production stance. Analysts warn the market remains caught between near-term supply support from sanctions risks and looming oversupply threats, setting the stage for volatile price action ahead.

OTHER IMPORTANT MACRO DATA AND EVENTS

A shockingly weak U.S. jobs report showed Nonfarm Payrolls plunging far below forecasts to just 22K, intensifying concerns over consumer spending, the dollar’s resilience, and the Federal Reserve’s next steps.

The U.S. services sector accelerated in August with the ISM index rising to 52.0 and new orders surging, yet employment remained weak, reinforcing expectations of a Fed rate cut.

What Can We Expect from The Market This Week

ECB Interest Rate Decision: The European Central Bank is expected to hold its deposit facility rate once again at 2.00% with inflation just a tad bit above target. The last time the ECB cut rates was back in June, now pausing its easing cycle as inflation returned to near the 2% target and policymakers assessed there was no urgency for further cuts.

US CPI August: Headline inflation grew 0.2% in July to 2.7% annually, up from the previous month, remaining above the Federal Reserve's 2% target. Energy costs slowed, but rising prices in used cars and transportation services affected end figures, while core inflation rose to a five-month high of 3.1%.

UK GDP July: UK gross domestic product grew by 0.4% in June, a major improvement from negative growth in April and May, with services providing the largest boost. It is a positive development, with preliminary second-quarter growth only at 0.3%.

China CPI August: China's consumer price index increased by a whopping 0.4% in July, a 6-month high after weak domestic demand and deflationary pressures in the world's second-largest economy. The growth resulted from pricier services and goods, reinforced by state-backed demand in trade-ins, eldercare, childcare, and digital sectors.

German CPI: Germany's annual inflation rate averaged 2.2% for August in its preliminary data, two ticks higher than the target, which has been maintained for two months, though easing energy prices may keep it on target for another month.