PAST WEEK'S NEWS (JANUARY 15 – JANUARY 19, 2024)

China's 2023 growth edges past targets, but December data hints at continued cooling. Although economic growth exceeded the government's 5% forecast, China's economic expansion faltered in the fourth quarter, with a weak post-pandemic rebound caused by slowing consumer spending, a distressing property market, and limited fiscal support. December's readings, including stagnant factory activity and deflationary pressures, suggest these headwinds may continue into 2024, casting a shadow over the world's second-largest economy.

The tech industry is reeling under a surprise tax bill, and thousands of people have already been caught in the layoff storm as R&D investment plummets. A 2022 tax change, forcing amortisation of software development costs, including the salaries of developers, has slammed tech companies with massive tax bills, triggering layoffs, reducing hiring, and dampening R&D that started in 2023 and is expected to climb in 2024. With thousands already jobless and industry giants like Unity and Google announcing further cutbacks, calls to amend the law are growing, but legislative action remains deadlocked.

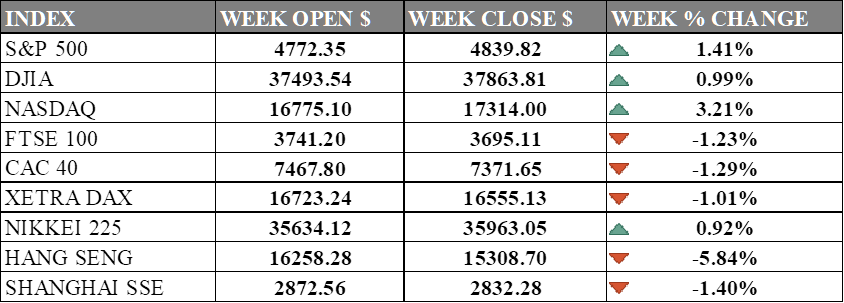

INDICES PERFORMANCE

The major U.S. stock indexes ended mostly higher last week with the Nasdaq surging the most while the DJIA and S&P 500 also climbed although less sharply. The S&P 500 advanced 1.41% to close at 4839.82, up from its open of 4772.35. The Dow Jones Industrial Average rose 0.99% to finish at 37863.81 compared to its starting point of 37493.54. The tech-heavy Nasdaq jumped 3.21% to 17314.00 after opening the week at 16775.10. Resurgence in Treasury yields and uncertainty regarding a potential March interest-rate cut by the Federal Reserve have been the reason behind strong tech performance.

In Europe, the major indexes were mixed. The UK's FTSE 100 fell -1.23% to close at 3695.11 compared to its open of 3741.20. France's CAC 40 dropped -1.29% to end the week at 7371.65 after opening at 7467.80. Germany's XETRA DAX slipped -1.01% to settle at 16555.13 from its starting point of 16723.24. European shares slumped ahead of European Central Bank policy decision in anticipation of higher rate for longer. Freshly released data indicates a higher-than-anticipated decline in German producer prices for December, reflecting an 8.6% year-on-year drop.

Asian indexes were also mixed on the week. Japan's Nikkei 225 rose 0.92%, closing at 35963.05 versus its open of 35634.12 boosted by capital withdrawal from China trend, although slowing with investors maintaining a systematically lower allocation to Japan. Hong Kong's Hang Seng sank -5.84% to finish at 15308.70 from its starting level of 16258.28. China's Shanghai Composite slipped -1.40% to close at 2832.28 compared to its open of 2872.56. Investors expressed disappointment in China's lack of strong stimulus measures amidst weak economic data. Semiconductor stocks, including Hua Hong Semiconductor and Shanghai Fudan Microelectronics, fell at the close due to concerns about potential additional chip export restrictions to China by the US.

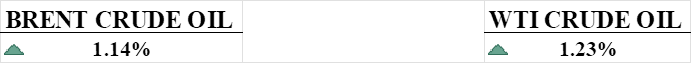

CRUDE OIL PERFORMANCE

Crude prices held back by concerns over slowing global demand despite simmering geopolitical tensions in the Middle East and an attack on a key Russian fuel export terminal. Cold weather disruptions in the US, a major fuel consumer, and stagnant Chinese economic growth further clouded the demand outlook. While the Israel-Palestine conflict and Yemeni attacks on shipping in the Red Sea raised supply concerns, these were overshadowed by worries about a sluggish economic recovery in key oil-consuming regions. Although prices is up slightly this week, it is expected to move within rangebound until there is impactful catalyst.

OTHER IMPORTANT MACRO DATA AND EVENTS

While December's softer-than-expected core CPI and recent sluggish wage growth solidify the BOJ's near-term dovish stance, potential fiscal stimulus and renewed yen weakness could rekindle inflationary pressures later in the year, keeping the central bank on its guard.

Robust job growth likely continued in January as evidenced by a 16-month low in unemployment claims, painting a rosy picture for the economy and potentially delaying the Fed's anticipated rate cuts. While housing starts dipped in December, ongoing strong demand and rising permits suggest a rebound could be imminent.

U.S. retail sales defied expectations, surging in December on robust vehicle and online purchases, fuelling optimism for an economic soft landing. While concerns linger over low-income spending and high debt levels, strong core sales and a resilient labour market suggest consumer spending will remain a pillar of U.S. growth in 2024, paving the way for potential Federal Reserve rate cuts later this year.

What Can We Expect from The Market This Week

BoJ Interest Rate Decision: Expectations are that BoJ will maintain its negative interest rate, the world's last. Despite widespread anticipation for the status quo, market speculation suggests a potential lift of negative interest rates in the first half of 2024, a decision that could significantly impact the Japanese yen and global economy, especially with rumours that Japanese money in the Chinese market is being pulled.

BoC Interest Rate Decision: Though Canadian inflation shows signs of retreat, its pace remains sluggish, prompting the Bank of Canada to hold its key interest rate steady at 5%. This cautious approach balances the need to dampen price pressures with the risk of stalling economic growth, keeping market participants on tenterhooks for future policy signals.

ECB Interest Rate Decision: The ECB is carefully watching inflation and the effectiveness of its policies to determine interest rates. Despite expectations for rate cuts, recent price increases have tempered immediate reductions, underscoring the importance of monitoring inflation's impact on the eurozone economy and global investors.

US GDP Q4: Economic growth faces a potential slowdown with expectations at 2.0%, capping a strong runup but hinting at headwinds. While forecasts differ, from Deloitte's moderate optimism to the Conference Board's brace for temporary dips, Although recession expectations are severely reduced, slowdowns are imminent, as history shows when Treasury yields recover from inversion.

US PCE Price Index: Consumer prices revealed that inflationary pressures are gradually easing, with the YoY figure at 2.6% in November 2023, slightly below the forecasted 2.8%. The December 2023 MoM data is expected to be a 0.2% increase, contributing to increased pressure on the US dollar index and dampening expectations for rate cuts in 2024.