INTRADAY TECHNICAL ANALYSIS MARCH 05th (observation as of 07:00 UTC)

High-Impact News:

Wednesday March 05

- (US) 08:15 ET: ADP Nonfarm Employment Change

- (CA) 08:30 ET: Canada Labour Productivity

- (US) 09:45 ET: S&P Global Services PMI

- (US) 10:00 ET: US Factory Orders

- (US) 10:00 ET: ISM Non-Manufacturing PMI

- (US) 10:30 ET: US Crude Oil Inventories

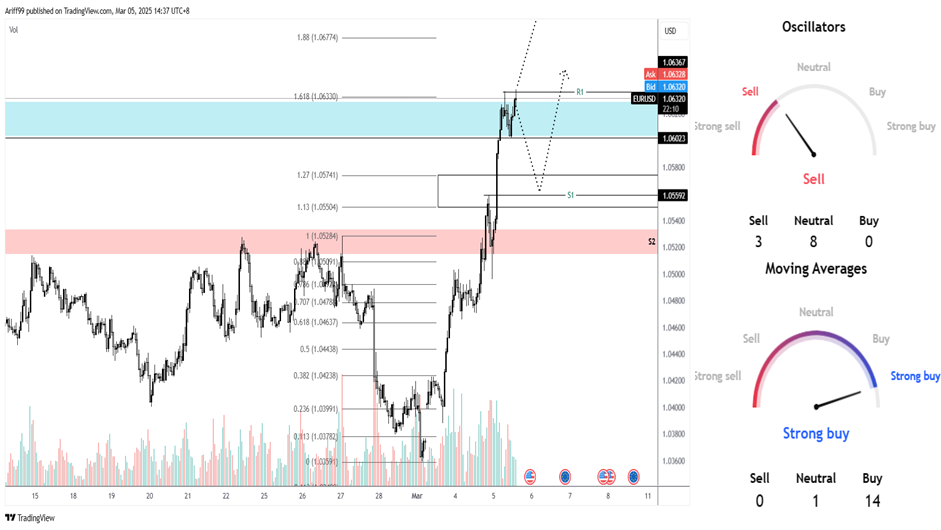

[EURUSD]

Commentary/ Reason:

1. Price just broke above multi-months resistance level and now at a supply zone that require strong buying momentum to break through.

2. The indicators are mixed with slight bias toward buy with a possibility of a short-term retracement.

3. Price is likely to retrace back to a break-out level at S1 if there is not enough buying momentum or turn into a downtrend if it breaks below S2.

[USDCHF]

Commentary/ Reason:

1. Price is in a long-term downtrend that can be visualized in the declining parallel channel and have broken below its immediate support level that is coinciding with a multi-month support.

2. Technical is heavily biased toward sell due to its long-time running selling pressure but oscillators suggest near-term buying opportunity.

3. Price could continue below S1 if there is no buying pressure that should push price to atleast R1 where there is large buy/sell volume taken place or R2 where buying pressure broken by higher selling activity.

[USDJPY]

Commentary/ Reason:

1. Price have been severely weak, breaking below its main price channel into another while have not had enough buying pressure to re-enter the channel.

2. Technical indicators however are heavily biased toward buying activity as price is in severe discount and had only recently show sign of near-term buying pressure.

3. The price is expected pull back to S1 where buyer won over seller to possibly clear remaining buying order before having enough momentum to enter the main price channel whereas price could continue falling if it failed to rebound at S2 level.

[GBPUSD]

Commentary/ Reason:

1. The price is in a longer-term uptrend with high recent buying pressure although it is now at a supply zone and near the upper bound of the price channel.

2. The technical are heavily biased toward buying opportunity although oscillators are staying neutral, suggesting uncertainty toward price direction.

3. The price is expected to consolidate with high possibility of retracing toward S1 where there is a lot of buying activity pushing price higher into the supply zone with swap zone at S2 already been tested although slight.