PAST WEEK'S NEWS (May 24 – May 30, 2021)

Stocks Performance (U.S. Stocks)

The major equity markets indexes were relatively steady for most of the week, in part to a seeming lack of directional drivers.

Investors keep a close eye on the mixed economic data for the week. On the positive side, weekly jobless claims fell more than expectations, and durable goods orders increased by 1% in April, also more than expected. On the downside, some regional manufacturing gauges came in lower than anticipated, although still indicating solid expansion. Negotiations regarding the new round of infrastructure spending also continued, with Republicans unveiling a $928 billion counteroffer to President Biden’s latest proposal of roughly $1.7 trillion.

Growth shares handily outperformed their value counterparts. Facebook and Alphabet helped communication services stocks outperform within the S&P 500, and a rebound in Tesla boosted consumer discretionary shares. The light trading volumes came in advance of the long Memorial Day weekend, with U.S. markets scheduled to be closed Monday, May 31.

Advancing sectors were led by Consumer Durables sector at 5.15%, followed by Consumer Services at 3.06%, Technology Services (2.90%), and Producer Manufacturing at 2.84%. Meanwhile, the weakest sectors were from the Utilities sector at -0.90%, followed by Industrial Services at 0.05%, Health Technology (0.08%), and Distribution Services sector (0.35%).

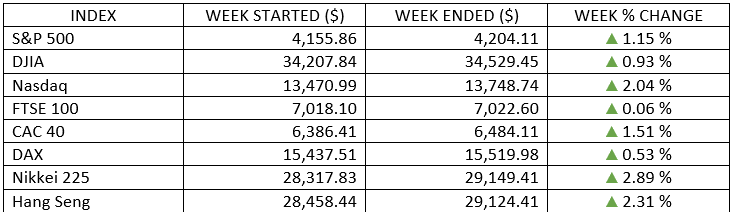

Indices Performance

Risk assets appeared to draw support from the calmness of the Treasury market, which staved off pestering inflation concerns and accompanying valuation concerns. The NASDAQ composite performed best, adding more than 2%, while the Dow Jones Industrial Average advanced closer to 1%, and S&P 500 eked out its fourth consecutive monthly rise.

Shares in Europe advanced on continued affirmations of ultra-easy monetary policy and reports of a massive U.S. fiscal spending plan.

The UK’s FTSE 100 index ended roughly flat, in part reflecting the UK pound’s appreciation versus the U.S. dollar. The reopening of the economy and comments from BoE policymaker Gertjan Vlieghe, who said the central bank could raise interest rates as soon as the first half of next year, helped the currency rise for a fifth consecutive week.

Japan’s stock markets registered a gain for the week, on signs that Japan was accelerating its COVID-19 vaccine rollout.

Oil Sector Performance

Oil posted its biggest weekly gain since the middle of last month ahead of the U.S. Memorial Day weekend that starts the country’s summer driving season.

A larger crude inventories drawdown figures by the industry and expectations of a strong rebound in global fuel demand in the Q3 helped the oil prices to push higher on the week.

Although, some market analysts seem concerned that Iranian oil might flood the market and weigh down on prices. The expectations that the Iran nuclear deal with the West (JCPOA) is set to be revived. The easing of sanctions would allow one million barrels per day of Iranian crude to flow back into global markets.

Market-Moving News

Stocks Back on Track

The major U.S. stock indexes posted modest gains in a quiet week of trading, with the S&P 500 and the Dow both rising around 1% and the NASDAQ adding more than 2%. The results left the S&P 500 and the Dow within less than a percentage point of record highs set three weeks earlier.

Growth Recovery

For the second week in a row, growth stocks chipped away at the year-to-date dominance of value-oriented stocks, as a U.S. large-cap growth index outperformed its value counterpart by a wide margin. The trend helped lift the growth and tech-oriented NASDAQ, which outperformed the S&P 500 and the Dow.

May Positive Performance

May was the sixth positive month out of the past seven for the S&P 500, which rose nearly 1%. The Dow added about 2% while the NASDAQ lagged, falling more than 1% and snapping a 6-month string of gains.

Calming Trend

A measure of investors’ expectations of short-term U.S. stock market volatility fell to its lowest level since February 2020, when the pandemic began to send stocks down sharply. The Cboe Volatility Index fell 20% for the week and was down 39% from a recent peak on May 12.

Oil Finds Traction

U.S. crude oil prices climbed more than 4% for the week to nearly $67 per barrel, the highest level since October 2018. Strong U.S. demand heading into the summer bolstered prices ahead of a key meeting of leaders from top oil-producing countries.

Inflation Watch

The measure that the U.S. Federal Reserve prefers for tracking inflation surged 3.1% for the 12-month period ended in April, exceeding the Fed’s 2.0% inflation target. Friday’s report on the increase in the price index for personal consumption reflected a surge in consumer demand as pandemic-related restrictions are rolled back.

Treasury Talk

U.S. Treasury Secretary Janet Yellen told a congressional panel that she expects the rate of inflation to remain elevated through the end of 2021 before fading next year. That outlook suggests a longer period of elevated inflation than Biden administration officials had forecast in previous public comments.

Jobs Ahead

On the positive side, weekly jobless claims fell more than consensus expectations, to a new pandemic-era low of 406,000.

Other Important Macro Data and Events

The yield on the benchmark 10-year U.S. Treasury note decreasing over the week before ending flat. Against a basket of major currencies, the dollar index edged slightly higher, rose 0.03% to stay at 90.056. EUR/USD rose 0.1%, USD/JPY added 0.84%, and GBP/USD advanced 0.28%.

U.S. equities put up a mildly negative reaction to the slight suggestion from the Fed’s meeting minutes. The minutes from the April 27-28 meeting revealed that while the Fed is not expected to make any monetary policy changes anytime soon, though, a few policymakers have suggested that the Fed begin to discuss a plan to taper their quantitative easing program. Those in favour of taper talks cited longer-term inflation worries and a faster than expected U.S. economic recovery. This is an obvious first step toward the removal of accommodation and stimulus.

The U.S. Commerce Department reported on Friday that its core personal consumption expenditure price (PCE) index increased 3.1% in the year ended in April, slightly above expectations, and the biggest increase in nearly three decades—and well above the Fed’s 2% target for its preferred inflation gauge.

The Biden administration is reportedly set to unveil a budget that would take federal spending to $6 trillion in the coming fiscal year.

Comments from Federal Reserve officials helped temper inflation fears that could spark a faster-than-expected reduction in stimulus. Treasury Secretary Janet Yellen said she sees the burst in prices as temporary, though likely to last through the end of 2021.

U.S. GDP increased at a 6.4% annualized rate last quarter. The unrevised estimated followed a 4.3% growth rate in the Q4. The U.S. labor market data also showed a stronger-than-expected data.

GDP data from Europe and Japan showed Europe in double-dip recession and Japan at risk of the same. Germany confidence, the Ifo Business Climate Index for Germany rose to 99.2 in May from 96.6 in April, its highest level since May 2019 as optimism about the economic outlook strengthened. The French economy slipped into recession in the Q1, with a preliminary estimate of 0.4% growth revised to a contraction of 0.1% due to weaker-than-expected construction data.

Switzerland walks away on a framework trade deal with the EU that would codify access to the single market because of differences over wages and immigration. The end of the 7-year talks means that existing treaties with the bloc’s fourth-largest trading partner might eventually lapse.

In Japan, the government is set to extend the COVID-19 state of emergency covering Tokyo and eight other prefectures for three weeks until June 20 as Prime Minister Yoshihide Suga noted that the situation remains highly unpredictable.

What Can We Expect from the Market this Week

Inflation is going to be a very popular word these past few weeks and expected to spill in the following week.

With few narrative-changing developments and the Q1 earnings season largely complete, it is a good opportunity to conduct a gauge check on the health of the corporate sector. Unlike the previous three quarters when the better-than-projected results were primarily a function of low expectations, the fast-rising Q1 earnings reflect broad economic strength. Demand is snapping back at a rapid pace as inflections decline, vaccinations rise, and restrictions are lifted.

Cryptocurrencies also have captured plenty of attention. The selling in the cryptocurrency market last week likely served as a reminder of volatility and liquidity in these areas has.

Important economic data being released this week including the Markit PMI index, APD national employment report, productivity growth, factory orders, and unit labour costs.