Stocks Performance (U.S. Stocks)

U.S. stocks logged their best weekly gain since early April as investors reacted to the increased possibility of a divided government of Democrat’s presidential win and continued Republican control in the Senate. Investors are no longer expecting major tax hikes, a rollback of the 2017 corporate tax cuts, or additional significant regulation. There will likely be no “green new deal”, no public health care option, or changes to the structure of the Supreme Court.

Technology and Internet stocks surged as concerns about big changes to U.S. anti-trust laws eased. The consumer discretionary and communications services sectors were especially strong, as Amazon.com Inc., Facebook Inc., and Google were seen to be beneficiaries of a lower risk of antitrust action. Taking the public option off the table also provided a significant boost to health care stocks.

By sectors, the most outperformed weekly stocks were led by Health Services sector at 12.55%, followed by Commercial Services at 11.95%, Technology Services 10.24%, and Distribution Services at 10.10%. Meanwhile, the weakest sectors were from the Industrial Services at 2.49%, Utilities at 2.66%, Energy Minerals (3.42%), and Finance sector (5.15%).

Indices Performance

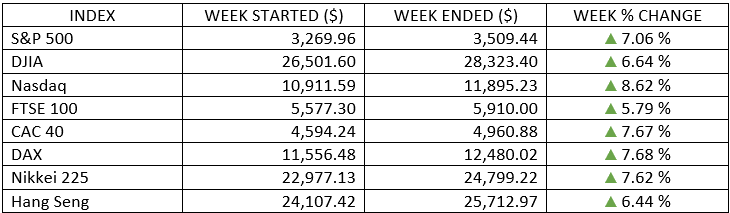

A week after dropping around 6%, the major U.S. stock indexes recovered that lost ground, logged their best weekly gain since early April. The S&P 500 and the Dow both bounced back from last week's decline, jumped around 7% while the NASDAQ surged more than 8%. The rally came as coronavirus cases continued to surge and as investors assessed results from Tuesday’s election.

All major equity markets in Europe and Asia moved higher, with the positive reaction to the U.S. election outweighing concerns about new lockdowns in Europe and the risk of a double-dip recession.

UK stocks underperformed as talks with the EU about post-Brexit trade once again seemed to make little progress, despite indications early in the week that a compromise over the controversial issue of fishing rights might emerge soon.

Oil Sector Performance

Crude oil prices were lifted by the IEA’s report of large drawdowns in crude oil inventories, though demand concern still lingers as European countries toughened travel restrictions because of increasing COVID-19 cases.

Market-Moving News

Stocks Rebound

A week after dropping around 6%, the major U.S. stock indexes recovered that lost ground. The S&P 500 and the Dow both jumped around 7% while the NASDAQ surged more than 9%.

Election Reaction

Many market analysts attributed the stock market surge in part to investors’ hopes that the likelihood of a continuing partisan divide over control of the White House, the Senate, and the House might keep a favourable tax and regulatory environment intact. In addition, expectations rose for near-term economic stimulus measures.

Jobs Comeback

The U.S. labour market continues to recover, as 638,000 jobs were added in October, topping most economists’ estimates. Meanwhile, the unemployment rate fell to 6.9% from 7.9% in September, and the labour force participation rate climbed after declining in the previous month.

Earnings Check-up

Nearly 90% of S&P 500 companies had released their results, the number of firms that had beaten expectations remained at or near a record level as of Friday, according to FactSet. However, it will be the sixth time in the past seven quarters in which earnings have declined compared with the same period a year earlier.

Fed Holds Steady

As expected, the U.S. Federal Reserve Board kept interest rates unchanged, and it made few edits to a statement assessing the state of the economy. Chairman Jerome Powell reiterated the Fed’s willingness to provide additional policy support and urged that lawmakers provide more fiscal stimulus.

Anxiety Eases

The election and surge in the stock market appeared to bring calm to an index that measures investors’ expectations of market volatility over the next 30 days. The Cboe Volatility Index, or VIX, fell around 35%ꟷthe sharpest weekly decline since April.

Yield Swings

It was a volatile week for U.S. Treasury bonds, as the yield of the 10-year note closed on Tuesday at the 0.90% level for the first time since June, only to tumble to 0.78% on Wednesday. By the end of the week, the yield crept back up above the 0.80% level.

Bitcoin Boost

The price of the cryptocurrency bitcoin surged about 15% for the week, climbing to its highest level since January 2018. The price has risen about 110% year to date; over the past month, it’s up around 35%.

Other Important Macro Data and Events

Former Vice President Biden led President Trump 279-214 in the electoral count, according to most sources, clinching the U.S. presidential post. However, the market appeared to not care who will be president so long as the status quo is preserved in Congress. Expectations were that the House would remain with the Democrats and the Senate would remain with the Republicans.

While election uncertainty faded, U.S.’s economic data continued to show gradual improvement. PMIs for both the manufacturing and services areas of the economy improved, and unemployment claims continued to decline.

The Federal Reserve also made an appearance this week, though largely overshadowed by the election. The fed funds rate was left unchanged as widely expected. Mr. Powell said the current pace of asset purchases remained appropriate for the current situation but added that the voting committee discussed options if more accommodation is needed.

U.S. Treasuries finished on a lower note. The 2-year yield increased one basis point to 0.16%, and the 10-year yield increased four basis points to 0.82%. The U.S. dollar index fell 1.9% to 92.26.

What We Can Expect from the Market this Week

Investors in the region reacting to President-elect Joe Biden preparation to transition into the White House even as Donald Trump rejected the outcome of the U.S. election. Investors also are assessing the implications of Biden’s leadership on U.S. foreign policy and the stance toward China and key oil producers Iran and Venezuela.

After the conclusion of the election last week, we think that the market's immediate focus will shift toward the health and pace of the economic rebound, the negotiations around a needed additional fiscal-aid stimulus from Washington, and the increase in COVID-19 cases and the progress toward a vaccine to set the tone for market performance.

Important economic news released this week including Job Openings and Labor Turnover Survey on Tuesday, OPEC’s monthly report on Wednesday, Federal budget statement, unemployment claims and CPI on Thursday, and PPI on Friday.