Stocks Performance (U.S. Stocks)

Optimism about fiscal stimulus, positive economic data, and an encouraging start to earnings reporting season, boosted all major U.S. stock indices to record highs. The anticipation of President Biden’s proposed stimulus package, buoyed by supportive comments from incoming Treasury Secretary Janet Yellen, gave the S&P 500 its best first-day reaction to a presidential inauguration since at least 1937.

Joe Biden was inaugurated on Wednesday as the 46th president and signed several executive orders to aid the fight against the coronavirus, and Treasury Secretary nominee Janet Yellen asserted that it's time to "act big" on fiscal stimulus. Republican lawmakers, however, pushed back on President Biden's $1.9 trillion stimulus proposal.

Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOG), and Facebook (NASDAQ: FB) rallied between 6-9% last week on an appreciation from Netflix's (NASDAQ: NFLX) earnings report that these companies still have serious earnings potential. NFLX shares surged 13.5%.

Gritstone Oncology Inc. (NASDAQ: GRTS) jumped in response to an agreement with the National Institute of Allergy and Infectious Diseases (NIAID) to initiate a phase 1 trial of its second-generation SARS-CoV-2 vaccine candidate and entering a license pact for its experimental Covid-19 vaccine.

The energy sector led the index to a loss as President Biden signed some executive orders regarding the energy and climate control on his first day in office. The industrials sector was also lower. The technology was stronger lifted by the mega-capitalization computer and Internet stocks.

By sectors, the most outperformed weekly stocks were led by Technology Services sector at 5.08%, followed by Electronic Technology at 3.13%, Retail Trade (3.06%), and Consumer Durables at 2.00%. Meanwhile, the weakest sectors were from the Energy Minerals at -5.56%, Non-Energy Minerals at -3.22%, Industrial Services (-2.58%), and Transportation sector (-2.75%).

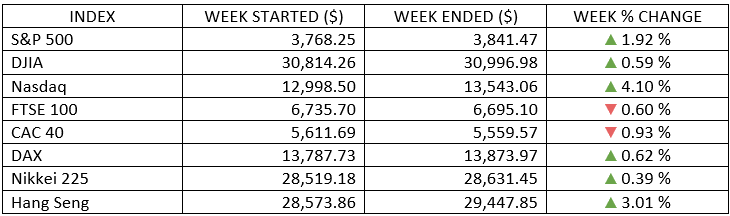

Indices Performance

In a trading week shortened by the Martin Luther King Jr. Day holiday, the major U.S. indexes regained momentum. Optimism over earnings results and the political transition helped to lift the indexes, hitting new intraday highs on Thursday before a pullback on Friday.

European equity markets were mostly lower as lockdown restrictions were extended in several countries, including the UK and Germany. However, Germany’s DAX Index was higher after the ZEW survey showed a jump in investor expectations. Italy’s Prime Minister Conte survived a confidence vote, but Italian stocks underperformed after reports the PM is, nevertheless, considering an early election.

The UK’s FTSE 100 Index fell 0.60%, partly held back by the British pound’s strength relative to the dollar and fears that the strict coronavirus lockdown would not end anytime soon.

Most Asian markets were higher after China’s industrial production data for December and Q4 GDP showed its economy recovering faster than expected. Hong Kong’s Hang Seng Index was especially strong on hopes of warmer U.S.-China relations under President Biden and after stock of Alibaba Group Holding Ltd. surged in reaction to the reappearance of billionaire co-founder and former CEO Jack Ma, who has been out of public view for months.

Oil Sector Performance

Oil prices mixed as investors weighting between the anticipation of more U.S. stimulus spending to the surprising rise in U.S. inventories, and on worries of increasingly tight lockdowns globally.

Market-Moving News

Indexes Back on Track

After slipping the previous week, the major U.S. stock indexes regained the positive momentum. Optimism over earnings results and the U.S. political transition helped to lift the NASDAQ about 4%, the S&P 500 2%, and the Dow less than 1%.

Growth Stocks Resurgence

U.S. growth stocks outperformed their value counterparts by a wide margin, as a growth stock benchmark climbed nearly 4% while a value benchmark fell slightly.

China's Growth Comeback

China’s government economic growth accelerated in the Q4, leading to a full-year 2020 GDP growth figure of 2.3%, despite the impact of the pandemic. China could become the only major economy in the world to have grown rather than contracted in 2020; the U.S. is scheduled to report its initial GDP estimate on Thursday, January 28.

Fed Ahead

The U.S. Federal Reserve is widely expected to keep its benchmark interest rate unchanged—and at a near-zero level—when it concludes a two-day meeting on Wednesday. Fed statements will be closely watched for any indications about the central bank’s intentions to maintain its current monetary policy stance throughout 2021.

Positive Surprises

As of Friday, 86% of the S&P 500 companies that had reported Q4 results exceeded analysts’ earnings estimates, according to FactSet. That so-called beat rate ranks above the 74% five-year average, and FactSet says it could lead to the first overall quarterly earnings increase since the Q4 of 2019.

Housing Strength

The U.S. housing market continues to be a positive catalyst for the financial markets and the broader economy. The National Association of Realtors reported that sales of previously owned homes rose in 2020 to the highest level since 2006, lifted in part by ultralow interest rates.

Bitcoin Volatility

The recent surge in price volatility for bitcoin continued, as the cryptocurrency rose to nearly $38,000 on Tuesday before briefly dropping below $29,000 on Friday. In mid-December, bitcoin was trading at around $19,000.

Other Important Macro Data and Events

In the U.S. economic data, weekly jobless claims fell back from a multi-month high but remained elevated, at 900,000, while IHS Markit’s preliminary gauges of both manufacturing and service sector activity in January surprised on the upside. The housing sector remained in outstanding shape, with existing home sales and housing starts at their highest levels since 2006.

U.S. government bond yields and oil prices raised higher and generally steady over the week. (although oil slipped Friday to end the week slightly lower).

Gold, copper, and other commodity prices were also higher, helped by a slide in the U.S. dollar.

Both the European Central Bank and the Bank of Japan met last week and kept their accommodative policies firmly in place but lowered its GDP forecast.

The PMI suggested that business activity in the eurozone contracted at a faster rate in January, as renewed lockdowns weighed on services. However, factory output expanded for a seventh month, albeit at a slower rate, due to growth in new orders, exports, and backlogs.

In the Europe, lockdown prolonged. Germany extended its tough lockdown restrictions until February 14. The Dutch government imposed the first nationwide curfew since World War II and banned flights from the UK to stop the spread of a mutated variant of the virus. EU leaders stepped back from imposing an EU-wide travel ban but warned that stricter lockdowns measures are likely to persist due to the new strains of the virus. Ireland will extend its lockdown, due to end February 5, to March 5.

UK Prime Minister Boris Johnson told broadcasters that it is “too early” to say when the national lockdown will end, raising fears that restrictions could last until midyear.

What We Can Expect from the Market this Week

The U.S. Federal Reserve statements will be closely watched when it concludes a 2-day meeting on Wednesday. The Fed is widely expected to keep its benchmark interest rate unchanged at a near-zero level. The discovery and rollout of effective vaccines have raised hope that restrictions will gradually be lifted, accelerating the economic recovery and return to normalcy.

Given the positive outlook for economic growth and earnings, we would view any upcoming pullbacks as attractive buying opportunities for investors with a long-time horizon.

U.S. economic data being released this week including Q4 GDP, home market index, consumer confidence index, durable goods orders weekly unemployment claims, leading economic index, and personal income and consumer spending,