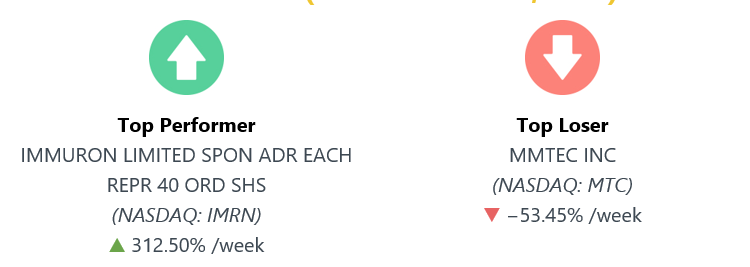

Stocks Performance (U.S. Stocks)

The week saw a dramatic reversal in sentiment, as stocks logged their worst weekly decline since March, ending a string of consecutive weekly gains that had erased year-to-date losses for some major indices as fears of a second wave of infections and doubts about a speedy economic recovery dampened investor sentiment

Nasdaq briefly rose above the 10,000-level for the first time ever with Amazon, Apple and Microsoft all touching record highs. Netflix and other “stay at home” stocks easily outperformed airlines and other shares reliant on the reopening of the economy.

By sectors, the most outperformed weekly stocks were led by Consumer Durables at -0.12%, followed by Retail Trade at -1.27%, and Technology Services (-1.75%). Meanwhile, the weakest sectors were from the Energy Minerals sector (-9.94%), Industrial Services (-9.75%), Process Industries (-8.33%) and Distribution Services sector (-8.02%).

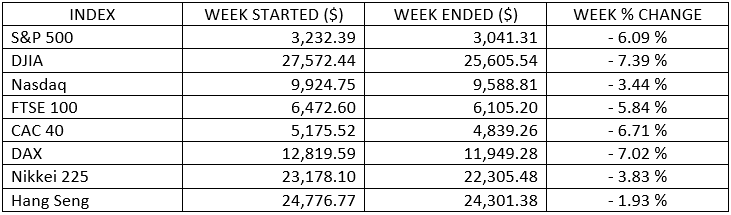

Indices Performance

S&P 500 briefly erased its losses for 2020 early in the week before turning lower, led by energy and financials. Technology significantly outperformed most other sectors as strength in mega-capitalization stocks lifted the technology-heavy Nasdaq Composite Index to a new all-time high. The Nasdaq briefly rose above the 10,000-level for the first time ever with Amazon, Apple and Microsoft all touching record highs.

Oil Sector Performance

Oil prices began the week higher after OPEC and its allies agreed to extend their production cuts by another month. But oil prices reversed course, along with stocks and bond yields, after the economic warnings from the OECD and the Fed cast doubt on the outlook for demand.

Market-Moving News

Volatility Recharged

An index that measures investors’ expectations of market volatility over the next 30 days soared 47% during the week, rising to levels last seen in mid-April. The Cboe Volatility Index, or VIX, spiked on Friday as high as 44, up from about 25 at the end of the previous week.

Consumer Comeback

U.S. consumers are increasingly optimistic about the economy, based on results of a survey released on Friday and conducted in early June.

Bond Price Rally

Amid the gloomier economic outlook, many investors bid up prices of government bonds, sending yields sharply lower. After ending the previous week at 0.91%, the yield of the U.S. 10-year Treasury bond dropped to around 0.70%.

Stimulus 2.0?

U.S. Treasury Secretary Steven Mnuchin said on Thursday that the government was weighing a second round of stimulus payments for Americans to help stabilize the economy. If the idea gains traction and clears Congress, the cash would add to the $267 billion distributed by the IRS so far this year.

Recession Declaration

The National Bureau of Economic Research (NBER) determined that the U.S. economy entered a recession in February, ending a decade-long expansion.

Other Important Macro Data and Events

The Fed’s pledge to keep interest rates near zero and maintain its current pace of asset purchases caused bond yields to sink. Moving in tandem with US treasuries, the yield on Government of Canada 10-year bonds dipped to within three basis points (0.03%) of its all-time low set last month. As investors turned less optimistic, the price of gold climbed, and crude oil posted its first weekly decline since April.

In economic data, weekly initial jobless claims improved slightly, but their continued high level underscored the Fed’s cautious view regarding the pace of the recovery.

What We Can Expect from the Market this Week

An OPEC-led monitoring panel will meet on Thursday to discuss ongoing record production cuts to see whether countries have delivered their share of the reductions, but will not make any decision, according to five OPEC+ sources.

Sterling also faces a test this week as the Bank of England holds a policy meeting on Thursday. The BOE is expected to increase its quantitative easing programme by 100 billion pounds ($125 billion

Important economic data being released including Empire State manufacturing survey (June), retail sales (May), industrial production, capacity utilization (May), housing starts, building permits (May), and conference board leading index (May)

Chinese economic data for May is set to be released around 10:00 a.m. HK/SIN, with industrial production as well as fixed asset investment for that month expected.