PAST WEEK'S NEWS (June 28 – July 4, 2021)

Although the company did not report any recent news, Marin Software stock is trending up amid touts for shares on Reddit's WallStreetBets forum to collectively push back against a potential short-squeeze. MRIN is an online advertising firm providing online ad management tools and support.

Stocks Performance (U.S. Stocks)

A better-than-expected economic data help lift several stocks to new highs, although worries over the spread of the “Delta” variant of the COVID-19 seemed to rein in investor enthusiasm somewhat.

All eyes were on last week’s jobs report to gauge if the positive economic momentum from the first half of the year can be sustained in the second half. After two consecutive months of payrolls undershooting expectations, job gains surprised to the upside, as the U.S. economy added 850,000 jobs, the most in 10 months. Some slacks remain, as the unemployment number also edged higher. The data was strong enough to instil confidence about the recovery but not so strong it accelerated the Fed’s timeline to reduce its accommodation.

From a sector perspective, advancing sectors were led by Electronic Technology sector at 2.97%, followed by Health Technology at 1.68%, Technology Services (1.54%), and Consumer Durables at 1.28%. Meanwhile, the weakest sectors were from the Energy Minerals sector at -1.66%, followed by Finance at -0.75%, Non-Energy Minerals (-0.37%), and Utilities sector (-0.16%).

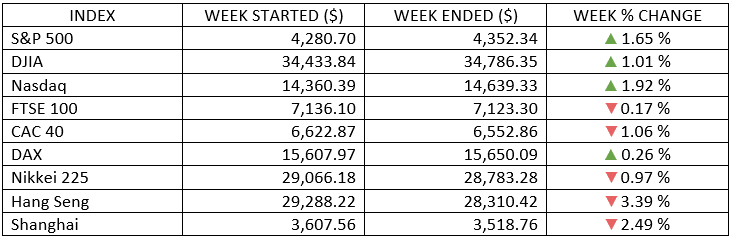

Indices Performance

It was an impressive week for the S&P 500, which extended its streak to seven straight record closes, and topped the 4300 level with ease. The Nasdaq Composite outdid the benchmark index with a 1.9% gain and its own set of record-setting performances. The Dow Jones Industrial Average advanced 1.0% and closed at its first record high since May.

European shares were mixed on worries that inflationary pressures might bring forward interest rate increases. Another headwind was the spread of a highly infectious variant of the COVID-19, which clouded the outlook for an economic recovery.

Japan’s stock market was negative for the week, as concerns on possible extension of COVID-19 restrictions is to be decided by the authorities. The restrictions are due to expire on July 11. The rebounding virus infection rates also eroded optimism about progress in the country’s vaccination drive.

Chinese stocks fell following speculation the Chinese central bank could begin tightening monetary policy, and some possible unease among overseas investors over President Xi Jinping's warning to foreign powers in a speech to mark his party's centenary.

Oil Sector Performance

WTI crude futures topped $75 per barrel amid speculation that OPEC+ will agree to a smaller-than-expected increase in supply, starting in August. An agreement was supposed to be reached on Thursday, but the week ended without an agreement. OPEC+ postponed decision to hold more talks on oil output policy, as the delay came after the UAE blocked a plan for an immediate easing of cuts and their extension to the end of 2022.

Brent was weighted throughout, before ending the week relatively unchanged, reflecting concerns about fuel demand in parts of Asia where cases of the highly contagious COVID-19 Delta variant are surging.

Market-Moving News

Indexes Steadily Rising

The major U.S. stock indexes posted incremental daily gains throughout the week, rising around 1% to 2% overall. The S&P 500 and the NASDAQ added to their record highs set the previous week, while the Dow eclipsed a record that it set nearly two months earlier.

Sectors Tug-Of-War

The second quarter produced a reversal in U.S. market leadership between the value and growth equity styles. An index of large-cap growth stocks returned nearly 12%, while its value counterpart added just over 5%. However, value remained the leader through the first half of 2021 with a 17% return to growth’s 13%, as value outperformed in the first quarter.

Midyear Check-up

The U.S. stocks extended their strong run that began in the spring of 2020. The S&P 500 posted a 15.3% return through the first six months of this year and all 11 sectors were positive. Energy had the biggest gain at 45.6%; utilities was the weakest at 2.4%.

Jobs Improvement

The pace of job growth accelerated in June. The economy generated 850,000 new jobs last month, exceeding most economists’ expectations for around 700,000. In April and May, job growth totalled 269,000 and 583,000, respectively.

Yield Pullback

Government bond prices rallied over the past three months, sending the yield of the 10-year U.S. Treasury bond down to 1.45% as of Wednesday’s end of the Q2. While that’s far below the 1.74% yield at the close of the Q1, it’s well above the 0.93% figure at the end of 2020.

Bank Bonanza

Several of U.S. banks announced plans to increase their dividend payments to shareholders in the wake of the latest round of regulatory stress tests to gauge their ability to withstand economic shocks. The U.S. Federal Reserve said all 23 banks that took this year’s stress test passed.

WTI At $75

U.S. crude oil prices rose for the sixth week in a row, eclipsing $75.00 per barrel on Thursday and Friday—the highest level since October 2018. Prices have gained around 55% year to date after starting 2021 at around $48.50.

Other Important Macro Data and Events

Some positive economic data developments throughout the week, including the June nonfarm payrolls that increased by 850,000, the June ISM Manufacturing Index checked in at 60.6% for its 13th straight month above 50.0% (expansionary activity), the Conference Board's Consumer Confidence Index for June was better-than-expected at 127.3. Weekly initial claims declined to a post-pandemic low of 364,000. Many banks increased their dividend payments after easily passing the Fed's stress test in the prior week.

The employment report, however, wasn't as strong as the headline jobs figure initially suggested. The unemployment rate (5.9%), average hourly earnings (+0.3%), and the average workweek (34.7) missed expectations, indicating the Fed’s threshold for “substantial further progress” has not yet been met. In addition, the labour force participation rate (61.6%) was unchanged, and there were higher rates of unemployment for minority groups.

U.S. Treasury yields decreased through most of the week, particularly for the longest maturities. The less robust-than-expected improvement in the labour market in two of the last three months has likely contributed to the drop in 10-year Treasury bond yields below 1.50%.

Core eurozone government bond yields also fell, reflecting growing fears about the spread of the delta variant of the coronavirus in Europe. Comments from ECB President Christine Lagarde highlighting the risk of virus variants and their potential effects on the eurozone economic recovery also weighed on yields.

Bank of England Governor Andrew Bailey reiterated the view that the uptick in UK inflation would prove transitory appeared to contribute to the decline in gilt yields.

What Can We Expect from the Market this Week

While the prospects of a strong economic recovery underpin equity markets, investors remained nervous that a sharp recovery from the pandemic could push up inflation to an uncomfortable level for the U.S. Federal Reserve. With inflation readings likely to stay elevated through the summer, accelerating job gains and a likely reduction in the Fed’s bond purchases on the horizon, we think the path of least resistance for long-term bond yields is higher.

Growth will likely slow as the economic cycle moves from recovery to expansion. But it will remain robust in our view, supporting the case for improved performance of cyclical sectors and value-style investments.

Important U.S. economic data being released this week including the and the PMI composite, JOLTs job openings, Release of June 15–16 minutes meeting of the U.S. Federal Reserve Board, weekly unemployment claims, consumer credit and wholesale inventories.