PAST WEEK'S NEWS (APRIL 03 - APRIL 07, 2023)

Encouraging data on inflation suggests that consumer prices are moderating due to lower demand and better supply chain management.

The latest retail sales report indicates that consumer spending is slowing down due to a healthy labour market but some emerging signs of softening.

The combination of moderating inflation and a decelerating economy will lead the Fed to move to the sidelines in the coming months, ending its aggressive rate hike cycle, which is seen as a positive development for the stock market.

Despite recent recession worries, stocks continue to gain year-to-date, but renewed volatility is expected as evidence of a slowdown emerges.

Markets are expected to continue making progress toward a new sustained expansion and bull market despite the slowdown.

INDICES PERFORMANCE

Most of the indices had a strong gain except Nikkei and Hang Seng, indicating weakness in Asian market.

The DJIA, FTSE 100, and CAC 40 are among the top gainers although there is civil unrest in France that may have dialled down.

US Market are performing on lower CPI number that may push the Fed into pausing any rate hike for the rest of the year.

China market fall over tension around Taiwan but bounced in early Asian trading session amid 20 billion yuan fresh liquidity injection.

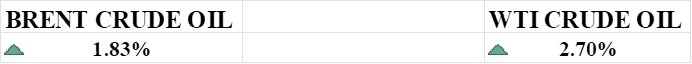

CRUDE OIL PERFORMANCE

OPEC decision to cut additional 1.16 million barrels per day is picking up steams in addition to China potential recovery that has not been clearly defined while investor is eyeing key data from the region. Regulation dispute amid exports from northern Iraq to Turkish port remained unsettled on unauthorised exports case.

OTHER IMPORTANT MACRO DATA AND EVENTS

The US Consumer Price Index dropped to 5.0% in March from 6.0% the previous month, the lowest inflation in nearly two years. The Producer Price Index also fell to 2.7%, the lowest in more than two years and down sharply from a 4.9% annual rise in February.

US retail sales dropped by 1.0% in March, more than anticipated, mainly due to declining sales of big-ticket items like vehicles and appliances. It marks the fourth decline in five months.

Government bond yields rebounded after a sharp decline in early March due to bank liquidity fears. The 10-year Treasury bond yield was around 3.52% on Friday, up from 3.29% a week earlier but down from its recent peak of 4.07% on March 2.

Bitcoin surpassed $30,000 on Tuesday, its highest since June 2022. As of Friday, it was around $30,400, up from under $20,000 on March 10.

What Can We Expect From The Market This Week

China's GDP and industrial production data for Q1 will move the market after a recent 20 billion yuan ($2.9 billion) fresh liquidity injection.

Economic sentiment in Germany, as measured by the ZEW, is expected to improve slightly after a decline reported last month due to worries in the financial market.

The UK CPI and retail sales for March will be released amid unrest in the region, especially in its economy, which has been said by the IMF to be performing the worst out of G20 members.

US jobless claims and existing home sales will provide insight into the situation of the labour market and business activity in the real estate sector.

Canada retail sales are expected to contract since January after the Bank of Canada held their interest rate at 4.5% last week.