PAST WEEK'S NEWS (Aug 9 – Aug 15, 2021)

Shares of Fulcrum Therapeutics, an early clinical-stage biopharmaceutical company, are rocketing higher after an encouraging clinical trial readout. Investors excited about the company's sickle-cell disease candidate which pushed the stock 180% higher for the week. Katapult Holdings stock meanwhile plummeted, with the share price lost more than half its value in a single trading session after investors are responding negatively to its Q2 financial results. The company now trades substantially below its debut valuation.

Stocks Performance (U.S. Stocks)

Major stocks gained ground on the week, as solid corporate earnings and employment data outweighed renewed concerns of the coronavirus spread and its possible implications for future economic activity.

North American equities strung together another week of gains. In the S&P 500, value stocks outperformed their growth counterparts, to inch to fresh highs, as well as with the Dow. Meanwhile emerging markets also recovered some of last week’s losses despite Beijing continuing its regulatory crackdown.

There was also some focus on news from Washington during the first half of the week, as the Senate approved a $1.2 trillion infrastructure bill and authorized $3.5 trillion in additional spending. The bills will now be considered by the House but reports from Friday pointed to some fresh uncertainty as nine House Democrats said they won't vote for the $3.5 trillion budget resolution until the $1.2 trillion bipartisan infrastructure bill is signed into law.

Most sectors advanced, led by materials, followed by consumer staples, and financials leading the way. The energy sector finished in the red on concerns that OPEC discipline on the supply side and worries that the upsurge in coronavirus infections could weigh on global demand. Information technology stocks also lagged, driven by the pullback in the semiconductors and semiconductor equipment industry, which came under pressure from concerns about potential weakness in memory prices.

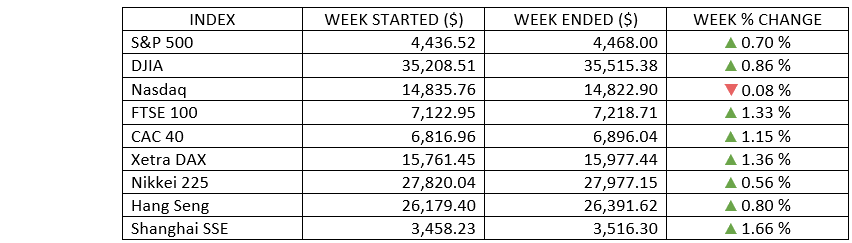

Indices Performance

The past week saw more new records in the stock market with the Dow and S&P 500 inching to fresh highs, while the Nasdaq underperformed, shedding 0.1% for the week.

Shares in Europe advanced as investors focused on the economic recovery and shrugged off worries about surging coronavirus infections in key markets and signs of slowing growth in Asia.

Japan’s stock market registered modest gains for the week as the deteriorating COVID-19 situation kept risk appetites in check as pressure grew on the government to tighten restrictions further. Chinese stocks also recorded modest gains on worries that increased government oversight of the country’s technology and private education industries would spread to other sectors.

Oil Sector Performance

Oil prices eased as demand growth for crude and its products had slowed sharply as surging cases of COVID-19 worldwide has forced governments to revive restrictions on movement.

Market-Moving News

Small Changes

The S&P 500 and the Dow rose slightly, extending their recent run of small gains amid quiet trading, while the NASDAQ posted a tiny decline for the week. For the S&P 500, Friday marked the index’s 48th record closing high of 2021.

Yield Volatility

Friday’s report on falling U.S. consumer confidence sent prices of U.S. government bonds higher, pushing yields lower. The yield of the 10-year U.S. Treasury bond fell on Friday to around 1.30%, down from 1.36% on Thursday. Yields remain far below a recent peak of 1.74% in March.

Waning Confidence

The Delta variant’s spread in recent weeks has left U.S. consumers anxious about the economic recovery. A preliminary monthly reading on Friday from a University of Michigan consumer confidence survey recorded a sharp decline from the previous month, sending the index down to its lowest level since December 2011.

Mixed Inflation Report

Although U.S. consumer prices continue to rise at a much faster pace than they have in recent years, the rate of acceleration moderated in July and was in line with economists’ expectations. The CPI rose 5.4% compared with the same month a year earlier, but July’s increase was lower than June’s rise on a seasonally adjusted basis.

Labour Data

U.S. job openings rose by 590,000 to 10.1 million in the latest monthly count, setting a record high and exceeding most economists’ expectations. The increase means there are now more job openings than unemployed Americans seeking work—a sign of an unusually tight labour market.

Labour Market Tracking to Before Pandemic Level

New claims for unemployment benefits fell for the third week in a row, with 375,000 filed in the latest weekly count. The latest figure is 12,000 lower than the previous week’s total, leaving claims near pre-pandemic levels.

Earnings Outperformance

The quarterly earnings season that’s now wrapping up is expected to produce a record number of companies beating Wall Street analysts’ revenue expectations. As of Friday, 87% of S&P 500 companies had exceeded the Q2 revenue estimates—the highest so-called beat rate since FactSet began tracking that data in 2008. Over the past five years, the average has been 65%.

Infrastructure Movement

The U.S. Senate on Tuesday passed a $1.1 trillion plan to improve the nation’s physical infrastructure before approving a Democrat-written $3.5 trillion measure that extends to nontraditional forms of infrastructure. The proposals have moved to the House, where weeks of debate are expected.

Other Important Macro Data and Events

U.S. Treasury yields tick up before retracing the move later in the week. Comments from several Federal Reserve officials supporting a sooner-than-expected tapering of the central bank’s bond purchases appeared to spur selling activity earlier in the week. And on Friday morning, however, yields largely retraced their previous moves amid the release of a highly disappointing consumer sentiment survey.

The other economic reports were close to estimates while the preliminary reading of the University of Michigan Sentiment Survey for August produced a big downside surprise. The index fell to 70.2 from 81.2, reaching its lowest level since late 2011 due to deteriorating sentiment about all aspects of the economy.

In a somewhat light week for U.S. economic data releases, all eyes were on the latest U.S. inflation numbers. The CPI increased by 0.5% sequentially in July, a deceleration from the 0.9% registered in June and the smallest month-over-month uptick since March. Core CPI, which excludes volatile food and energy costs, came in at 0.3%. This slowdown in the inflation rate appeared to align with the prevailing narrative that increases in consumer prices should prove transitory as the economy works through pandemic-related bottlenecks. However, the PPI increased by 1.0% sequentially for a second consecutive month. This uptick in PPI came in higher than many economists had expected.

Core eurozone bond yields ended roughly level, rising into midweek, and retreating on expectations that the ECB could remain dovish for longer. UK gilt yields also ended roughly unchanged, although yields rose toward the end of the week as data showed strong economic growth in the Q2, fuelling expectations that the BoE might begin to withdraw its stimulus sooner.

In vaccination development, the EU’s vaccination campaign has overtaken the U.S. in terms of administering first and second doses and should surpass the UK in the coming weeks, according to the Financial Times. The introduction of health passes for those who have been fully vaccinated so that they can visit bars, restaurants, public events, and venues sparked protests in Italy and France.

What Can We Expect from the Market this Week

Markets have been rather optimistic for much of this year, with U.S. stocks reaching a new record last week and interest rates still at historically low levels. While this does not suggest a correction is imminent, but pullbacks are a normal part of sustained bull markets.

Important U.S. economic data being released this week including retail sales growth, the leading indicators index, housing starts, and FOMC minutes.