Stocks Performance (U.S. Stocks)

Stocks edged higher last week as the market's historic rally extended to the first week of December. The move is as optimism about vaccine progress and strong economic data continued to offset concerns about surging COVID-19 cases in many regions. Renewed hopes in Washington for a congressional deal for additional economic stimulus also added to the positive tone.

The Dow Jones Industrial Average once again pushed above the 30,000 level, after first breaching the milestone last week, and the S&P 500 and the NASDAQ Composite indices climbed to record highs. The NASDAQ, powered by big gains in mega-capitalization companies such as Apple Inc. and Tesla Inc., is now up a whopping 39% year-to-date.

Energy shares bounced back after OPEC and other major oil producers reached an agreement to ease output cuts more gradually next year than previously planned, while utilities stocks lagged. By sectors, the most outperformed weekly stocks were led by Non-Energy Minerals sector at 6.78%, followed by Electronic Technology at 4.81%, Energy Minerals (3.61%), and Industrial Services at 3.81%. Meanwhile, the weakest sectors were from the Retail Trade at -1.16%, Utilities at -1.13%, Consumer Durables (-0.08%), and Process Industries sector (0.12%).

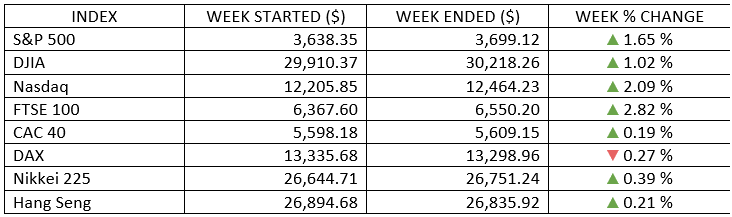

Indices Performance

Each of the major U.S. indices rose totalled 1% to 2%, slightly below the previous week’s increases.

Overseas equity markets were mixed. Germany and Italy slipped lower as PMIs in the region retreated to their lowest levels since May, in the wake of strict lockdowns. UK stocks were solidly higher, boosted by cautious optimism on the Brexit front and by word that Britain was the first Western nation to approve a COVID-19 vaccine.

Strong industrial profit and manufacturing data in China lifted stocks in Asia and Japan.

Oil Sector Performance

The price of crude oil wavered most of the week but ended higher after OPEC and its allies agreed to ease output cuts more gradually than previously planned. Oil extended its gains to a 9-month high sometime in the week.

Market-Moving News

Extended Run

The major U.S. stock indexes pushed their record levels higher, extending the mostly positive momentum seen since the start of November despite the rise in coronavirus cases.

A November to Remember

The S&P 500’s 10.8% gain last month was the index’s biggest in eight months and its best November result since 1928, according to S&P Dow Jones Indices. November marked a turnaround from September and October when the S&P 500 posted a cumulative decline of 6.6%.

Mixed Jobs Report

The pace of the U.S. labor market’s partial recovery from the spring’s COVID-19 economic shock is slowing. 245,000 jobs added in November, around half of what economists had expected, marking the fifth straight month of slowing growth. Unemployment fell to 6.7%.

Economic Stimulus Revival?

Spiking coronavirus cases and a somewhat weak monthly jobs report lifted hopes that Congress might overcome an impasse that prevented another round of coronavirus economic relief. Democratic and Republican leaders spoke about a possible deal on Thursday, and lawmakers from both parties have been voicing support for a bipartisan agreement.

Yield Surge

Government bond prices were under pressure, as the yield of the benchmark 10-year U.S. Treasury bond soared as high as 0.98% at one point on Friday, matching a recent high achieved around three weeks earlier.

Crude Comeback

Crude oil prices continued to climb further out of the hole they plunged into during the spring following a collapse in demand. The price of U.S. crude on Friday climbed above $46 per barrel for the first time in nine months, owing in part to a new production agreement reached by OPEC and other oil-producing nations.

Bitcoin Rebounds

After stalling the previous week, the price of the cryptocurrency bitcoin resumed its recent rally, eclipsing $19,000 and rising about 13% for the latest week. Bitcoin started the year around $8,000, and it was just $10,600 as recently as early October.

Brexit on the Brink

The United Kingdom and the EU remained at odds on key Brexit issues on Friday as the deadline for a trade deal approached. Great Britain left the EU in January but agreed to continue following EU trade rules until year end so both sides could come to a new trade agreement.

Other Important Macro Data and Events

U.S. dollar dropped to a two-and-a-half-year low versus other major currencies, as the stimulus expectations put further upward pressure on bond yields, and bond prices. The weak dollar, in turn, buoyed prices of commodities including copper, which jumped to a seven-year high.

Some economic data, including construction spending, initial jobless claims, and the ISM manufacturing index, suggested solid economic growth despite the recent rise in COVID-19 cases and business restrictions.

However, Friday’s below-consensus U.S. employment report painted a more cautious picture, and Federal Reserve Chairman Jerome Powell cautioned the Senate Banking Committee that the US economy remains in an uncertain state.

Pfizer and BioNTech had applied to EU regulators for emergency use authorization of their prospective coronavirus vaccine. On Wednesday, the UK granted such approval, making it the first Western nation to authorize the widespread distribution of a vaccine.

What We Can Expect from the Market this Week

The spotlight of the week will be concentrated on the trio of vaccine progress, the current state of the economy and the potential for a fiscal package in Washington.

Important economic news released this week including consumer credit on Monday, wholesale inventories and JoLT survey on Wednesday, unemployment claims, CPI and Treasury budget on Thursday, and PPI index on Friday.