Stocks Performance (U.S. Stocks)

Stocks declined for the second straight week, as technology stocks experienced their worst pullback since March. There appeared to be no specific catalyst behind the declines other than continuing talk of overbought conditions on Wall Street following the recent rally. The continuing lack of progress in Congress on a new stimulus package also seemed to be weighing on sentiment, with investors particularly worried about the building financial pressures on states and municipalities. On Thursday, USD 300 billion relief package were brought by Republicans to a vote in the Senate, which then halted by Democrats, who passed a package roughly 10 times as large in the House of Representatives in May.

Apple, Microsoft, Amazon, Alphabet, and Facebook fell between 4.4% and 7.4%. Tesla fell 10.9% and was snubbed a spot in the S&P 500 by the index committee.

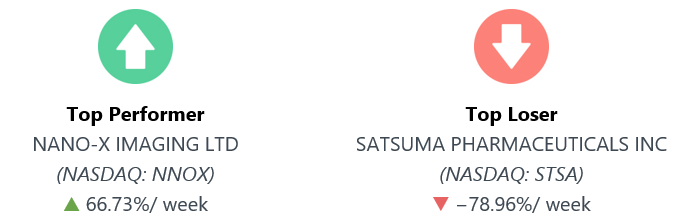

By sectors, the most outperformed weekly stocks were led by Transportation at 1.75%, followed by Non-Energy Minerals sector at 1.45%, Process Industries at 0.72%, and Consumer Non-Durables at -0.17%. Meanwhile, the weakest sectors were from the Technology Services (-5.69%), Energy Minerals (-5.23%), Retail Trade (-4.77%), and Electronic Technology sector (-4.60%).

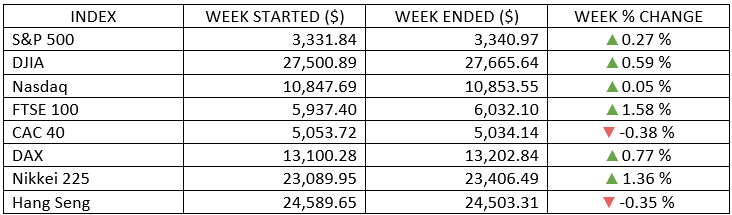

Indices Performance

U.S. equities lost ground as investors continued to sell the high-flying technology stocks that led the remarkable rebound from the COVID-19 decline. However, Europe and Japan advanced this week.

Most European stocks resisted the tech-led downdraft in the U.S. and instead moved higher, buoyed by improved economic data and assurances of continued accommodative central bank policies, especially in the UK, France, and Italy. Spain was the only major European market to lose ground. In the Asia/Pacific region, Japan equities climbed.

Stocks in Hong Kong and Shanghai sank after the reports of the potential sanctions against SMIC.

Oil Sector Performance

Oil prices retreated dragging along the energy shares. WTI slipped to a three-month low after Saudi Arabia signalled softer demand by cutting official prices. The drop was for the second week in a row, after tumbling on Friday below $38 per barrel.

Market-Moving News

Turbulent Market

The major U.S. stock indexes fell for the second week in a row, retreating again from the record highs that the S&P 500 and the NASDAQ achieved on September 2.

From Record to Correction

The NASDAQ on Tuesday fell into a correction, as the index was down 10% from the record high that it had set just six days earlier. Several of the market’s biggest technology stocks weighed on the NASDAQ, posting weekly declines of more than 5%.

Euro Rallies

The euro surged in currency markets after the president of the ECB expressed optimism for the continent’s economic recovery, citing positive trends for manufacturing and services. Christine Lagarde also played down recent concerns over the euro’s strength, and the ECB offered no concrete plans for further stimulus measures.

Brexit (Deal or No-Deal)

The United Kingdom’s process of divorcing itself from the EU continues to run into obstacles, with U.K. Prime Minister Boris Johnson and the EU at a potential impasse in talks toward a trade agreement. The latest dispute involves legislation that would override aspects of a Brexit withdrawal agreement involving the border between Northern Ireland and Ireland.

Coronavirus Aid Impasse

Prospects for approval of another congressional stimulus package before the November election appeared to dim, as a GOP-authored coronavirus relief package failed to secure enough Senate votes to move forward. Democrats said the measure doesn’t go far enough, and the sides remained at odds over issues such as state aid and another round of direct payments to Americans.

Oil Slick

Energy stocks took a hit as crude oil prices dropped for the second week in a row, tumbling on Friday below $38 per barrel.

Rising Prices

Inflation remains below the U.S. Federal Reserve’s 2.0% target, but it is rising, despite high unemployment. The Department of Labor on Friday reported that consumer prices rose 0.4% in August compared with July, or 1.3% from a year earlier. In contrast, the YoY rise was just 0.2% as recently as May.

Fed Decision Ahead

While no major policy moves are expected when the U.S. Federal Reserve Board concludes a two-day policy meeting on Wednesday, Chairman Jerome Powell could offer some further details on a recent shift in how the Fed views inflation. Powell said last month that the Fed won’t worry as much as it previously had about the prospect of low interest rates triggering rising prices.

Other Important Macro Data and Events

Investors were worried about increasing U.S.-China tensions, and a setback in vaccine development, as AstraZeneca paused its COVID-19 vaccine trial in the UK due to a serious adverse reaction in a patient.

Also, there’s a loss of labor market momentum and increasing pessimism about any new fiscal stimulus before the November presidential election. The Senate failed to pass its $300 billion coronavirus relief bill, while President Trump suggested disincentives for U.S. companies to outsource jobs to China, and China's largest semiconductor foundry could reportedly be added to a trade blacklist.

Investors seeking safe havens have boosted gold prices and the U.S. dollar, and have pushed Treasury yields lower. U.S. Treasuries ended the week with modest gains. The 2-yr yield declined three basis points to 0.13%, and the 10-yr yield declined five basis points to 0.67%. The U.S. Dollar Index advanced 0.6% to 93.28.

Investors mostly shrugged off the growing possibility of a no-deal Brexit as the eighth round of UK-EU talks got underway. Negotiations looked especially vulnerable to collapse after the UK government confirmed it planned to violate international trade laws by unilaterally changing the Brexit deal.

What We Can Expect from the Market this Week

Apart from the tumble in the technology stocks, skepticism about a compromise on a coronavirus stimulus package before the election, and signs of slowing progress in the labor market all contributed to the negative sentiment.

We continue to believe a longer-term recovery is under way, but stocks are likely to enter a more volatile period than the one experienced during the summer months. The path forward could be bumpier and the pace of the recovery slower, and as a result, stocks could start to consolidate some of the recent gains.

Important economic news released this week including industrial production on Tuesday, retail sales along with the Federal Reserve interest rate decision on Wednesday, weekly unemployment claims and housing starts on Thursday, and consumer sentiment on Friday.