As Wilson notes, looking at the most recent disappointing macro data including poor durable good, capital spending and Markit PMIs, “recent data points suggest US earnings and economic risk is greater than most investors may think.”

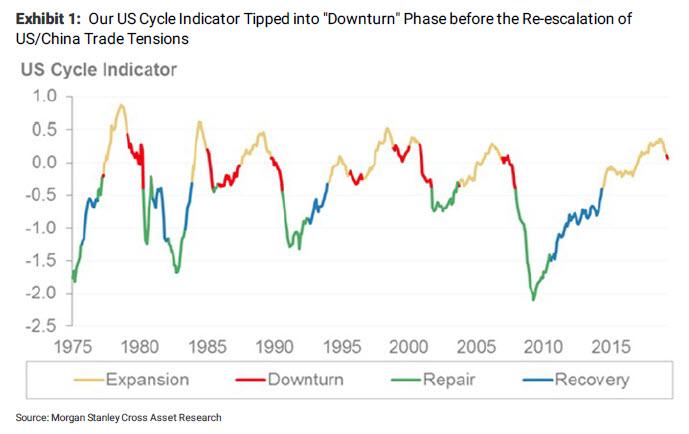

Supporting that claim is the fact that our US Cycle indicator moved into a downturn phase based on the April data which was before the trade talks broke down in early May (Exhibit 1). The OECD leading indicator also fell to its lowest level since the last recession. In addition, we are now hearing from many leading semiconductor (INTC, MCHP) and industrial companies (CAT, DE) that the second half recovery many are counting on is looking less likely. Like the weaker macro data in April, we don’t think these softer outlooks are the result of the uncertainty in the US/China trade negotiations. In the past week, our economists have lowered their 2Q US GDP forecast to 0.6% from 1.0%. We suspect this could deteriorate further if trade negotiations don’t improve soon.

Source: Morgan Stanley Cross Asset Research

And since all of these reflect April data – which means it weakened before the re-escalation of trade tensions – the latest trade war will only make a dismal economic picture worse. In addition, Wilson claims, “numerous leading companies may be starting to throw in the towel on the second half rebound”, something the Morgan Stanley strategist has repeatedly warned about even though “many investors are not.”

In short, “get ready for more potential growth disappointments even with a trade deal.”

Source: Zerohedge