PAST WEEK'S NEWS (June 21 – June 27, 2021)

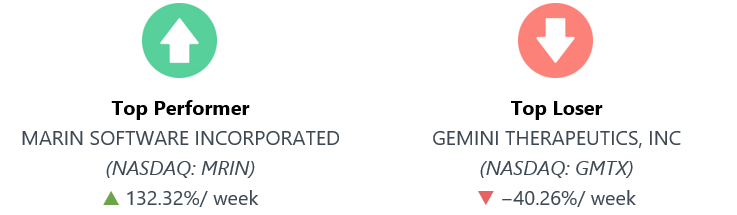

MRIN stock is trending up after the company announced plans to add Instacart management to its platform known as MarinOne. MRIN is an online advertising firm providing online ad management tools and support. Meanwhile Gemini Therapeutics shares collapsed after the company reported a disappointing preliminary data from a Phase 2a Study of GEM103, an age-related macular degeneration treating.

Stocks Performance (U.S. Stocks)

Each of the major indices bounced back from previous week's losses and rose more than 2.0% last week, as inflation fears may have factored in to ease the pressure.

The week’s economic data may have also helped calm fears about economic overheating and inflation. Several figures released during the week indicated healthy expansion but came in below consensus estimates. Durable goods orders rose less than expected in May, weekly jobless claims came in higher than expected, and IHS Markit’s PMI beat expectations and climbed to a record.

Later in the week, economically sensitive securities got a boost from news of an agreement on a bipartisan infrastructure deal. On Thursday, President Biden announced that a bipartisan group of 10 Senators had agreed on a plan for roughly $1 trillion in infrastructure spending over the next five years. The bill has yet to be drafted, however, and many expect it to face resistance from both ends of the political spectrum.

From a sector perspective, advancing sectors were led by Energy Minerals sector at 7.23%, as oil prices reached their highest levels since October 2018 on falling global inventories, followed by Commercial Services at 4.36%, Producer Manufacturing (4.04%), and Consumer Durables at 3.97%. Meanwhile, the weakest sectors were from the Communications sector at 0.56%, followed by Utilities at 0.80%, Health Technology (2.03%), and Retail Trade sector (2.15%).

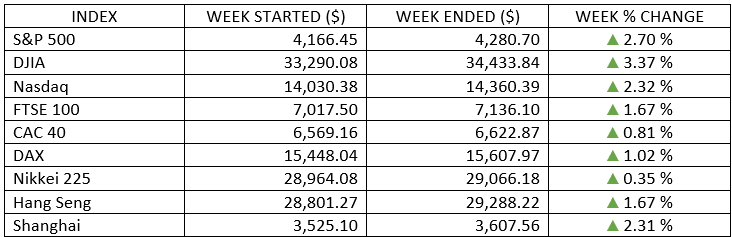

Indices Performance

After moving sideways for most of the last two months, the S&P 500 and the technology-heavy Nasdaq Composite index hit a new high last week, helping both to record their best weekly gains since early April. All the major indexes added roughly 3% for the week.

European shares rose in volatile trading, buoyed by a reaffirmation of ultra-loose monetary policy and a bipartisan agreement on a huge U.S. infrastructure spending plan.

Japanese stocks had a tumultuous start to the week, falling sharply on the first trading day before rebounding throughout the week. China’s Shanghai Composite Index rose 2.3%, ending a three-week losing streak.

Oil Sector Performance

Oil recorded its fifth consecutive weekly rises, buoyed by the pace of global COVID-19, drawdown in inventories and a recovery in demand in the U.S. and European markets.

Market-Moving News

Indexes Record Highs

U.S. stock indexes rallied on Monday, and the positive momentum extended through most of the week, lifting the S&P 500 and the NASDAQ above previous record highs set in early May and late April. Overall, the S&P 500, the NASDAQ, and the Dow added roughly 3% for the week.

Market Shift

The latest week’s stock market gains marked a reversal from the prior week, as the major U.S. indexes recovered the previous week’s losses and then some. In addition, a measure of investors’ expectations of short-term stock market volatility reversed course, dropping 25% for the week after surging slightly more than that in the preceding week.

Positive Earnings Outlook

Ahead of the mid-July start of quarterly earnings season, nearly twice as many companies that have issued guidance prior to their earnings releases raised their expectations compared with the number that lowered their forecasts. 66 companies in the S&P 500 had issued positive guidance as of Friday, while 37 had issued negative guidance, according to FactSet.

Bitcoin Volatility

The price of Bitcoin briefly tumbled below $30,000 on Tuesday. Global investors worried about disruptions from new regulations in China, which is trying to ban Bitcoin mining within its borders.

Fed's Inflation Outlook

A week after U.S. Federal Reserve members lifted their inflation forecast at their latest policy meeting, Fed Chairman Jerome Powell largely downplayed inflation concerns in testimony before Congress. Powell said he continues to believe that the recent spike in consumer prices will eventually ease, although he did acknowledge economic uncertainty will persist as pandemic restrictions are lifted.

Rise of Oil

U.S. crude oil prices climbed for the fifth week in a row, rising 4% and reaching $74 per barrel—the highest level since October 2018. As recently as early April, oil was trading below $60.

Infrastructure Breakthrough?

After months of negotiations, President Biden and a bipartisan group of senators announced an agreement on a roughly $1 trillion plan to improve the nation’s physical infrastructure. The White House will now try to move the package through Congress alongside a broader measure sought by Democrats that extends to nontraditional forms of infrastructure.

Other Important Macro Data and Events

Several figures released during the week indicated healthy expansion but came in below consensus estimates. Durable goods orders rose less than expected in May, with many analysts pointing to supply chain issues, while weekly jobless claims came in higher than expected, at 411,000. New home sales fell 5.9% in May, and previous months’ sales were revised lower, with many builders citing materials shortages and costs.

IHS Markit’s gauge of June manufacturing activity beat expectations and climbed to a record 62.6. The services gauge came in much lower than anticipated (64.8)—if off another all-time high of 70.4 in May. Finally, personal spending was flat in May, defying expectations for a 0.4% gain. Supply shortages, particularly in autos, again appeared to be at work.

Inflation fears resurfaced late in the week. The yield on the benchmark 10-year Treasury note jumped on Friday morning following a report of the core personal consumption expenditures index had risen 0.5% in May, bringing the year-on-year increase to its fastest pace (3.4%) since 2008. Treasury prices fell as yields increased.

Core eurozone government bond yields ended the week marginally higher. German bund yields initially tracked rising Treasury yields and were then lifted further by strong PMI data and business confidence readings, before fell in line with BoE dovish outlook.

BoE policymakers voted to keep the key interest rate at 0.1% and to maintain the asset purchase program until the end of the year. The central bank said inflation could reach as high as 3% and economic growth would be strong, but the increases would be temporary.

Eurozone PMI rose to 59.1 in June, the fastest pace of growth in 15 years, versus 57.1 in May, as the economy continued to reopen and the services sector posted further strong expansion, according to IHS Markit. Business confidence in the outlook, meanwhile, rose to the highest since future sentiment data were first available in 2012.

What Can We Expect from the Market this Week

Rising inflation is the exhaust produced by our speeding economy, and given the Fed's mandate to control inflation, shifts in central-bank policy will likely present speedbumps as we advance. A recalibration in interest rate and central-bank-policy expectations could trigger some volatility, though increased vaccination rates, rising consumer demand, and surging corporate profits rightfully outweigh inflation concerns.

Important U.S. economic data being released this week including home price index, job and employment report, pending home sales, PMI figures and trade balance.

A monthly employment report scheduled to be released on Friday will show whether recent moderation in jobs growth carried over into June. The last monthly report, released in early June, showed that the economy generated 559,000 new jobs in May compared with 278,000 in April and 785,000 in March.