PAST WEEK'S NEWS (May 27 – May 31, 2024)

April's inflation data revealed that the inflation remain elevated, with the core PCE price index rising 2.8% from a year ago. The Federal Reserve is expected to leave interest rates flat at its June 12th meeting, seeking more evidence of easing inflation before considering rate cuts although bond market disagrees, with 10 year rates falling from high of 4.6% to 4.5%. Keeping rates on hold would leave government debt yields, and rates tied to them like mortgages, range bound. Feds updated economic projections at the June meeting will signal whether policymakers still envision multiple 2024 rate cuts or a more gradual easing starting next year. Risks of persistent inflation or economic threats could alter the expected rate cut timing.

Mortgage rates have been volatile recently. After dropping below 6.9% in mid-May, the average 30-year fixed rate has hovered around 7% for the past few weeks. Although this is much lower than last fall's 23-year high of over 8%, homebuyers are still hoping for further reductions. Significant drops in rates are unlikely unless the Federal Reserve cuts interest rates in response to sustained lower inflation. Experts also emphasise the need for reduced consumer spending and a decline in the 10-year Treasury yield. However, a sharp drop in rates could reignite competition, potentially pricing some buyers out of the already limited housing market.

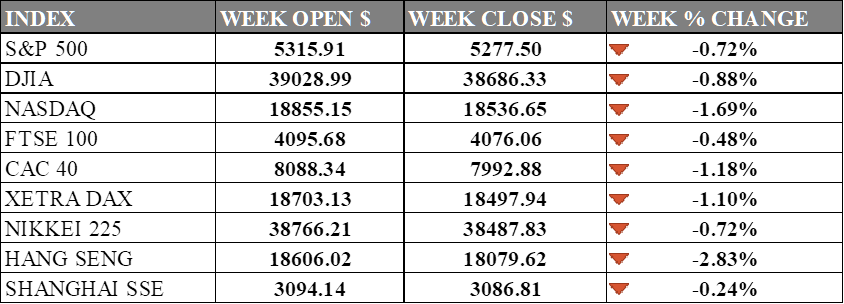

INDICES PERFORMANCE

The major U.S. stock indexes declined last week. The S&P 500 fell 0.72% to close at 5277.50 from its open of 5315.91. The Dow Jones Industrial Average (DJIA) declined 0.88% to finish at 38686.33 compared to its opening level of 39028.99. The Nasdaq also dropped 1.69% to close at 18536.65 after opening the week at 18855.15. For the first time, chip stocks have surpassed software stocks in the S&P 500, now holding the largest sector weighting, particularly in AI.

In Europe, most major indexes experienced losses. The UK's FTSE 100 fell 0.48% to close at 4076.06 compared to its open of 4095.68. Germany's XETRA DAX dipped 1.10% closing at 18497.94 from its starting point of 18703.13. France's CAC 40 declined 1.18% to end the week at 7992.88 after opening at 8088.34. inflation in the eurozone climbing to 2.6% in May, exceeding expectations. Germany is also grappling with its own economic pressures with declining import prices and a dip in retail sales, while corporation like Mutares is potentially selling its French subsidiary, which could signal shifts in the private equity sector.

Asian markets also saw declines. Japan's Nikkei 225 dipped 0.72%, closing at 38487.83 versus its open of 38766.21 tracking US core PCE inflation that eased in April. Hong Kong's Hang Seng fell sharply by 2.83% finishing off at 18079.62 from its starting level of 18606.02. China's Shanghai Composite posted a small loss of 0.24%, ending the week at 3086.81 compared to an opening figure of 3094.14. Notable stock movement were Zhong Ji Longevity Science’s with a 33% gain after securing a deal for subscription shares, China Shenhua Energy’s shares gaining over 1% following the announcement of a new technology fund, and China Risun Group’s shares rising over 3% after declaring a final dividend.

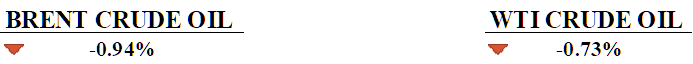

CRUDE OIL PERFORMANCE

Volatile crude oil prices ended last week down around 1% as traders positioned ahead of the OPEC+ meeting. At the June 2nd meeting in Vienna, OPEC+ stunned markets by deciding to extend voluntary output cuts of 2.2 million barrels per day through Q3 2024, before gradually phasing them out by end-2025. In total, OPEC+ is now cutting output by a massive 5.86 million bpd, equal to 5.7% of global demand, in a bid to stabilize prices. The cuts come despite improving economic data, including manufacturing expansions in China and Japan. However, crude sold off late week as traders cashed in gains after a key U.S. inflation gauge relieved policymaker pressure to aggressively hike rates. With OPEC+ supply restraints competing against economic growth concerns, volatility is expected to persist.

OTHER IMPORTANT MACRO DATA AND EVENTS

Japan's household spending data for April is expected to show a tepid 0.6% year-on-year rise, marking the first increase in 14 months, although the underlying consumption remains slow despite recent wage hikes. The weak private consumption is a concern for policymakers aiming for sustainable economic growth and durable inflation, as Japan shifts away from its ultra-easy monetary policy stance.

Chinese manufacturing activity unexpectedly contracted in May, with the official manufacturing PMI falling to 49.5, although some suggest that it is due to holidays. While non-manufacturing growth slowed as well, overall composite PMI data indicated continued but weaker expansion, signalling Beijing's latest stimulus provided only limited economic support and more may be needed.

What Can We Expect from The Market This Week

ECB Interest Rate Decision: The European Central Bank is expected to maintain its key interest rates, with inflation declining further and the growth projection for 2024 revised down to 0.6%. The ECB is determined to ensure inflation returns to its 2% medium-term target and will continue a data-dependent approach for its interest rate decisions.

BoC Interest Rate Decision: The Bank of Canada expected to cut its policy rate by 25 basis points to 4.75%, down from 5%, although officials say it’s “too early” for rate cuts despite signs of easing wage pressures and weak growth in its last meeting. However, BoC Governor Tiff Macklem has hinted at a potential rate cut in the near future, subject to sustained easing of price pressures.

US Nonfarm Payrolls: The job report for April showed a slowdown in job growth, with 175,000 jobs added, falling short of market expectations. Significant job increases were observed in the healthcare and social assistance sectors, while the transportation and warehousing sectors also saw gains. The market kept its forecast modest, with slightly higher growth at 185,000 jobs.

China Trade Balance: China’s trade surplus has fallen to $72.35 billion after slower export growth and a surge in imports. Additional US sanctions on China have also taken effect as it is recalibrating its trade approach, shifting towards nations more aligned with its interests, and signing bilateral and regional free trade agreements.

German Industrial Production: German industrial production saw a significant downturn with a 0.4% decrease in the real stock of orders in manufacturing in March, with the expectation of a slight recovery at 0.1% in April. The Federal Association of German Industry (BDI) predicts a further decline due to higher energy prices, interest rates, and ongoing supply chain issues.