The financial market has seen a surprisingly positive upturn in the past few days, rising by a notable 3.1%. This surge in the market comes despite a series of grim macroeconomic data reports, including the poor jobs report and the "bullish" Q3 GDP numbers, which were primarily due to increased government spending. Despite this, consumer spending is also down, along with personal savings, corporate profits, and pending home sales.

This lack of consumer confidence is further highlighted by the collapse of the Chicago Purchasing Managers' Index (PMI), which is an indicator whose number below 30 could signal a recession. That said, the market is said to be getting a boost from a "month-end markup." This is a phenomenon in which investors tend to buy stocks, particularly those with higher valuations, as the month comes to a close in an effort to boost profits and reduce losses.

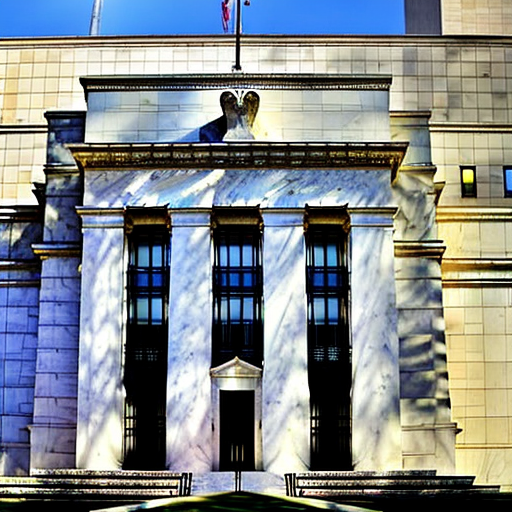

This may be one of the primary reasons behind the 3.1% rise in the market, as investors seem to be betting on potential short-term gains in the face of long-term economic concerns. The Fed’s Chairman, Jerome Powell, has also made a dovish speech recently saying smaller interest rate hike in December, which has further contributed to the market’s apparent optimism because less bad news is good news nowadays.

In his speech, Powell highlighted the Fed’s commitment to reducing inflation by maintaining high interest rates. However, a possible hike of 50 bps instead of 75 bps as forecasted before is due to lower PCE price index data, which is an indicator used by the Fed to decide interest rate hikes. This has given investors some assurance that the Fed will slow its rate hike or disinflation. It has yet to snowball into a fully "fed pivot" narrative, as several economists have suggested. The final decision will be made at the FOMC meeting on December 14th.

Overall, the market’s 3.1% increase is certainly an encouraging sign, though it is important to consider the underlying factors behind this surge. The month-end markup, Jerome Powell’s speech, and investors’ willingness to overlook long-term economic concerns in order to make short-term gains have all contributed to the current market optimism. Whether or not this optimism is sustainable remains to be seen.