PAST WEEK'S NEWS (MAY 22 - MAY 26, 2023)

President Joe Biden and House Speaker Kevin McCarthy have reached a preliminary agreement to raise the federal debt limit until early December, averting a potential global financial crisis. The deal includes spending levels for military and domestic programs and preserves Biden's infrastructure and green-energy laws. However, there are still challenges from Republicans who want work requirements for anti-poverty programs and Democrats who oppose cuts to the IRS budget. The agreement must be approved by both chambers of Congress before June 5 to prevent a funding shortfall. The uncertainty surrounding the debt ceiling talks has caused market volatility, but news of the deal has boosted market sentiment, leading to gains in U.S. stock futures and Asian shares. This development has also relieved pressure on the U.S. dollar and Treasury yields. Nonetheless, the market remains cautious due to the possibility of opposition or delays to the deal.

OpenAI has launched an initiative to involve democratic input in AI development by awarding grants for experiments in establishing rules for AI systems. The project aims to explore important questions in AI governance and provide free access to the results. Meanwhile, Brad Smith, president of Microsoft, emphasizes the need for swift action and calls for safety measures and a comprehensive regulatory framework in AI. He supports shared responsibility and licensing for AI developers, as there are growing calls for stricter oversight in AI development. The growing risks associated with highly capable and intelligent AI are intensely discussed due to their potential to pose a significant threat to national security, alongside other notable risks such as cybersecurity threats and economic shocks.

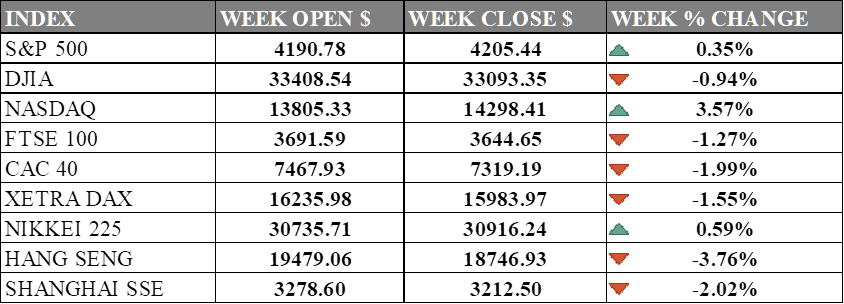

INDICES PERFORMANCE

The U.S. market was slightly higher, as the S&P 500 and the Nasdaq 100 rose by 0.35% and 3.57%, respectively, while the Dow Jones Industrial Average fell by 0.95%. The market was supported by the news that the U.S. Senate reached a deal to raise the federal debt limit until early December, averting a potential default that could have triggered a global financial crisis. However, the market also faced some headwinds from the rising inflation, the supply chain disruptions, and the uncertainty over the fiscal stimulus and the monetary policy.

The European market was mostly lower, as the FTSE 100, the CAC 40, and the XETRA DAX dropped by 1.27%, 2%, and 1.55%, respectively. The market was pressured by the renewed banking fears after a report that some European banks may face losses from their exposure to a troubled Chinese property developer. The market also reacted to the mixed economic data from the euro zone, which showed a slowdown in manufacturing activity but an improvement in consumer confidence.

The Asian market was mixed, as the Nikkei 225 and the Shanghai SSE rose by 0.58% and 1.03%, respectively, while the Hang Seng fell by 3.76%. The market was influenced by the developments in China, which left its benchmark loan rates unchanged for the 18th straight month but also announced a ban on U.S. chipmaker Micron Technology from selling memory chips to some key industries. The market also followed the news from Japan, which held a general election that resulted in a landslide victory for Prime Minister Fumio Kishida's ruling party.

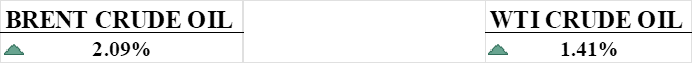

CRUDE OIL PERFORMANCE

Oil prices rose on Friday as US officials neared a debt-ceiling deal and conflicting reports on supply emerged from Russia and Saudi Arabia ahead of the OPEC+ meeting. Both benchmarks posted a second week of gains. However, concerns about the debt negotiations and a possible Federal Reserve interest rate hike persisted. Talks on raising the US debt ceiling could spill over into the weekend. The outcome of the OPEC+ meeting next week remained uncertain, leading to cautiousness among traders. US gasoline demand was expected to stay strong, while the number of US oil rigs declined. Economic growth and inflation concern in Europe capped price gains.

OTHER IMPORTANT MACRO DATA AND EVENTS

The U.S. stock market had a mixed week, with the NASDAQ performing well and gaining 3.6%, while the S&P 500 increased by 0.3% and the Dow slipped 1%.

Market sentiment was influenced by debt ceiling talks, and the 10-year Treasury bond yield rose to its highest level in two and a half months.

The NASDAQ outperformed other indices for the fifth consecutive week, driven by strong results from big tech. S&P 500 earnings declined for the second consecutive quarter, while the Federal Reserve remained divided on the need for another interest rate hike.

Inflation showed a slight increase in April, with the Personal Consumption Expenditures Price Index rising by 4.4%. The Feds mainly use this data to gauge inflation and a slight increase may point toward hawkish move in next June meeting.

What Can We Expect from The Market This Week

Manufacturing PMI by China, Germany, the UK, and the US ISM Manufacturing: A slowing economy can be expected as more countries are expecting lower PMIs, especially from manufacturing.

Unemployment rate in Japan, Germany, and the US: resilience in the labour market is expected, although economies are slowing probably due to high inflation both on the consumer and business sides.

JOLT Job Openings: Labour demand fell last month to 9.59 million, and the market consensus is at 9.775 million job openings as the debt ceiling discussion gives hope for another round of funding.

Nonfarm payrolls and initial jobless claims: Another piece of labour data from the US expects the labour market to weaken, although there is increasing hope for job openings.

German CPI: Inflation in Germany is expected to stay sticky, with consensus expecting a 0.6% increment.