PAST WEEK'S NEWS (March 22 – March 28, 2021)

Stocks Performance (U.S. Stocks)

Equities in major markets were mixed last week as investors seemed to continue weighing optimism about economic reopening against COVID-19 cases, inflation, and interest rate concerns.

Concerns about the safety of some vaccines and threats by some countries to withhold exports of vaccine production, as well as renewed lockdowns in Europe added to investor worries that the vaccination campaign that underpinned stock market gains for the last six months could be disrupted. Most equity markets were lower for much of the week until some rebounded into the green on Friday. This came about after President Joe Biden doubled the goal for vaccinations in his first 100 days in office to 200 million.

The closure of the Suez Canal because of a disabled cargo ship raised worries about already stressed global supply lines but boosted oil prices and energy stocks.

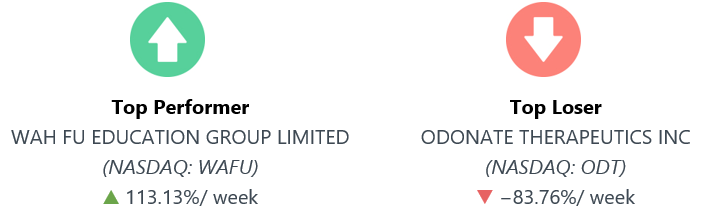

Wah Fu Education Group Limited shares climbed to all-time highs. The Chinese education stocks were trading sharply higher on last trading day of the week, potentially following the Thursday IPO of a peer in the space, Elite Education. Meanwhile, Odonate Therapeutics hit rock bottom, plummets toward record low after the company announces discontinuation of development of Tesetaxel, its chemotherapy agent which are widely used in the treatment of cancer.

Advancing sectors were led by Producer Manufacturing sector at 2.70%, followed by Industrial Services 2.08%, Transportations (2.08%), and Consumer Non-Durables at 2.03%. Meanwhile, the weakest sectors were from the Consumer Services at 3.89%, Consumer Durables at 2.75%, Commercial Services (0.40%), and Retail Trade sector (0.32%).

Indices Performance

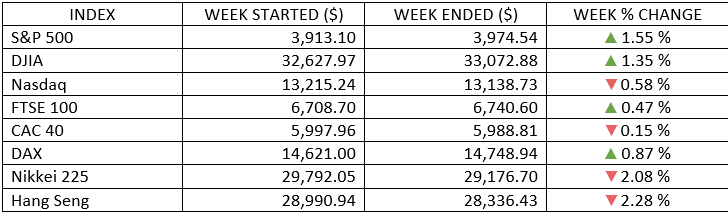

Stocks largely ran in place last week, with the S&P 500 edging out a slight gain. The Dow Jones Industrial Average also closed higher, while the Nasdaq Composite lost ground.

Major stock indexes were mixed as economic restrictions got tighter: France’s CAC 40 ended the week down modestly, while Germany’s DAX Index, Italy’s FTSE MIB, and the UK’s FTSE 100 Index posted gains.

Japanese stocks underperformed in a continued reaction to the Bank of Japan reducing support to the equity market last week.

Oil Sector Performance

Oil prices were little changed, as the gains were capped on lockdowns in Europe and a build in U.S. crude inventories that curbed risk appetite and raised oversupply fears. While in the Suez Canal, a container ship that ran aground is still blocking all traffic in the key oil shipping route.

Market-Moving News

Stocks Swing

U.S. stocks hasn’t made any big sustained moves up or down since mid-February, though it ultimately ended with a modest gain, except for the Nasdaq Composite that lost ground.

Small-Cap Stumble

Small-cap stocks lagged for the second consecutive week, signalling a potential pause or reversal in their recent market leadership.

YTD Yield

The government bond yields retreated from the 14-month highs touched last week. The yield subsided on Fed remarks that downplayed the inflation concerns. On Wednesday, both Federal Reserve Chair Jerome Powell and Treasury Secretary Janet Yellen testified before Congress that they saw little danger of an overheating economy.

Testimonial Remarks

On Tuesday and Wednesday, Treasury Secretary Janet Yellen, was testifying alongside Federal Reserve Chair Jerome Powell before the House Financial Services Committee and Senate Banking Panel, which then offered an optimistic outlook for the economy, fuelled by expectations for continued progress due to vaccine rollouts and the $1.9 trillion of federal relief spending. Yellen also told lawmakers that future tax hikes will be needed to pay for infrastructure projects and other public investments.

Vaccine Development

AstraZeneca's encouraging U.S. vaccine trial data was questioned by an independent panel, but the company confirmed its vaccine was 76% effective against symptomatic COVID-19.

Unemployment Claims

A sizable decline in weekly jobless claims, falling by nearly 100,000 to 684,000 last week, the first report below 700,000 since the pandemic began. While the latest reading is still punitively high, on the other hand, jobless claims have fallen sharply recently, supporting our view that employment conditions will resume their path of improvement this year.

Suez Canal Blockage

A container ship clogging the Suez Canal also clogged newsfeeds and captured attention in recent days, as approximately 12% of global trade is estimated to pass through the canal each year, posing a risk if the block is not resolved soon.

Other Important Macro Data and Events

For the currencies, this is how they've changed since last week. The. The dollar index advanced 1.12% to stay at 92.766. EUR/USD declined -0.16%, USD/JPY rose 0.74%, GBP/USD slipped -0.7%, and USD/CHF rose 1.12%.

Economic data were mixed, with several key indicators falling short of expectations. Among the disappointments were drops in February new home sales and durable goods orders.

However, the Markit March Services PMI rose to its highest level since mid-2014, and the manufacturing PMI hovered near an all-time high. Weekly initial claims declined by 97,000 to 684,000, fell to their lowest level in over a year.

Confidence measures and PMIs were also better than expected in Europe and Japan. The euro area manufacturing PMI reached its highest point since the series compiled by IHS Markit began.

Core and peripheral eurozone government bond yields fell overall. Concerns over Europe’s slow vaccine rollout amid the onset of a fresh wave of coronavirus infections drove demand for high-quality government bonds. Data showing a EUR 7.1 billion increase in the ECB’s weekly bond purchases also weighed on yields. Gilt yields declined on fears that the EC might block vaccine exports to the UK, potentially slowing the country’s inoculation campaign.

Weaker-than-expected inflation data, which pushed out expectations for the Bank of England to tighten its monetary policy, also pulled yields lower.

Coronavirus info: New or extended restrictions were imposed in several countries, including Germany and France, and Japan announced it won’t have outside spectators at this summer’s Olympic games.

What Can We Expect from the Market this Week

The path ahead for the stock market may be a bit windier. The inflation and interest rate will be a primary source of anxiety, though we don't think that will undermine the larger expansion and bull market. The pace of gains in the second year after the market bottoming typically slowed considerably and corrections are more frequent. Nevertheless, we are still in the beginning of the recovery phase and going forward corporates are expected to deliver the required growth to catch up with the fast-rising equity markets. Reflecting back over the last one year since the start of the pandemic, a long-term strategy to investing and a disciplined approach will continue to be rewarded.

To position, consider these key drivers for the equity markets: (1) the reopening of the economy, (2) additional fiscal spending, and (3) central bank easing.

Among important U.S. economic data being released this week include the retail sales, home price index, consumer confidence, employment change, the PMI composite and jobs report.