PAST WEEK'S NEWS (January 25 - January 31, 2021)

Stocks Performance (U.S. Stocks)

Equities fell in every major global market last week in its largest weekly loss in three months in response to growing worries on several fronts. Concerns increased about new virus variants, vaccine rollout delays and supply shortages. Hopes that a new fiscal aid package in the U.S. to provide a near-term economic boost were also dulled when top lawmakers said passage of a deal was at least a month away. Market also falls from record highs as short sellers get squeezed and brokerage firms restrict trading. While in Europe generally, countries tightened economic lockdowns and border controls to counter high COVID-19 case counts.

GameStop (NYSE: GME) entered the week at $65 per share and peaked at $483 per share later in the week, as it become the poster child for the rebellion against short sellers. Things got so wild that brokerage firms restricted trading activity on heavily-shorted stocks like GME, AMC (NYSE: AMC) and KOSS (NASDAQ: KOSS), which sent these stocks lower and drew the ire of many market participants. These brokerage firms eventually eased some restrictions, allowing users to resume their speculation and push these stocks higher at the end of the week. GME shared ended the week higher by 400% and KOSS at more than 1,800% higher. This volatility unnerved the market for multiple reasons, including concerns about fund managers selling long positions to cover their shorts and, for some, the potential for increased regulation.

The drama fixated the market and took away from the batch of better-than-expected earnings reports, including from leading companies like Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), Facebook (NASDAQ: FB), and Tesla (NASDAQ: TSLA).

On the vaccine front, Johnson & Johnson (NYSE: JNJ) published encouraging data for its one-shot COVID-19 vaccine, although the efficacy rate was much lower than the two-shot vaccines currently on the market. Novavax (NASDAQ: NVAX) said its vaccine candidate produced an 89.3% efficacy rate in its Phase 3 trial in the UK.

By sectors, the most outperformed weekly stocks were led by Electronic Technology sector at 15.72%, followed by Retail Trade at -0.93%, Utilities (-1.58%), and Consumer Non-Durables at -1.67%. Meanwhile, the weakest sectors were from the Energy Minerals at -5.79%, Distribution Services at -5.70%, Non-Energy Minerals (-5.48%), and Producer Manufacturing sector (-4.95%).

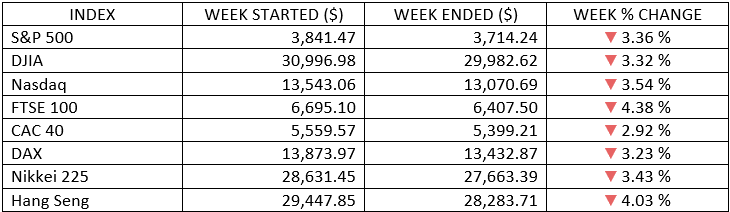

Indices Performance

The major U.S. indexes recorded the worst week since late October, as the big shift came on Wednesday, when the indexes lost more than 2% to slipped more than 3% for the week, as risk sentiment was pressured by a frenzy of short-squeeze activity.

European shares fell amid worries that the economy could slow due to the raging coronavirus pandemic and delays in the distribution of coronavirus vaccines.

In Asia, Hong Kong and Shanghai, markets were especially weak after China’s central bank was turning more hawkish after it drained $12.1 billion in liquidity from the financial system and an official cautioned about asset bubbles.

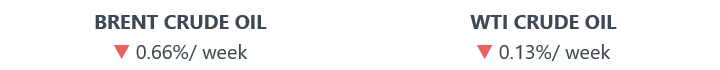

Oil Sector Performance

Oil prices edged lower, as renewed COVID-19 lockdowns raised concerns about global fuel demand.

Market-Moving News

Stocks Slipped

The major U.S. stock indexes couldn’t maintain the previous week’s positive momentum, as the major indexes all fell more than 3%. The big shift came on Wednesday, when the indexes lost more than 2% and the S&P 500 retreated from the record high it had reached a day earlier.

Volatility Spike

The Cboe Volatility Index, which measures investors’ expectations of short-term stock volatility, surged more than 50% for the week, rising to its highest level in three months. The jump was fueled in part by so-called short squeeze battles that triggered wild rides for shares of electronics retailer GameStop and movie theater chain AMC.

Mixed January

The S&P 500 and the Dow fell 1% to 2% for the first month of the year while the NASDAQ posted a more than 1% gain, lifted in part by strong earnings from technology companies. The market’s positive start to 2021 reversed course entering the closing days of the month.

Earnings Checkup

Although Q4 earnings results continued to improve in the latest week, U.S. companies are still expected to report an overall earnings decline. With results in from more than one-third of companies in the S&P 500 as of Friday, earnings were projected to end up 2.3% lower than they were a year earlier, according to FactSet. That’s an improvement on the 4.8% decline that had been expected the previous week.

Shrinking Economy

The government’s initial GDP estimate showed that the U.S. economy contracted 3.5% in 2020, marking the largest annual decline since 1946. However, the Q4 GDP grew at an annual rate of 4.0%, a result that followed the Q3’s record 33.4% growth and the sharp pandemic-driven declines in the first two quarters of 2020.

Fed Holds Steady

The U.S. Federal Reserve didn’t change its monetary policy stance at its latest meeting but noted that U.S. business activity has recently softened amid a resurgence in COVID-19 cases. The central bank expressed hope that vaccine distribution can help the economy recover.

Other Important Macro Data and Events

In Federal Reserve meeting, Fed Chair Powell delivered a dovish-sounding post-FOMC press conference, reaffirmed its commitment last week to keep interest rates low and monetary stimulus in place until the economic rebound has traction. Reports also suggested that President Biden's $1.9 trillion stimulus deal could be pushed back to mid-March due to bipartisan objections.

A shift to more defensive positioning pushed U.S. government bond prices higher and yields lower. The U.S. dollar also gained strength, which in turn put downward pressure on the price of commodities, including oil, gold, and copper.

U.S. economic data was mixed. Consumer confidence and personal income were higher, and initial jobless claims were lower, but durable goods orders rose much less than expected. Q4 GDP growth also disappointed, as increased pandemic restrictions and expiring stimulus programs took their toll.

European stock markets all came under pressure from lower confidence readings across the region and increased COVID-19 restrictions. Surprisingly, Italy was one of the best performers, despite the resignation of Prime Minister Giuseppe Conte in a manoeuvre to form a new coalition government.

European Q4 GDP: Germany, France, and Spain reported relatively resilient GDP numbers for the fourth quarter, spurring hopes that the eurozone might avoid a deeper recession. The German economy expanded 0.1%, and Spain’s GDP grew 0.4%, while France’s economy shrank 1.3%.

On COVID-19 front:

France's top medical adviser said a third national lockdown might soon be needed to contain infections. Portugal said it would extend a lockdown until mid-February. The UK tightened its travel curbs, requiring travellers coming from some countries to quarantine in government-sanctioned hotels. Germany prepared to ban all travel from South Africa, the UK, Portugal, Brazil, and other countries where variants of the coronavirus that are more contagious have contributed to surging infection rates. Riots broke out in the Netherlands due to recently imposed curfew restrictions.

What We Can Expect from the Market this Week

Episodes like last week are a reminder of the important difference between speculation and investing. When it comes to the long-term strategy, make sure the portfolio decisions remain aligned to the timeline and the goals we’re trying to achieve. Even the best markets endure volatility. It’s the discipline and decisions made during volatility that can help investors to stay on track to the goals over time.

Given the positive outlook for economic growth and earnings, we would view any upcoming pullbacks as attractive buying opportunities for investors with a long-time horizon.

A monthly labour market update due out on Friday is likely to be the week’s most closely watched economic report. The new release will show whether January marked the seventh consecutive month of a slowdown in jobs growth. In December, jobs fell by 140,000, the first time since April 2020 that jobs declined rather than increased.

Other U.S. economic data being released this week including ISM manufacturing index, construction spending, ADP employment report, weekly unemployment claims, factory orders, trade order, and consumer credit.