PAST WEEK'S NEWS (May 12 – May 16)

It's been a busy week for the President of the United States, spearheading monumental trade agreements, reshaping U.S. economic relations with key global partners, and fostering peace in the Middle East. With China, a temporary 90-day ceasefire in the trade war, finalised in Geneva, drastically reduces tariffs, with U.S. tariffs on Chinese goods dropping to 30% and China’s to 10%, avoiding uncertainty that saw tariffs peak at 145% and stimulating market recovery by opening China to U.S. businesses. In Saudi Arabia, Trump secured a historic $142 billion arms deal, the largest in history, supplying advanced military equipment across air, missile, maritime, and communication systems, strengthening U.S.-Saudi ties and countering previous diplomatic strains. Similarly, a $1.2 trillion economic deal with Qatar includes a $96 billion Boeing aircraft purchase, $1 billion in quantum technology investment, and defence contracts for anti-drone systems and drones, enhancing bilateral commercial ties. These agreements represent Trump’s business-first approach, prioritising economic gains and job creation while strengthening relationships.

April's headline inflation rate continued to ease, dropping to 2.3% compared to 2.4% last March, reaching its lowest point since February 2021, while core inflation held steady at 2.8%. President Trump has highlighted cheaper prices in several categories, including gasoline, energy, groceries, and eggs, though the effects of Liberation Day tariffs implemented on April 2nd are expected to appear more significantly between May and October due to inventory stockpiling and tariff delays. Consumer sentiment coming from the University of Michigan declined 8% from March to April, with Americans expecting prices to surge over the next year in line with weaker labour markets, a weaker economy, and diminished income growth. Federal Reserve Chair Jerome Powell, criticised by Trump as "too late Powell", is maintaining a wait-and-see approach with a 91.6% probability of no interest rate cut at the June meeting, only seeing a September cut if ever. The report reveals stark differences in consumer sentiment based on political affiliation, with Democrats showing much lower confidence in the economic outlook than Republicans.

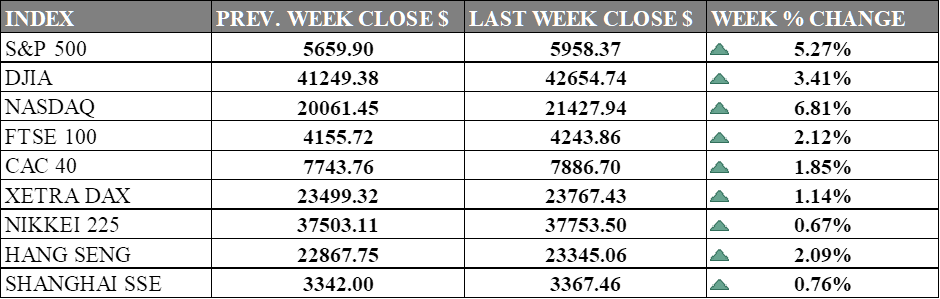

INDICES PERFORMANCE

Wall Street saw a remarkable rally last week, bringing market confidence back. The S&P 500 surged by 5.27%, closing at 5958.37, with widespread optimism overtaking previous concerns about tariffs. The Dow Jones Industrial Average (DJIA) also posted impressive gains of 3.41%, finishing at 42654.74, the least benefactor due to Unitedhealth crisis. The Nasdaq led the way with an outstanding increase of 6.81%, closing at 21427.94, as tech stocks enjoyed strong buying interest. The market rally was mostly based on U.S.-China deal made in Geneva, proposing clear cut figures on tariff ceiling.

European markets had also showed consistent positive performance for the week. The UK's FTSE 100 gained 2.12%, closing at 4243.86. France's CAC 40 increased by 1.85%, ending at 7886.70, while Germany's XETRA DAX continued its upward trend with a gain of 1.14%, closing at 23767.43. European markets appear to be responding uniformly to favourable regional economic factors, with equities showing strength across the board.

Asian markets maintained positive momentum, though with more modest gains compared to their Western counterparts. Japan's Nikkei 225 posted a slight gain of 0.67%, closing at 37753.50. Hong Kong's Hang Seng Index showed solid positive movement, rising by 2.09%, finishing at 23345.06. In mainland China, the Shanghai Composite Index advanced by 0.76%, ending at 3367.46, with gains distributed more evenly across sectors rather than concentrated in specific industries like defence as ceasefire achieved between Bharat and Pakistan.

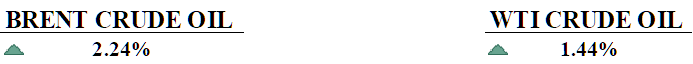

CRUDE OIL PERFORMANCE

Oil gained around 2% last week even with persistent oversupply concerns although a temporary U.S.-China tariff truce may have improved demand outlook. The prospect of a U.S.-Iran nuclear deal, potentially adding 400,000 barrels per day to the market, and rising OPEC+ output became main concern for oil traders. Moody’s downgrade of the U.S. credit rating to Aa1 from Aaa, citing a $36 trillion debt burden, further heightened caution. Chinese industrial production exceeded expectations, signaling resilient oil demand, though weaker retail sales limits optimism. Egypt’s shift to purchase more fuel oil, due to costly natural gas, could push regional demand higher amid declining domestic gas production..

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. retail sales slowed in April as fading tariff-driven car buying, weakening consumer demand, and economic uncertainty point toward slower growth ahead even with resilient job markets and temporary inflation relief.

U.S. factory gate prices slumped in April, signalling cooling inflation, as the Federal Reserve holds interest rates steady at 4.25%-4.50% with cuts expected in September.

What Can We Expect from The Market This Week

Eurozone CPI: Euro annual inflation remained stable at 2.2% in April preliminary data, unchanged from March and slightly above market expectations of 2.1%. The inflation rate continues to hover just above the European Central Bank's 2% target, maintaining pressure on policymakers to focus on growth instead.

RBA Interest Rate Decision: The Reserve Bank of Australia is widely expected to cut its cash rate by 25 basis points to 3.85% at its May 20 meeting, which would be the second cut since February when rates were lowered to 4.10%. Market indicators show a 96% expectation of the cut as Australia's inflation continues to moderate within the central bank's target range.

UK CPI April: The consensus for UK's April inflation data is unusually high at 3.3%, even with a decline to 2.6% in March from 2.8% in February. Analysts are closely monitoring whether this downward trend will continue as the Bank of England contemplates its next move on interest rates.

German GDP Q1: Preliminary data shows Germany's gross domestic product grew by 0.2% in the first quarter of 2025 compared to the previous quarter's 0.2% contraction in Q4 2024, avoiding a technical recession. The modest growth, which was in line with market expectations, brought the quarterly GDP figure to around 1.1 trillion euros.

US New Home Sales: New home sales in the United States jumped 7.4% to a seasonally adjusted annual rate of 724,000 units in March 2025, reaching the highest level since September 2024. In spite of high mortgage rates, the housing supply continued to increase, with the median sales price of new houses at $403,600, down 1.9% from February.