PAST WEEK'S NEWS (April 21 – April 25)

Donald Trump's second presidential administration is about to reach its 100-day milestone on April 30, a benchmark that originated with Franklin D. Roosevelt's first 100 days in 1933 when he passed 15 major pieces of legislation during the Great Depression. During Trump's first 100 days, he has focused on shrinking the federal government through the Department of Government Efficiency led by Elon Musk, resulting in approximately 75,000 voluntary buyouts and tens of thousands of additional layoffs. Trump signed 137 executive orders covering areas from immigration to tariffs, inciting over 80 lawsuits challenging his actions on immigration, gender, diversity, and climate change. His administration has famously imposed intense tariffs, particularly against China (up to 145%); while initiating peace talks between Russia and Ukraine, eliminated $20 billion in climate funding, and disbanded numerous federal roles, including at USAID. The S&P 500 has declined 8.5% since Inauguration Day thanks to trade wars, recession concerns, and Federal Reserve tensions, while Trump's approval rating has averaged 45%.

Tech companies earnings are in season, with President Trump's erratic tariff policies possibly reflected in their financial outlooks. It starts with Tesla this week, a car company that relies on suppliers in Mexico and China for critical components like automotive glass and battery cells, is particularly vulnerable to the tariffs, with analysts projecting a mere 1% revenue growth for the first quarter and a potential decline in the second quarter. The electric vehicle maker has already reported a 13% decline in vehicle deliveries, forcing it to offer incentives and discounts to stimulate demand, which could further erode its already thinning margins. CEO Elon Musk's position could be under fire with his increasingly controversial role in the Trump administration having ignited local protests and boycotts, alienating a portion of Tesla's customer base and putting shareholders' interests on the sideline. As investors await Tesla's earnings report, they will be closely watching for any signs of how the board of directors plans to navigate the landscape and whether Musk's leadership remains tenable.

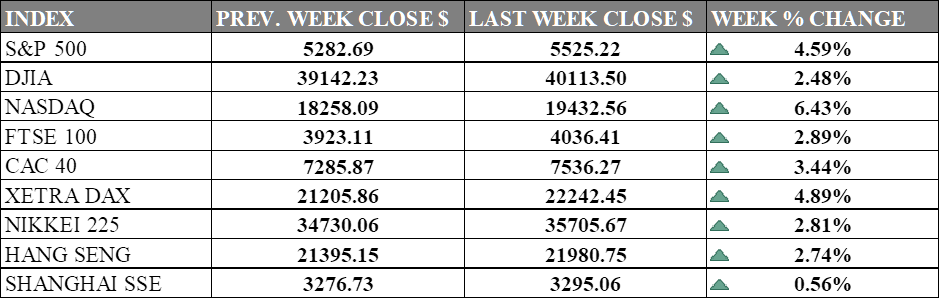

INDICES PERFORMANCE

Wall Street cheered for a strong positive rally this week with reignited confidence after Trump backtrack in tariff escalation and his rhetoric against Fed Chair Jerome Powell. The S&P 500 surged by 4.59%, closing at 5525.22, showing significant buying momentum. The Dow Jones Industrial Average (DJIA) posted a solid gain of 2.48%, finishing at 40113.50, indicating renewed investor confidence. Meanwhile, the Nasdaq led the advance with an impressive 6.43% increase, closing at 19432.56, as tech stocks attracted substantial buying interest. This upward movement suggests growing investor optimism rather than market growth.

European markets continued their strong performance for the week, aligning with the U.S. rally. The UK's FTSE 100 gained 2.89%, closing at 4036.41. France's CAC 40 experienced an increase of 3.44%, ending at 7536.27, while Germany's XETRA DAX surged by 4.89%, closing at 22242.45. European markets appear to be responding to widespread economic optimism, mirroring the positive sentiment in U.S. markets.

Asian markets also displayed strength, with consistent gains across the region. Japan's Nikkei 225 posted a solid gain of 2.81%, closing at 35705.67. Hong Kong's Hang Seng Index showed significant resilience, rising by 2.74%, finishing at 21980.75. In mainland China, the Shanghai Composite Index advanced modestly by 0.56%, ending at 3295.06, potentially reflecting cautious optimism about economic growth despite more robust gains in other Asian markets.

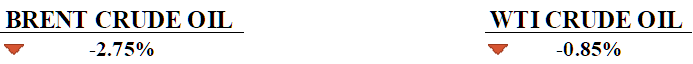

CRUDE OIL PERFORMANCE

Oil prices edged higher by Friday’s close but ended the week lower, pressured by oversupply concerns and prolonged U.S.-China trade tensions. Brent crude settled at $65.86 a barrel, down 2.75% for the week, while WTI finished at $63.14, losing 0.85%. Even with China's partial tariff exemptions, hopes for a trade resolution faded as Beijing denied active negotiations, hurting crude market sentiment. Analysts pointed to speculation that OPEC+ could accelerate production hikes and potential additional Russian supply as key bearish factors. However, a modest rise in U.S. drilling rigs and signs of tightness in the prompt physical market provided some support to prices. Overall, oil markets remain volatile, with near-term direction hinging on geopolitical developments and upcoming OPEC+ decisions.

OTHER IMPORTANT MACRO DATA AND EVENTS

Germany cut its 2025 growth forecast to stagnation due to global trade tensions, especially U.S. tariffs, while facing falling exports, rising unemployment, and continued economic struggles after two years of no growth.

U.S. jobless claims rose to 222,000, pointing toward a stable labour market amid concerns that tariffs could slow economic growth.

What Can We Expect from The Market This Week

BoJ Interest Rate Decision: The Bank of Japan maintained its key short-term interest rate at 0.5% following its March 2025 meeting and is expected to continue to do so with mounting economic risks from tariffs, holding it at the highest level since 2008.

US Nonfarm Payroll: The US economy added 228,000 jobs in March, significantly exceeding forecasts and indicating continued strength in the labour market. This figure represents an increase from the revised 117,000 jobs added in February, while the consensus for April is modest at 129,000 due to federal employee layoffs.

ISM Manufacturing PMI: US manufacturing activity fell into contraction in March, falling to 49.0 from 50.3 in February and missing market expectations. This suggests a slowdown in factory activity after a brief period of expansion, with the next report expecting further shrinkage.

China Manufacturing PMI: China's manufacturing sector showed expansion since February, as the official NBS PMI rose to 50.5 and the Caixin/S&P Global PMI increased to 51.2. Both indicators surpassed expectations, pointing towards improving conditions and growth within the country's factory activity.

PCE Price Index: The primary inflation indicator for the Fed increased by 0.4% month-over-month and 2.8% year-over-year in February 2025, slightly above market forecasts, indicating persistent inflationary pressures. The expectation for March is more tame at 0.1%.