PAST WEEK'S NEWS (Sep 13 – Sep 19, 2021)

Corvus Pharmaceuticals Inc surged higher on abnormally high volume last week. The stock might be trading higher following favourable data results by AstraZeneca PLC for patients with unresectable, stage 3 non-small cell lung cancer. Corvus Pharmaceuticals is a clinical-stage biopharmaceutical company engaged in developing drugs and antibodies that target the most critical cellular elements of the immune system. The company has traded as high as $5.74 and as low as $1.86 over a 52-week period.

Meanwhile the shares of Protagonist Therapeutics, a clinical-stage biotechnology company, plummeted in response to news of a clinical hold from the FDA.

Stocks Performance

While the prices for seemingly everything has been on the rise, from consumer goods to commodities to houses to stocks, the stock market has paused to catch its breath as well. Investors weighed some encouraging economic data against worries about supply chain challenges, elevated valuations, and concerns over how stocks would respond to an eventual tightening in monetary policy.

In addition, not only was there uncertainty about infrastructure and the debt ceiling, but there were also growing problems in China. Beijing's regulatory crackdown persisted, the renewed lockdown on the COVID-19 outbreak, and reports discussed the possibility of Evergrande - one of China's largest property developers - defaulting on its debt.

Energy sector recorded solid gains on the back of rising oil prices, while strength in auto-related shares boosted consumer discretionary stocks. The materials, utilities, industrial, and communication services sectors underperformed with 1-3% losses.

Indices Performance

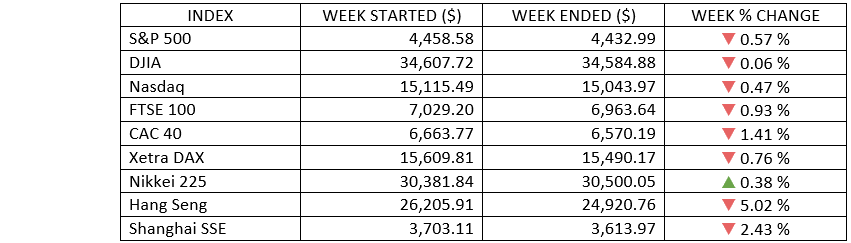

The major U.S. equities ended the week with modest declines. The S&P 500 and NASDAQ fell for the second week in a row, while the Dow posted its third straight negative result.

Shares in Europe also weakened, as concerns about the impact of the coronavirus’s Delta variant on the global economy outweighed expectations of continuing central bank support.

Japanese equities extended their gains over the week, buoyed by political optimism and expectations of further fiscal stimulus under a new prime minister.

Chinese stocks fell sharply for the week. Weak August economic data, a fresh coronavirus outbreak in Fujian province, the growing debt crisis at embattled property developer China Evergrande Group, and the threat of tighter gaming regulations in Macau dampened investor sentiment.

This week, China’s stock markets are closed Monday and Tuesday for the Mid-Autumn Festival and will reopen on Wednesday, September 22.

Oil Sector Performance

Oil prices settled the week higher, with Brent near a 7-week high and WTI near a 6-week high, as the output recovery is seen lagging demand. The output in the U.S. Gulf of Mexico has recovered more slowly than expected after Hurricane Ida damaged facilities in August and tropical storm Nicholas hit this week.

Market-Moving News

Small Pullback

The S&P 500 and NASDAQ fell for the second week in a row amid choppy trading, although their latest weekly declines were modest at just 0.5%. The Dow's decline was even smaller; that index posted its third straight negative result.

Stalled Momentum

With less than two weeks remaining in September, the stock market’s modest decline since the early part of the month threatens to snap the S&P 500’s string of seven positive months in a row. As of Friday, the index was down more than 2% from a record high achieved on Sept 2.

Inflation Moderation

While inflation remained strong, the recent spike in U.S. consumer prices moderated in August. The CPI rose 5.3% compared with the same month a year earlier, but the rate of increase was down slightly from July’s figure and was markedly below June’s surge in inflation.

Retail Therapy

Despite a recent decline in consumer sentiment, U.S. retail spending unexpectedly rebounded. Sales rose 0.7% in August, marking a sharp turnaround from July’s 1.8% decline. The August result could temper expectations for a sharp slowdown in economic growth in the Q3.

Shaken Confidence

The recent deterioration in U.S. consumers’ economic expectations has eased somewhat, according to a preliminary reading released on Friday. The University of Michigan said its monthly consumer sentiment index came in slightly above its figure in August, when sentiment fell sharply among survey participants.

Crude Awakening

U.S. crude oil prices rose above $70 per barrel for the first time in a month and a half and climbed as high as $73 as further storms in the Gulf of Mexico threatened to disrupt oil production there. Thursday marked the fifth consecutive daily gain for crude prices, although oil pulled back on Friday as the threat from the latest storm eased.

China's Retail Slump

China’s 2.5% growth in August retail sales was far slower than most economists had expected as restrictions targeting an outbreak of COVID-19’s Delta variant weighed on consumer activity. Monthly growth in China’s industrial production was also below expectations.

Other Important Macro Data and Events

Investors pondered a few significant data surprises during the week. On Tuesday, the Labor Department reported that core CPI increased 0.1% in August, below consensus expectations for a 0.3% increase and the smallest gain since February. On Thursday, the Commerce Department reported that August retail sales outside the volatile auto sector jumped 1.8%, defying consensus expectations for a small decline. A gauge of factory activity in the New York region, reported Wednesday, also came in well above expectations.

Tuesday’s mild inflation data appeared to drive a rally in the bond market, helping push the yield on the benchmark 10-year U.S. Treasury note to its lowest intraday level since August 23.

Core eurozone bond yields rose in sympathy with U.S. Treasuries, with a Financial Times report saying that the ECB expects to meet its 2% inflation target by 2025 and is on course to raise interest rates in about two years—significantly ahead of consensus expectations. Peripheral eurozone bonds tracked core yields. UK gilt yields advanced after data indicated that inflation surged in August, sparking concerns that this development might prompt the BoE to increase interest rates sooner than expected.

Inflation in the UK jumped to 3.2% in August, its highest level in more than nine years. The Office for National Statistics said that much of the spike was due to a substantial drop in restaurant and café prices last year and meaningful increases this year.

Gold prices settled for a second weekly loss as a firmer dollar dented the metal's allure for holders of other currencies.

What Can We Expect from the Market this Week

At the two-day meeting that concludes on Wednesday this week, the U.S. Federal Reserve is expected to explore when to trim its bond-purchasing stimulus program as an initial step toward broadly tightening its monetary policy. Recently uneven economic data has fueled talk among economists that the Fed may hold off on setting a specific tapering date while tying policy changes to job growth in September and beyond.

Some important U.S. economic data being released this week include housing starts, existing and new home sales, PMI composite, and the Fed Funds Target upper bound.