Stocks Performance (U.S. Stocks)

Equities came under pressure after details from the recent U.S. Federal Reserve meeting signaled fading optimism about growth. An unexpected jump in the number of weekly claims for U.S. jobless benefits also added to the concern. On the political front, negotiations in Washington over an expanded fiscal support package remain stalled, and heightened U.S.-China trade tensions weighed on sentiment.

The S&P 500 saw its biggest gains in the consumer discretionary (Amazon.com Inc.), technology (Apple Inc. and Microsoft Corp.) and communication services sectors (Alphabet Inc. and Facebook Inc.). The jump in Apple’s share price boosted the company’s valuation above US$2 trillion, solidifying its position as the world’s most valuable company.

By sectors, the most outperformed weekly stocks were led by Consumer Durables at 7.13%, followed by Technology Services at 3.25%, Retail Trade at 3.20%, Electronic Technology at 3.14%, and Health Technology (0.66%). Meanwhile, the weakest sectors were from the Energy Minerals sector (-5.21 %), Industrial Services (-2.37%), Distribution Services (-2.09%), and Finance sector (-1.74%).

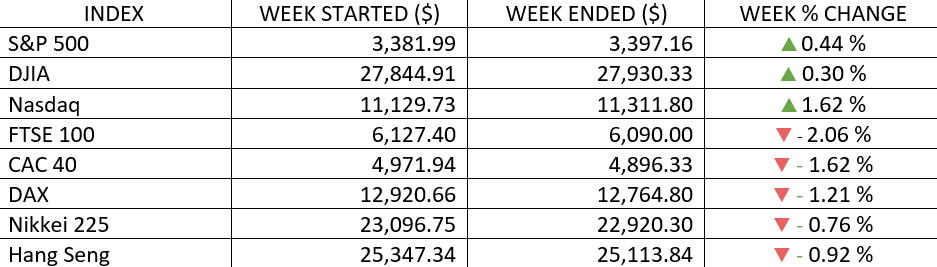

Indices Performance

The S&P 500 advanced for the fourth straight week, with technology stocks leading the index to a new record high. The 103-trading-day recovery from the March 23 low was the quickest rebound ever for the index from a decline of similar magnitude. Energy and financials led the declining sectors.

Most major equity markets in Europe and Asia, fell this week. In Europe, where COVID-19 infection rates had been advancing for months, higher daily case counts in several countries, including France, Germany, and Spain, weighed on sentiment. Hong Kong stocks fell after the U.S. suspended its extradition treaty and ended reciprocal tax treatment with the territory. Japan reported its GDP a record plunge in the Q2. An unexpected drop in machine orders in June and weaker trade activity also caused Tokyo stocks to underperform.

Oil Sector Performance

Energy sector recorded declines as OPEC and other major hydrocarbon-producing nations predicted a slow recovery in global oil demand.

Market-Moving News

Index Record Highs

NASDAQ extended its recent run of setting new record highs, outperforming the other major indexes. The S&P 500 set its own record on Friday, eclipsing its previous peak set six months earlier. The Dow finished the week little changed overall and was about 5% shy of its record.

Retail Earnings Jump

A difficult quarterly earnings season is wrapping up on a strong note, as several major retailers reported surging sales that exceeded analysts’ expectations.

Home Sales Surge

The housing market remains a positive catalyst for the fragile U.S. economy. A report released on Friday showed that sales of existing homes surged nearly 25% in July relative to the previous month and nearly 9% from a year earlier. The results far surpassed economists’ expectations.

Apple's Record

Apple’s market cap climbed above $2 trillion in intraday trading on Wednesday, marking the first time ever that the market value of a company’s total outstanding shares eclipsed that threshold. Shares of Apple climbed further on Friday, pushing its market cap to around $2.1 trillion.

Persistent Unemployment

After a one-week respite, the weekly total of U.S. unemployment claims climbed back above 1 million, with 1.1 million filings in the latest weekly count. In the previous week, the figure fell to 963,000, ending a string of 20 consecutive weeks in which claims had exceeded 1 million.

Mixed Global Outlook

Economic activity at U.S. companies has been picking up speed at a faster rate than it has in most other parts of the world. Data released on Friday from PMI showed that U.S. firms are seeing demand return as they reopen from coronavirus-related lockdowns imposed in the spring and early summer.

Cautious FOMC Minutes Meeting

The U.S. Federal Reserve is prepared to extend further support for the U.S. economy, but it’s remaining vague as to when it might take further action. Minutes released showed that board members believed more government spending would be needed to prevent a longer or deeper downturn as many states struggle to contain the coronavirus.

GDP Ahead

Investors will be closely watching a report scheduled to be released on Thursday that will provide an updated government estimate of Q2 GDP.

Other Important Macro Data and Events

Preliminary readings from PMIs suggested that the eurozone’s economic recovery lost momentum in August, driven by flattening growth in the service sector. The composite output index, which combines manufacturing and services, fell to 51.6 from 54.9 in July. (PMI readings of 50 mark the difference between an expansion and a contraction in output.) Although the manufacturing component reflected sharp increases in output and new orders, a rise in coronavirus infections and renewed travel restrictions weighed on services activity.

Trade-related headlines over the course of the week after the August 15 meeting between officials from China and the U.S. did not materialize. An official from China's commerce ministry said on Thursday that representatives from the two sides will talk "in the coming days." On a related note, the U.S. took more steps to restrict Huawei's access to components and there was more pressure on ByteDance to sell TikTok.

Meanwhile, lawmakers in Washington made no progress on the next fiscal stimulus.

Treasury yields drifted modestly lower through most of the week as the disappointing jobless claims and manufacturing data appeared to add to concerns that the U.S. economic recovery is slowing.

What We Can Expect from the Market this Week

Economic data and corporate profits released last week showed that the recovery is progressing, yet it remains uneven. Existing-home sales rose by the most on record in July, boosted by low mortgage rates and low inventory. A few big-box retailers that reported second-quarter results saw profits surge during the pandemic. While these are clear pockets of strength supporting the economy and the market, unemployment remains elevated, highlighting the need for another fiscal package. We believe appropriate balance and diversification can help prepare portfolios for any uptick in market volatility while also positioning them for the longer-term recovery.

Investors will be closely watching a Q2 GDP report scheduled to be released on Thursday that will provide an updated government second estimate. An initial estimate released on July 30 showed that U.S. economic output fell at an annualized rate of 32.9%, the worst contraction on record.

Important economic news coming out this week including Consumer Confidence Index and new home sales on Tuesday, durable goods orders on Wednesday, Q2 GDP report, weekly unemployment claims and pending home sales on Thursday, and personal income and spending on Friday.