PAST WEEK'S NEWS (APRIL 24 - APRIL 28, 2023)

The major U.S. stock indexes had a mixed week but ended up with modest gains of around 1%, saved from early losses by the strong earnings results of big tech companies. GDP growth in the first quarter of 2023 was positive but slower than the previous quarter, falling short of economists' forecasts. Inflation continued to moderate, and the proportion of S&P 500 companies beating earnings expectations is slightly higher than usual. The U.S. Federal Reserve is expected to raise its key benchmark interest rate by a quarter of a percentage point to a range of 5.00% to 5.25% at its next meeting with a probability rate of 91%.

San Francisco reputation as one of the most successful real estate markets is dwindling after pandemic that saw vacancy rate in office spaces fell to around 30% as remote working becoming more prevalent. Some area in SF have already went through negative growth in prices and cell phone activity is also record low, indicating less foot traffic. In other state, foreclosure filings jumped with the highest number stand at 40%. It seems bleak in the commercial real estate market, but it is still considerably strong in residential with lower unemployment rate and low delinquency rate in credit card.

First Republic Bank has yet to face another crisis after reporting lower deposits even after the injection of confidence by big banks. Eventually, FIDC took over the bank and sold it to the highest bidder, which happens to be JPMorgan for $10.6 billion, which will give JPMorgan $92 billion in deposits and $173 billion in loans and securities. The deals also come with a one-time profit of $2.6 billion and an approximately $500 million annual profit to JPMorgan, but also an expected $2 billion integration cost to fully absorb its balance sheet. It is unsure when and if the banking crisis will continue but the cost to insure against US bankruptcy are at its highest, even higher than 2008. Yellen of US Treasury said that the US would run out of money to pay its financial obligation by June 1st if the debt ceiling is not raised.

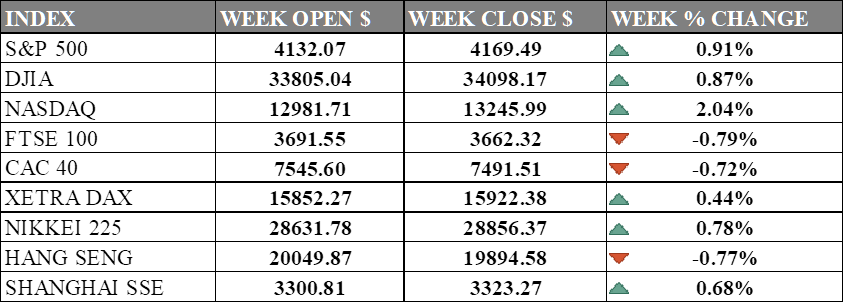

INDICES PERFORMANCE

The US stock market indices S&P 500, DJIA, and NASDAQ all posted positive weekly returns, with the NASDAQ leading the gains with a 2.04% increase. However, the markets faced headwinds from the ongoing debt ceiling impasse, which could trigger a default and economic crisis as soon as June 1. Treasury Secretary Janet Yellen has urged Congress to act "as soon as possible" to raise or suspend the debt limit, and President Biden has called a meeting of congressional leaders on May 9.

The European stock market indices FTSE 100, CAC 40, and XETRA DAX all posted negative weekly returns due to concerns over inflation, slowing economic growth, and banking turmoil in the US. The ECB kept its monetary policy unchanged but warned that the pandemic still posed risks to the economic outlook and urged governments to continue fiscal support measures.

The NIKKEI 225, HANG SENG, and SHANGHAI SSE Asian stock market indices performed mixed, with the NIKKEI 225 posting positive weekly returns and the HANG SENG posting negative weekly returns. Various factors influenced the Bank of Japan's (BOJ) decision to maintain its monetary policy unchanged at its first meeting under its new governor, Haruhiko Kuroda, on April 28, as well as some tweaks to its policy framework. Chinese markets were boosted by optimism about fuel demand and China's economic recovery, while Hong Kong markets were dragged down by political tensions with the US over Taiwan and human rights issues.

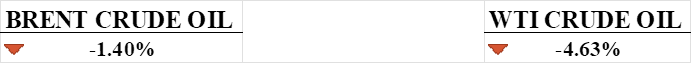

CRUDE OIL PERFORMANCE

Oil prices ended the week on a positive note due to signs of rising US oil demand and lower output although it declined overall for the week. Strong earnings reports from Exxon Mobil and Chevron also boosted the market, as the companies announced increased investments in low-carbon projects. US data showing declining crude production and growing fuel demand also supported the market. However, concerns over the global economic outlook and potential interest rate hikes by major central banks acted as headwinds. The ongoing supply glut also kept prices under pressure, as OPEC+ members continued to pump more oil than needed to balance the market. Analysts warned of an uncertain demand outlook due to the resurgence of COVID-19 cases in some countries and regions.

OTHER IMPORTANT MACRO DATA AND EVENTS

Stocks were generally flat in April, resulting in a dramatic drop in an index that reflects investors' short-term market volatility expectations. The CBOE Volatility Index finished April at its lowest level since November 4, 2021.

The United States' economy stayed in positive territory in the first quarter of this year, but it slowed significantly from the previous quarter and fell short of most experts' expectations. In the latest quarter, GDP increased at an annualised rate of 1.1%, down from 2.6% in the previous quarter due to persistently high inflation.

The share of S&P 500 businesses that have outperformed analysts' earnings predictions is slightly higher than typical during the midpoint of earnings season. According to FactSet, 79% of companies that had disclosed first-quarter results as of Friday met net income estimates, exceeding the five-year average of 77%. Earnings are predicted to fall 3.7% in comparison to the previous year.

A study released on Friday, ahead of a Federal Reserve meeting in the United States, revealed that the Fed's preferred indicator for measuring inflation continued to decline. The Personal Consumption Expenditures Price Index climbed 4.2% year on year in March, down from 5.1% in February. Core inflation jumped 4.6% in the most recent month, excluding volatile food and energy prices.

Government bond rates in the United States, Japan, and major European nations fell on Friday as the Bank of Japan maintained its low interest-rate targets. Yields were also pushed by the announcement of dismal GDP data from the eurozone on Friday, where the economy gained 0.1% in the first quarter of this year after contracting in the fourth quarter of 2022.

What Can We Expect from The Market This Week

Eurozone CPI and ECB Interest Rate Decision: Europe is about to see one of the biggest swings in recent times this week as it is expected to continue hiking rates as inflation stays hot in the region.

US Employment Data: The most important indicator of the US labour market, including nonfarm payroll, JOLT's Job Openings and Initial Jobless Claims are set to be released this week, along with other important US data that rely on them.

US Interest Rate Decision: Arguably the best indicator for market movement, especially in big tech or other interest-sensitive stocks. Even though the Fed is expected to continue hiking rates, First Republic Bank's failures paint a bleak future in which more banks will continue to fail and consolidate into a few mega-cap banks.

China's Caixin Manufacturing PMI: After a satisfactory retail spending report, a surprise outlook for manufacturing activity seems grim after surveys point towards a slowing recovery. The data will confirm or deny the initial surveys.

EIA Crude Oil Inventories: As demand for oil dwindles and the price of oil falls to levels before the OPEC+ cut, the data will set expectations for the landscape of oil demand and supply.