PAST WEEK'S NEWS (June 13– June 19, 2022)

Stocks Performance

The equity volatility that followed the higher-than-expected U.S. inflation report in the previous week extended into last week, taking the major indices lower.

Central banks were at the centre of the week's trading action, in anticipation of what they might do with respect to its inflation-taming effort. There were widespread worries about the current policy approaches being pursued by the central banks, with fear of a policy mistake was wrapped up in all of them. The principal driver, though, boiled down to growth concerns that revolved around stagflation and recession, as well as higher unemployment.

The breakage, though, had to do with more than just the rate-hike actions from the central banks. It also had to do with liquidity concerns that rocked the cryptocurrency market, earnings concerns that gripped the entire stock market, growth concerns that undercut commodity prices and drove junk bond spreads to their widest since November 2000, and excessive volatility in the Treasury market that rattled investor confidence.

Inflation and rate fears pushed the yield on the benchmark of U.S. 10-year Treasury note briefly to 3.49% on Tuesday, its highest level in more than a decade. (Bond prices and yields move in opposite directions.) Powell’s reassurances and the sluggish economic data sparked a relief rally to end the week, sending the 10-year note yield down to 3.24% by the close of trading on Friday, above the previous week’s level but down sharply from its intraweek high.

Indices Performance

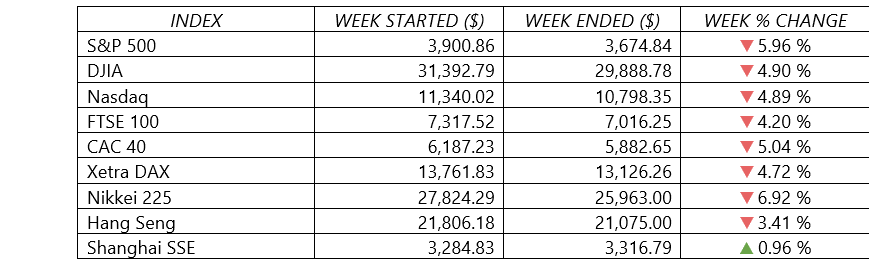

The major U.S. stock indexes fell for the second week in a row, with the S&P 500 and the NASDAQ posting the tenth negative weekly results out of the past eleven. Those two indexes retreated to levels last seen in late 2020, while the Dow closed below 30,000 for the first time since January 2021.

A 3.9% sell-off on Monday pushed the S&P 500 into a bear market, as the index’s decline from a record high achieved on January 3, 2022, exceeded 20.0%. The NASDAQ has been in a bear market since March, while the Dow on Friday was just shy of a bear, as it was 18.7% below a record set in January.

Shares in Europe also fell sharply on concerns that economic growth may stall after several central banks announced rate increases.

A Japanese stock index registered sharp losses for the week and the Japanese yen also fell relative to the U.S. dollar, as the nation continuing its divergence from global peers, with the BoJ maintained its ultralow interest rates.

Chinese stock markets advanced on hopes that a pickup in fixed asset investments would put the country’s economy back on track. The broad, capitalization-weighted Shanghai Composite Index added 1.0%.

Crude Oil Performance

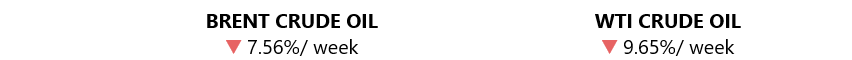

Oil wavered as traders weighed the prospect of slower economic growth against tight supplies, as well as on uncertainty that weighed on markets following numerous interest rate hikes around the world.

The Brent futures posted their first weekly dip in five weeks, while U.S. crude futures recorded their first decline in eight weeks.

Other Important Macro Data and Events

The FOMC raised its benchmark rate by 75-bps, taking its benchmark federal funds rate to 1.75%, its largest hike since 1994, Expectations only a week ago, some which were set by the Fed itself, were for an interest rate hike of only 50-bps. That all changed when the U.S. CPI surprised to the upside at 8.6% for the month of May.

The Swiss National Bank also surprised markets with as it unexpectedly raised interest rates for the first time in 15 years, by half a point to -0.25%, to subdue inflation. The central bank increased its inflation forecasts substantially and said further rate hikes could not be ruled out.

The Bank of England meanwhile implemented its fifth rate rise in a row, raised its key interest rate to 1.25%, an increase of 25-bps.

Separately, the ECB held an unscheduled emergency meeting on Wednesday. In a statement released after the ad hoc meeting, the ECB indicated it would take action to stem the widening yield spreads between member states’ sovereign bonds. These measures would include targeted adjustments to how it reinvests the proceeds from maturing debt in the portfolio associated with the central bank’s pandemic emergency purchase program. The ECB will also seek to develop a new tool to help alleviate the “fragmentation” in borrowing costs.

The Bank of Japan continued to play the role of outlier. It left its key policy rate unchanged at -0.1% and maintained a commitment to yield curve control with an aim of keeping the 10-yr JGB yield around zero percent. That decision didn't sit well in the forex market. The yen fell 2.1% against the dollar on Friday to 134.96.

U.S. retail sales slipped 0.3% in May, falling for the first time in five months amid rising inflation. A separate report showed that industrial production grew at a slower pace last month while factory production fell for the first time in four months.

Cryptocurrency prices slumped on the news that crypto lender Celsius had suspended customer withdrawals and transfers that drove some panic selling. Bitcoin started the week just above $25,000 and ends just above $20,000.

What Can We Expect from the Market this Week

The week’s market activity suggests that the volatility may continue until there is a shift in the economic conditions to the positive. In other words, markets need something to look forward to.

Investors will strap in next week for more interest rate reality, with Federal Reserve Chairman Jerome Powell due to testify before Congress and expected to reiterate the need to combat inflation through aggressive rate hikes.

Important economic data being released this week include updates on the PMI, existing home sales, initial jobless claims, and the University of Michigan reading on consumer sentiment and the Michigan consumer sentiment survey.

FedEx reports earnings on June 23 in what will be a closely watched report across several sectors. Meanwhile, the four-day Amazon event on AI, robotics, and automation innovation could turn some heads in the tech world.

In the healthcare sector, the World Health Organization is in the spotlight, with the global agency set to vote on whether to declare monkeypox a public health emergency. Notable movers off monkeypox developments have included SIGA Technologies, Bavarian Nordic, Emergent BioSolutions, and GeoVax Labs.

Gun and ammunition stocks will also be on watch next week, with some Republicans opening the door for a potential vote on a gun bill. Smith & Wesson, Sturm, Ruger, Vista Outdoor, Sportsman's Warehouse, AMMO and Olin Corporation are some of the stocks that could see extra volatility.