Stocks Performance (U.S. Stocks)

Stocks edged lower last week as investor confidence faltered as stalled Washington stimulus talks and the likelihood for a no-deal Brexit soured the mood. Imminent COVID-19 vaccine deployments pushed global markets to record highs early of the week before the optimism waned midweek. Several other factors contributed to the caution also including heightened tensions between the U.S. and China, the filing of an antitrust suit against Facebook Inc., a jump in applications for U.S. unemployment benefits, and the continued rise in coronavirus cases globally.

The energy sector outperformed by a wide margin, as Brent oil prices crossed $50 per barrel for the first time since the onset of the pandemic. The week was also notable for the IPOs of Airbnb and DoorDash, two of the largest to date in 2020. Airbnb (NASDAQ: ABNB) more than doubled in its IPO, DoorDash (NYSE: DASH) surged 85% in its first day of trading, and Tesla (NASDAQ: TSLA) sold $5 billion of common stock through an "at-the-market" offering program.

By sectors, the most outperformed weekly stocks were led by Consumer Durables sector at 1.71%, followed by Commercial Services at 1.06%, Health Technology (0.94%), and Energy Minerals at 0.76%. Meanwhile, the weakest sectors were from the Health Services at -2.06%, Finance at -1.65%, Electronic Technology (-1.21%), and Distribution Services sector (-1.03%).

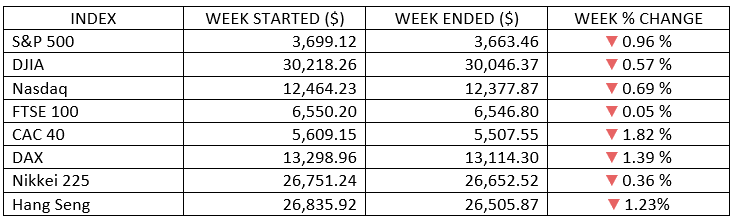

Indices Performance

Major U.S. indexes reached fresh record highs last week before pulling back to finish modestly lower, as stalled Washington stimulus talks and the likelihood for a no-deal Brexit soured the mood. The indexes slipped less than 1% for the week.

Major markets in Europe fell despite improving economic data and an extension of the ECB’s emergency support programs. The slide in UK stocks was relatively small as Britain became the first Western nation to begin COVID-19 immunizations. Brexit negotiations once again failed to yield a deal.

Markets in Asia were mostly down. Japanese shares declined less than most on better-than-expected economic data and as the government announced a new economic stimulus package. Stocks in Hong Kong and Shanghai fell on reports that the U.S. would sanction more Chinese officials because of the recent disqualification of Hong Kong legislators, and China reacted angrily to the sale of military equipment to Taiwan.

Oil Sector Performance

Brent oil prices crossed $50 per barrel for the first time since the onset of the pandemic. Prices climbed to a 9-month high and continued their ascent in anticipation of recovering demand as vaccines are distributed. Oil now rallied for six weeks straight as investors priced in a global recovery next year.

Market-Moving News

Change in Direction

The S&P 500 fell for the first time in three weeks as investors assessed prospects for further economic stimulus and U.S. regulatory approval of coronavirus vaccine. The major indexes slipped less than 1%, retreating from record highs.

Stimulus Stalemate

House and Senate leaders continued to pursue a deal on further coronavirus-related economic relief, but sticking points remained on Friday after months of negotiations and as Congress prepared to adjourn for the year. Any deal that emerges could be attached to a $1.4 trillion measure that must pass by December 18 in order to avert a government shutdown.

Euro Stimulus

The ECB expanded its economic stimulus program, citing risks that spiking coronavirus cases pose to the continent’s economy. The bank agreed to increase its asset-purchasing program by $605 billion, extend the program’s duration to at least March 2022, and grant more subsidized loans to banks.

Brexit Negotiations

European stock indexes fell on Friday as a Brexit deal remained elusive in talks between the UK and the EU. British Prime Minister Boris Johnson said there was a “strong possibility” that his country could exit the economic union at the end of this month without a free trade agreement. Sunday meeting also yield no result.

Inflation Gauge

Consumer prices rose more than expected last month. The latest CPI rose 0.2% relative to the previous month after showing no change in October. Rising costs for hotel stays, airfares, and apparel triggered some of last month’s rise.

Bitcoin Volatility

The price of bitcoin fell around 5% for the week, eroding some of the gains from the cryptocurrency’s recent rally. The price fell below $18,000 on Friday, just days after eclipsing $19,000. Bitcoin started the year around $8,000, and it was just $10,600 as recently as early October.

Unemployment Data

More than 850,000 Americans filed first-time unemployment claims in the latest weekly report, exceeding expectations. The total was the largest since mid-September.

Other Important Macro Data and Events

Broad market sentiment slid lower as progress on a stimulus deal in Congress seemed elusive, while jobless claims suggested business restrictions were slowing activity, and deaths in the U.S. from COVID-19 surpassed 3,000 a day for the first time.

Treasury Secretary Mnuchin offered a new $916 billion stimulus bill, while alternatively, Democratic Congressional leadership preferred to focus on the $908 billion bipartisan plan instead.

Treasury yields decreased through most of the week amid uncertainty over fiscal stimulus talks in the U.S. and Brexit trade negotiations.

In vaccine news, the UK began inoculating its citizens with the Pfizer-BioNTech vaccine, and the U.S. FDA advisory panel recommended that their vaccine be approved for emergency use. In addition, peer-reviewed data indicated that the AstraZeneca-Oxford vaccine is safe and effective in preventing symptomatic COVID-19 and that it protects against severe disease and hospitalization.

What We Can Expect from the Market this Week

The spotlight of the week will be concentrated on the trio of vaccine progress, the current state of the economy and the potential for a fiscal package in Washington.

The market appears to be largely focused on the prospects of a brighter outlook driven by vaccine rollouts, even as recent coronavirus trends continue to worsen and restrictions in activity are reimposed.

The U.S. Federal Reserve is scheduled on Wednesday to conclude its last policy meeting of the year. While no policy changes affecting interest rates are expected, observers will closely watch whether the Fed adjusts a bond-buying program to help potentially offset a recent slowdown in the economic recovery.

Important economic news released this week including RBA meeting minutes and OPEC report on Monday, import/ export, industrial production and IEA report on Tuesday, FOMC rate decision and housing market index on Wednesday, unemployment claims and housing starts on Thursday, and EU and US current account on Friday.