PAST WEEK'S NEWS (May 19 – May 23)

After a close 215–214 vote, the House barely pushed through President Trump’s “One Big, Beautiful Bill", a 1,116‑page, $3.8 trillion mashup of permanent tax cuts and deep social‑spending rollbacks. It locks in the 2017 tax cuts and sprinkles in new perks, like a beefed‑up child tax credit, a one‑time deduction on car‑loan interest for American‑made vehicles, and a tax break on overtime pay and tips until 2028. But on the opposite side, nonpartisan analysts warn the wealthiest Americans will pocket the biggest benefits, while folks at the bottom could lose ground when Medicaid, SNAP and student aid get slashed. The Congressional Budget Office warns the deficit will still balloon by another $3.8 trillion between 2026 and 2034. Fiscal critics in both chambers aren’t exactly cheering, leaving conservatives grumbling about the size of the package, while senators from Alaska to Maine are itching to rewrite key provisions. Now the bill heads to a Senate majority where the real tug‑of‑war will decide if it will be enacted.

Beijing condemned new U.S. export controls on high-tech semiconductors as "bullying" and "protectionism" as The U.S. Commerce Department released guidelines against the use of China-made hardware, especially targeted to limit China's distribution of advanced AI chips like Huawei's Ascend series, citing national security risks of technology transfer to adversaries, while China accused the U.S. of abusing export controls to suppress its development. Nvidia's CEO, Jensen Huang, stated that these restrictions have backfired, accelerating China's domestic chip industry and slashing Nvidia's market share in China from 95% to 50%. Meanwhile, U.S. senators raised alarms over AI chip sales to Saudi Arabia and the UAE, fearing leakage to China and Russia and supply shortages for American firms, urging the Trump administration to impose safeguards in light of the new partnerships.

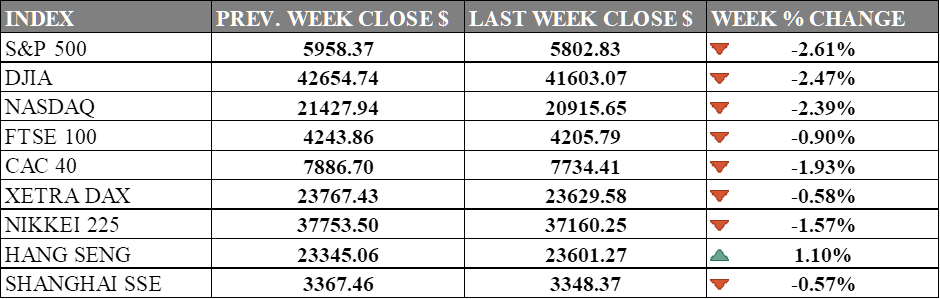

INDICES PERFORMANCE

Wall Street experienced a significant decline last week, with market confidence shaken across major indices. The S&P 500 dropped by 2.61%, closing at 5958.37, as concerns over various economic factors weighed on investor sentiment. The Dow Jones Industrial Average (DJIA) also posted notable losses of 2.47%, finishing at 42654.74. The Nasdaq declined by 2.39%, closing at 21427.94, as tech stocks faced selling pressure throughout the week.

European markets also showed weakness during the period, though with somewhat more resilience than their American counterparts. The UK's FTSE 100 declined by 0.90%, closing at 4243.86. France's CAC 40 decreased by 1.93%, ending at 7886.70, while Germany's XETRA DAX showed relative strength with only a modest decline of 0.58%, closing at 23767.43. European markets appear to be responding to both regional concerns and broader global market sentiment.

Asian markets presented a mixed picture, with some regional variations in performance. Japan's Nikkei 225 posted a decline of 1.57%, closing at 37753.50. However, Hong Kong's Hang Seng Index bucked the negative trend, rising by 1.10%, finishing at 23345.06. In mainland China, the Shanghai Composite Index showed minimal movement with a slight decline of 0.57%, ending at 3367.46, suggesting cautious trading activity in the region.

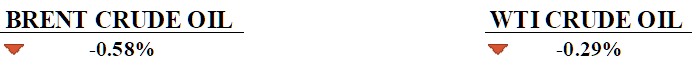

CRUDE OIL PERFORMANCE

Short-covering ahead of the U.S. Memorial Day weekend and market anxiety regarding stalled nuclear talks between the U.S. and Iran had dragged the market, due to possibility of disrupting crude supply, although only falling slightly. WTI was down 0.29% while Brent fell 0.58%. Traders are keeping a close eye on events in Rome, where stalled negotiations have sparked concerns about a conflict involving israel. In the meantime, focus shifted to OPEC+, which is anticipated to increase production by 411,000 barrels per day in July and may phase out the remaining voluntary reductions by October. As U.S. President Trump pushed to increase domestic nuclear capacity by simplifying regulations, criticised UK energy policies, and suggested a 50% tariff on EU goods, oil prices may take a small hit from speculators.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. existing home sales fell half a percentage in April to their slowest pace for the month since 2009, despite lower mortgage rates and rising inventory, with shifting buyer dynamics.

U.K. retail sales jumped 5.0% year-on-year and 1.2% month-on-month in April, as improved consumer confidence, boosted by falling interest rates and easing trade tensions, offset concerns over rising inflation, which hit 3.5%.

What Can We Expect from The Market This Week

PCE Price Index: Personal spending grew slower to 2.3% in March, down from 2.7% in February, marking the lowest reading since October, continued moderation in inflation. The core index (excluding food and energy) fell to 2.6% year-over-year in March from 3.0% in February, aligning with the Fed's progress toward its 2% target.

FOMC Meeting Minutes: The Federal Open Market Committee's May meeting minutes are scheduled for release; a meeting at which policymakers maintained the target fed funds rate at 4.25%-4.50% for the third time. Committee members highlight concern about persistent inflation in service sectors while acknowledging the impact of swings in net exports on recent economic data.

German CPI May: Germany's preliminary inflation reading for May is due, with forecasts pointing to inflation remaining stable around 2.1%, consistent with April's figure. The April data showed price pressures continuing to ease, though monthly prices still rose by 0.4% driven by higher food and service costs.

Chicago PMI: The Chicago Business Barometer reads 44.6 in April from 47.6 in March, indicating a deeper contraction in the manufacturing sector in the Chicago region. The decline was worse than market expectations of 45.5, a continued challenges for regional manufacturing activity despite previous growth in February and March.

RBNZ Interest Rate Decision: The Reserve Bank of New Zealand is expected to cut its Official Cash Rate from 3.50% to 3.25% at its upcoming meeting, following an earlier reduction in April, with easing inflation and mounting concerns about economic growth instead.