PAST WEEK'S NEWS (March 04 – March 08, 2024)

Federal Reserve Chair Jerome Powell hinted that the central bank is nearing a potential interest rate cut, stating they are "not far" from the needed confidence that inflation is sustainably moving towards the 2% target. His remarks before the Senate Banking Committee raised expectations of a rate reduction in the coming months, in confluence with the unusual volatility in the gold price. In Europe, ECB President Christine Lagarde indicated the ECB may lower rates in June but needs more evidence before considering cuts. Both central bank chiefs are careful in balancing economic stimulus and a cautious approach to avoid an even more fatal economic disaster, which is reinflation. Investors are closely watching to ensure interest rate decisions remain purely data driven as the U.S. election cycle approaches, avoiding any perception of political motivation.

China has set an ambitious 2024 economic growth target of around 5%, demonstrating a continued prioritisation of growth despite challenges from its property crisis and high local government debt. The government plans to moderate fiscal stimulus through deficit spending and issuing special bonds, while keeping monetary policy prudent and raising defence spending. Premier Li emphasised transforming the economic model and boosting advanced technologies like AI and quantum computing to enhance technological competitiveness, which could boost specialisation and attract foreign money back into its economy. However, the lack of concrete reform details and continued state interventionist approach may disappoint foreign investors looking for more market-oriented policies.

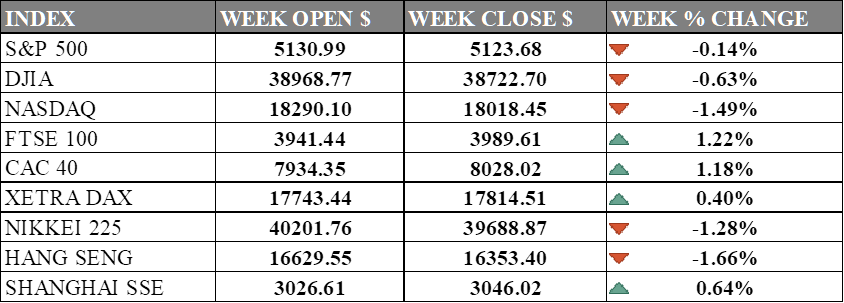

INDICES PERFORMANCE

The major U.S. stock indexes ended slightly lower last week. The S&P 500 fell 0.14% to close at 5123.68, down from its open of 5130.99. The Dow Jones Industrial Average declined 0.63% to finish at 38722.70 compared to its opening level of 38968.77. The tech-heavy Nasdaq dropped 1.49% to 18018.45 after opening the week at 18290.10. the decline was driven by a decline in chip stocks like Nvidia, while Apple's rise limited losses for the Dow Jones. Mixed job reports added to market uncertainty, with higher possibility of Fed rate cuts in June.

In Europe, the major indexes were mostly higher. The UK's FTSE 100 increased 1.22% to close at 3989.61 compared to its open of 3941.44. France's CAC 40 rose 1.18% to end the week at 8028.02 after opening at 7934.35. Germany's XETRA DAX gained 0.40% to settle at 17814.51 from its starting point of 17743.44. Although the ECB kept rates unchanged, mixed company performance and Eurozone's economy stagnant in Q4 2023, the Europe market ended better as employment is up by 0.3% and German industrial production rose 1% in January. However, there is still concern over structural weaknesses in German economy.

Asian indexes were mixed on the week. Japan's Nikkei 225 fell 1.28%, closing at 39688.87 versus its open of 40201.76 as they retreated from all-time highs and mirrored a tech-led downturn on Wall Street, while an upward revision of Japan's fourth-quarter GDP figures heightened expectations for potential interest rate increases by the Bank of Japan. Hong Kong's Hang Seng declined 1.66% to finish at 16353.40 from its starting level of 16629.55. China's Shanghai Composite rose 0.64%, closing at 3046.02 compared to its open of 3026.61. China’s shares initially dipped but recovered by Friday, driven by hopes of central bank rate cuts following signals from US and European monetary authorities. However, the Hang Seng Index still ended the week with a 1.66% drop due to concerns over China's economic data and geopolitical tensions with the US.

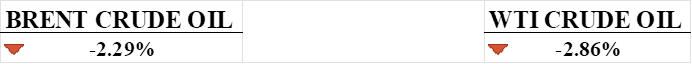

CRUDE OIL PERFORMANCE

Oil prices suffer slight losses previous week, as concerns over slowing demand overshadowed a tighter supply outlook for 2024. Middling inflation data from China points to a weakening demand in the world's largest oil importer. Fears of sluggish demand worsened in uncertainty over the path of U.S. interest rates after resilient nonfarm payrolls data. Brent crude futures dropped 2.29% while WTI crude futures declined 2.86%. Market is awaiting key U.S. consumer price index inflation data for cues on interest rate moves. Tighter supplies expected this year due to OPEC production cuts and Middle East disruptions failed to offset demand concerns.

OTHER IMPORTANT MACRO DATA AND EVENTS

The US economy saw stronger job growth in February, but significant downward revisions in December and January numbers suggest a softening labour market, potentially impacting the Federal Reserve's approach to interest rate cuts. Weak wage growth and rising unemployment may prompt the Fed to consider easing borrowing costs later this year, with market expectations now pointing towards a potential rate cut in June.

China's trade surplus expanded more than expected in the first two months of 2024, driven by resilient export demand and increased holiday spending, with the trade balance reaching $125.16 billion. Despite economic challenges, such as a property market crisis and slowing growth, the substantial growth in exports and imports suggests some early signs of improvement for China's economy, though sustainability remains uncertain as modest growth forecast set by Beijing.

What Can We Expect from The Market This Week

US CPI February: a measure of average price changes for consumer goods, considered a key event that could influence the Federal Reserve’s interest rate decisions. The figures exceeded consensus at 3.1% in January, sowing uncertainty in Fed rate cuts in March, mainly attributed to higher rents, while the February price is expected to remain flat.

German CPI February: a measure of average price changes for consumer goods in Germany, with the rate dropping to 2.5% in the earlier report, the lowest level since June 2021. Despite the discontinuation of the brake on energy prices and the introduction of a higher carbon price in January 2024, energy prices were 2.4% lower than in the same month a year earlier, while food prices increased 0.9%.

US Retail Sales: retail sales contracted by 8% month-over-month, marking the largest decline since March of the previous year, largely attributed to post-holiday season effects and adverse weather conditions. Particularly affected were sectors like building materials, miscellaneous store retailers, gasoline stations, and motor vehicles, while some sectors such as furniture stores and food services saw modest increases.

OPEC Monthly Report: a key report providing detailed analysis and outlook of the world oil market. The OPEC report highlighted recovering oil prices with slightly improved global economic growth forecasts, stable oil demand projections for 2024–2025, downward revisions to non-OPEC supply growth for 2024, mixed refining margin trends, rising tanker rates due to trade disruptions, falling OECD commercial stocks, and higher forecast demand for OPEC's crude oil in 2024 and 2025.

US Initial Jobless Claims: The recent surge in jobless claims to 217K, including a notable increase in the number of individuals filing for unemployment benefits, suggests a potential downturn in the labour market. This trend, characterised by rising unemployment claims over consecutive weeks, poses concerns for economists and policymakers regarding the overall health of the economy.