INTRADAY TECHNICAL ANALYSIS MARCH 14th (observation as of 07:00 UTC)

High-Impact News:

Friday March 14

- (GB) 03:00 ET: UK GDP January

- (GB) 03:00 ET: UK Industrial Production

- (EU) 03:00 ET: German CPI February

- (CN) 05:00 ET: China New Loan

- (US) 16:30 ET: CFTC Speculative Net Position

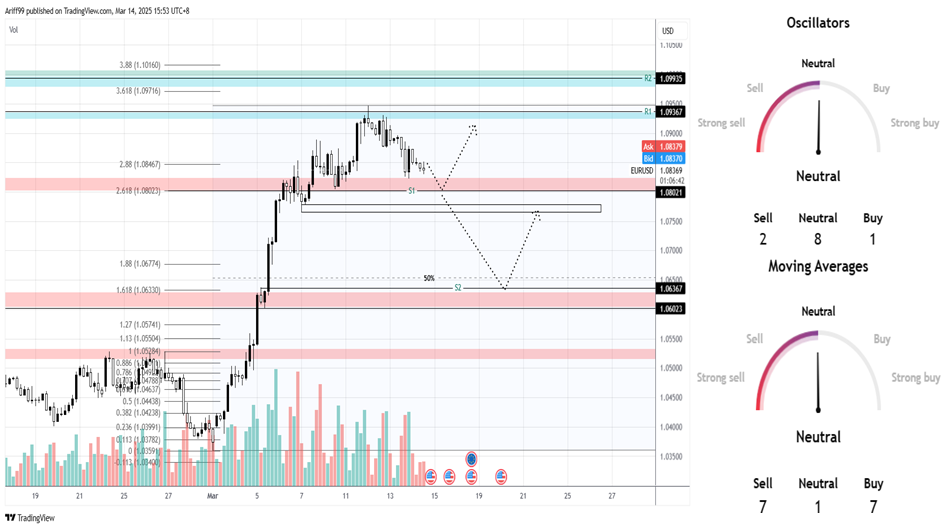

[EURUSD]

Commentary/ Reason:

1. Price retreated from a supply zone and continue to weaken past a fair value gap and into a support area.

2. The indicators are neutral with slight bias toward sell with a possibility of a short-term rebound.

3. Price is likely to rebound at the first support area S1 or S2 if there is enough selling pressure where price can be at discount for a continued rally although its more likely that price continue to rally after testing S1.

[USDCHF]

Commentary/ Reason:

1. Price is in a long-term downtrend that can be visualized in the declining parallel channel and price is at channel’s support level that is coinciding with last buying activity before price dump.

2. Technical is biased toward buy due to price moving above most moving averages while oscillators stay neutral.

3. Price could test the discount level that coincides with a resistance level before continuing downward although there is a chance of price turning into a short-term rally due to it re-entering price channel.

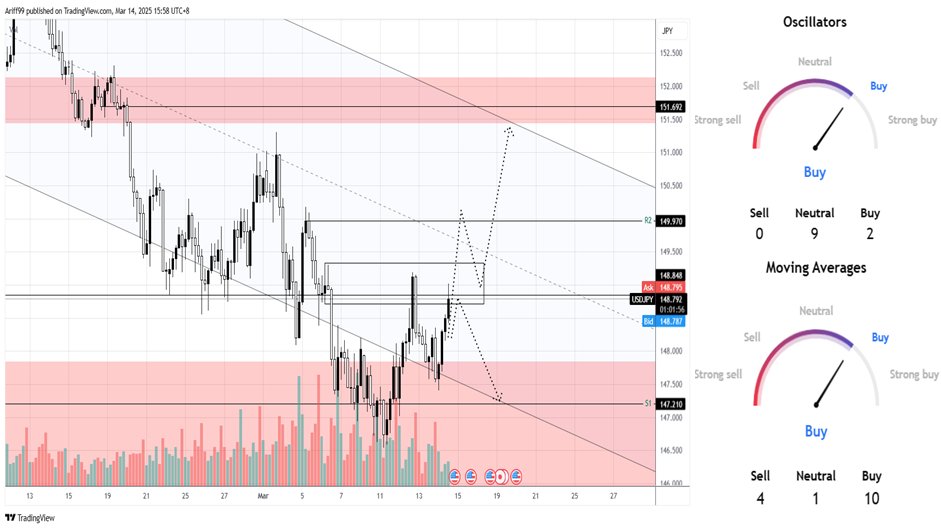

[USDJPY]

Commentary/ Reason:

1. Price have re-entered its downtrend parallel channel and rebound at the bottom channel, signifying price is closer to fair value.

2. Technical indicators however are heavily biased toward buying activity as price is in severe discount and had only recently seen sign of near-term buying pressure.

3. The price is expected to continue higher to R2 where it will continue in a short-term rally but if price fail to break higher than the last buying area marked in box, price may retrace to S1 or lower.

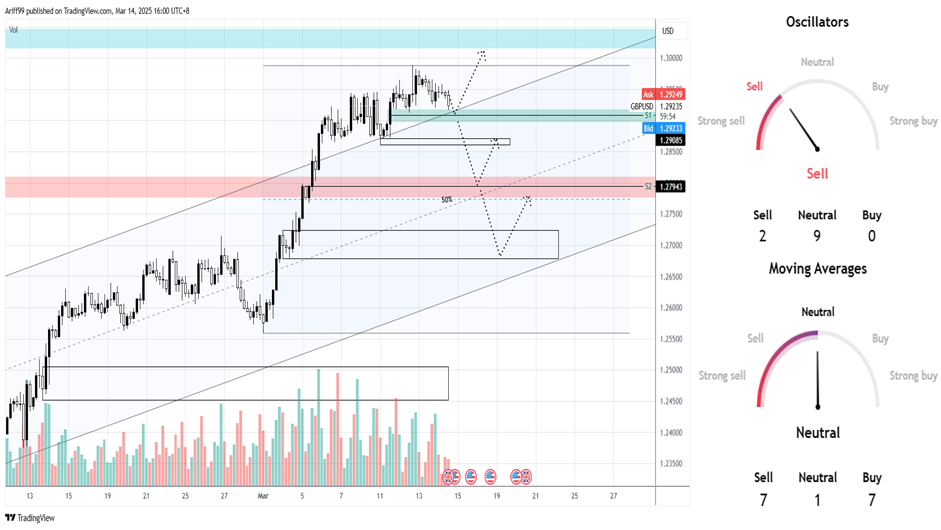

[GBPUSD]

Commentary/ Reason:

1. The price is in a longer-term uptrend with high recent buying pressure, breaking above upper bound of price channel just short of a supply zone.

2. The technical are heavily biased toward selling opportunity although moving averages are staying neutral, suggesting uncertainty toward price direction.

3. The price is expected to continue higher if it rebound off a fair value gap and into the supply zone while price will continue lower if it enters into price channel.