PAST WEEK'S NEWS (October 20 – October 24)

In a unilateral declaration echoing the tempests of past trade wars, President Donald Trump terminated all U.S.-Canada negotiations on Thursday, claiming Canada deployed a "fraudulent" Reagan-era advertisement to undermine U.S. tariff policies. The ad, part of Ontario Premier Doug Ford’s $75 million campaign targeting American consumers, incorporated a 1987 Reagan radio address on trade barriers, though the Reagan Foundation condemned its selective editing as a distortion of the late president’s stance. This act now leaves Canadian Prime Minister Mark Carney in an awkward position, having abandoned the fragile thaw forged after Trump’s prior annexation threats. As the Reagan Foundation reviews legal recourse, the episode exposes the fragility of transnational commerce when historical figures become political pawns in modern tariff battles. History whispers that such ruptures often sow seeds for deeper economic wounds that outlast the initial conflict.

The United States initiated what could be a controversial policy, allowing private companies access to 19 metric tonnes of weapons-grade plutonium from dismantled Cold War nuclear warheads to power advanced reactors for AI data centres, reversing an earlier $20 billion plan to dispose of the material. The executive order is part of a broader effort to boost domestic nuclear fuel production and reduce reliance on foreign uranium suppliers. Companies such as Oklo and Newcleo are expected to apply, with Oklo already investing billions to build infrastructure. However, critics warn the plan revives a failed plutonium-to-reactor fuel programme that previously exceeded $50 billion in costs and raises serious nuclear proliferation risks. National security experts argue the initiative could undermine the nuclear weapons modernisation programme by diverting resources from warhead production and straining already limited capacity at national laboratories. The policy has also sparked debate over whether the U.S. is prioritising Silicon Valley’s AI power needs at the expense of nuclear deterrence and global security.

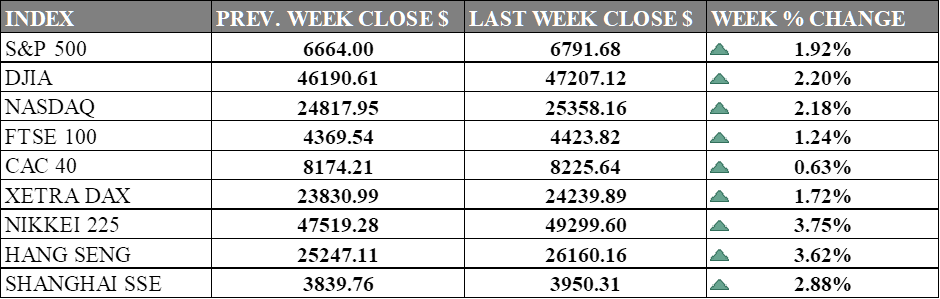

INDICES PERFORMANCE

Wall Street's major indices extended their gains this week, with technology stocks continuing to drive the rally. The S&P 500 rose 1.92% to 6,791.68, while the Dow Jones Industrial Average gained 2.20% to 47,207.12. The Nasdaq advanced 2.18% to 25,358.16, as investors maintained their appetite for growth stocks amid positive market sentiment.

European markets posted solid gains across the region. The UK's FTSE 100 climbed 1.24% to 4,423.82, while Germany's XETRA DAX rebounded strongly with a 1.72% advance to 24,239.89, recovering from the previous week's decline. France's CAC 40 showed the most modest performance among major European indices, rising 0.63% to 8,225.64.

Asian markets staged an impressive recovery this week. Japan's Nikkei 225 surged 3.75% to 49,299.60, marking one of the strongest performances globally as investors returned to Japanese equities. Hong Kong's Hang Seng Index reversed its previous losses with a robust 3.62% rally to 26,160.16, reflecting improved risk sentiment in the region. China's Shanghai Composite gained 2.88% to 3,950.31, building on the previous week's momentum as mainland equities attracted renewed investor interest.

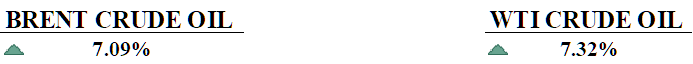

CRUDE OIL PERFORMANCE

U.S. crude oil prices rebounded from a three-week decline last week, notching slightly above 7% to around $61.50 per barrel with renewed U.S. sanctions targeting Russia’s largest oil producers, Rosneft and Lukoil. The sanctions, aimed at pressuring Moscow over Ukraine, could disrupt up to 1.5 million barrels per day of Russian seaborne exports, though analysts remain skeptical about their full impact given Russia’s history of circumventing restrictions. Optimism over a U.S.-China trade deal and easing inflation data supported market sentiment, while rising crude inventories in China, now totaling 1.38 billion barrels, helped absorb excess supply risk. Although China’s expanding strategic reserves and new sanctions on Russian oil offer some support, Bernstein analysts warn that a continued global surplus of about 1 million barrels per day keeps downward pressure on prices.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. inflation slowed in September, boosting hopes for a Federal Reserve rate cut next week as core prices rose less than expected.

UK private sector grew in October, with manufacturing rebounding and services steady, but exports weakened and businesses remain cautious ahead of the Budget.

What Can We Expect from The Market This Week

Fed Interest Rate Decision: The Federal Reserve is expected to cut interest rates by another 25 basis points at its October meeting, bringing the federal funds rate down to the 3.75%-4.00% range. This would be a continuation of the Fed's easing cycle aimed at supporting the labour market while managing inflation concerns.

BoC Interest Rate Decision: The Bank of Canada is expected to cut its benchmark interest rate by 25 basis points to 2.25% at its October meeting, marking the second consecutive cut to support its weakening economy.

ECB Interest Rate Decision: The European Central Bank is likely to hold its rates steady for the third consecutive time, maintaining the deposit facility rate at 2.00%. After cutting rates by 2 percentage points through June, policymakers are pausing to assess the impact of previous cuts with near-target inflation.

PCE Price Index: Personal consumption grew to 2.74% annually in August, up from 2.60% in July, while the core PCE stood at 2.91%. The next release is expected to sustain the growth rate, with expectations that inflation remains above the Fed's 2% target.

Chicago PMI: The Chicago Business Barometer fell to 40.6 in September, marking the 22nd consecutive month of contraction below the 50 threshold that separates growth from decline. The continued weakness was led by declines in new orders and challenges in the regional manufacturing sector.