PAST WEEK'S NEWS (April 12 – April 18, 2021)

Stocks Performance (U.S. Stocks)

Global stock markets advanced, with several equity benchmarks climbed to record highs last week, as economic growth appeared to accelerate, especially in the U.S. and China - the world’s two largest economies. The stronger-than-expected CPI was ignored, and the S&P 500 was pushed to new highs for the sixth consecutive week. Overall sentiment seemed to get a boost from Wednesday’s release of earnings results from banking giants JPMorgan Chase, Goldman Sachs, and Wells Fargo.

Vaccine news also appeared to drive sentiment. Futures wavered on Tuesday morning, after U.S. regulators announced that they were suggesting a “pause” in Johnson & Johnson’s coronavirus vaccinations following rare reports of blood clots. Though investors seemed encouraged by Pfizer’s announcement that it could deliver 10% more of its vaccine by the end of May than earlier promised.

Briefly highlighting the key events, the corporate earnings season start as the big banks reported better-than-expected Q1 earnings reports and issued upbeat commentary. Core CPI for March was muted on a year-over-year basis at 1.6%, and retail sales surged 9.8% m/m in March.

The Fed keep monetary policy accommodative, even as the economy and labor market continue to rebound. Fed Chair Powell added that once substantial progress on its employment and inflation goals has been reached, it will start to taper asset purchases well before it raises interest rates.

The U.S. government bond yields fell for the second consecutive week, dragging the dollar, which in turn helped boost commodity prices. Oil prices also supported by report of falling crude inventories by IEA.

Advancing sectors were led by Non-Energy Minerals sector at 4.59% as rising gold and copper prices boosted mining shares, followed by Consumer Durables at 3.39%, Health Services (3.21%), and Health Technology at 2.77%. Meanwhile, the weakest sectors were from the Transportations sector at -0.37%, Electronic Technology at 0.16%, Industrial Services (0.25), and Consumer Services sector (0.70%).

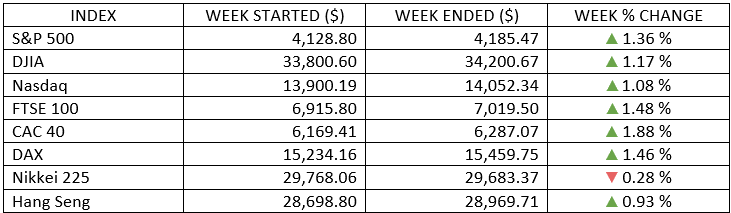

Indices Performance

The S&P 500 and the Dow recorded their fourth consecutive week of gains and moved to record highs, while the Dow surpassed 34,000 for the first time.

All European markets were also higher, rose on hopes of a strong recovery in the global economy and corporate earnings, despite a resurgence in coronavirus infections. Together with the strength in U.S. equities, consequently boosted the MSCI All-Country World Index to a record high.

Japanese equites fell after surprisingly weak February machine orders and ruling LDP party officials suggested the Olympics could be cancelled or proceed without any fans.

Oil Sector Performance

Oil recorded its best week since early March on optimism that recovery in demand from the COVID-19 pandemic is improving. Industry data from IEA showed U.S. oil inventories declined more than expected and OPEC raised its outlook for oil demand. The crude also edges higher after Yemen-based Houthi movement said it fired missiles on Saudi oil sites on Tuesday.

Market-Moving News

Fourth Week Advance

The S&P 500 and the Dow climbed for the fourth week in a row, rising more than 1% and pushing their record levels higher. Over that 4-week stretch, the S&P 500 has gained about 7% and the Dow 4%; the NASDAQ’s gain has been 6%.

Calming Stock Market

A measure of investors’ expectations of short-term stock market volatility fell for the fourth week in a row to the lowest level in about 14 months, as the Cboe Volatility Index slipped to around 16 on Friday. Twelve months earlier, in the early days of the pandemic, the so-called VIX was around 40.

Yield Pullback

Yields of U.S. government debt slipped as bond prices recovered, eroding some of 2021’s surge in yields. The yield of the 10-year U.S. Treasury bond fell to 1.57%, down from a recent high of 1.74% on March 31. Nevertheless, the yield is still up sharply from 0.92% at the end of last year.

Economic Healing

Two reports released on Thursday suggested an acceleration in the U.S. economic recovery. Retail sales jumped 9.8% in March, and first-time unemployment claims fell to 576,000 in the latest weekly count—the lowest level since the pandemic began to severely weaken the labor market.

Inflation Gauge

A monthly measure of U.S. CPI rose for the fourth month in a row and the pace of inflation hit the highest level in 2-1/2- years. The CPI jumped 0.6% in March, slightly higher than economists had expected. On an annual basis, inflation is at 2.6%.

Earnings Launch

Quarterly earnings season got off to a strong start, with profits of companies in the S&P 500 expected to rise around 30% as of Friday, based on the relatively small number of companies that have reported so far and forecasts for upcoming reports. That 30% growth rate exceeds the 25% gain that had been expected prior to the start of earnings season, according to FactSet.

Rise of the Crude Oil

U.S. crude oil prices climbed around 6% for the week to above $63 per barrel, the highest in more than a month. The gain came as the IEA increased its demand outlook for crude and a U.S. government report revealed a third consecutive weekly drop in inventories.

China's Recovery

China recorded a record 18.3% jump in Q1 GDP growth, as the world’s second-largest economy extended its strong recovery from the pandemic. While the surge reflects the deep decline in economic activity in early 2020, the latest figure could put China on track to exceeding its government’s full-year growth target of more 6.0%.

Other Important Macro Data and Events

In a “60 Minutes” interview, US Federal Reserve Chair Jerome Powell said that the US economy was poised to accelerate if COVID-19 continues to retreat. And in its April Beige Book, the Fed said the economy had accelerated “to a moderate pace”. A slew of economic data lent support to that view. Weekly initial jobless claims fell much more than expected, March homebuilding activity and retail sales surged, and both the Empire State Manufacturing Survey and the Philadelphia Fed Business Outlook Survey climbed to multi-year highs.

The long-term interest rates accelerated their monthly downtrend despite strong economic data. The 10-yr yield declined ten basis points to 1.57%, including an 11-bps drop in one day, in a move fuelled by short-covering activity.

The dollar turned lower for the week. Against a basket of major currencies, the index slipped -0.69% to stay at 91.53. EUR/USD advanced 0.72%, USD/JPY declined -0.84%, GBP/USD rose 0.92%, and USD/CHF slipped -0.49%.

The lower dollar, in turn, boosted prices of most commodities, including gold, copper and oil.

Eurozone retail sales in February were reported to have increased much more than expectations. However, economic data from the region was more mixed than that in North America, as many European countries struggled with increasing COVID-19 cases and difficulties in vaccination programs.

What Can We Expect from the Market this Week

Some investors remained worried about the possibility of rising inflation and proposals for higher taxes, as progress in President Biden's new infrastructure proposal is underway.

With recent market movements that seem to follow the near-term headlines, it is easy for investors to be swayed and discouraged when short term corrections happen. Investors then find themselves with two options, either to continue investing in a disciplined manner or to divest to cut losses. For those unable to digest short term pullbacks, it is perhaps better to reassess one’s risk tolerance and rebalance the investment portfolio accordingly.

Important economic data being released next week include the PMI composite, weekly unemployment claims and new home/ existing home sales.