PAST WEEK'S NEWS (Sep 6 – Sep 12, 2021)

eFFector Therapeutics, the newly public cancer company jumped last week after grabbing attention on social media about the recently de-spaced oncology company. Humanigen, Inc. stock meanwhile tumbled after the clinical-stage biopharmaceutical firm announced that the U.S. FDA has declined the company’s emergency use authorization (EUA) request to use lenzilumab to treat newly hospitalized COVID-19 patients.

Stocks Performance

Equity markets edged lower last week, weighted on several factors, including September’s reputation for being a weak month for stocks. Global growth concerns are mounting ahead of the renewed pandemic headwinds, inflation worries, and shifting ECB policy that adding new wrinkles to the outlook.

The ECB said, after its latest policy meeting on Thursday, that it had decided to move to a “moderately lower pace” of bond purchases under its PEPP for the rest of the year, after a rebound in European growth and inflation. Lagarde said that the central bank was not tapering its stimulus.

Political uncertainty may also have been at work. On Wednesday, the website Axios reported that Democratic Senator Joe Manchin backs as little as $1 trillion of Biden's $3.5 trillion spending plan, highlighting the wide gap between moderates and progressives. Manchin’s vote will be critical in passing the legislation in the evenly divided U.S. Senate.

Meanwhile, Treasury Secretary Janet Yellen said that extraordinary measures to avoid breaking the congressionally mandated federal debt ceiling were likely to be exhausted in October and warned about the economic consequences if lawmakers don't resolve the debt-ceiling issue.

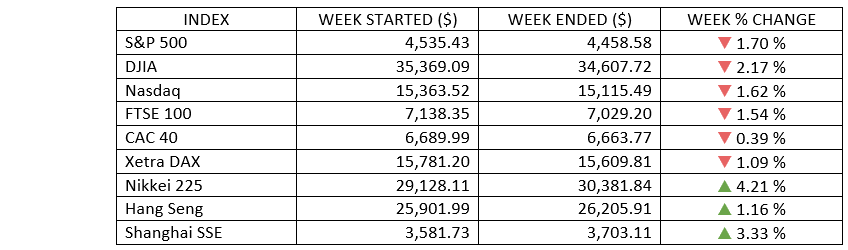

Indices Performance

The U.S. stock market had a tough four-day week, with the markets were closed on Monday in observance of Labor Day. The S&P 500 losing and closing lower in each session as buyers appeared exhausted. The Dow Jones Industrial Average declined more than 2.0% while the Nasdaq Composite posted a slightly smaller decline.

Shares in Europe weakened amid uncertainty about the economic outlook, the continuing coronavirus pandemic, and central bank policy.

Japanese equities extended their gains over the week, buoyed by political optimism and expectations of further fiscal stimulus under a new prime minister, following the decision by current Prime Minister Yoshihide Suga to step down.

Chinese stocks rose for the third straight week.

Oil Sector Performance

Oil prices settled a small weekly gains, as a decline in U.S. Gulf of Mexico output following damages from Hurricane Ida offered some support.

U.S. crude stockpiles fell last week as production tumbled the most on record due to disruptions caused by Hurricane Ida. Inventories shrunk by 1.53 million barrels, according to the EIA. The destructive storm led to a 1.5-million-barrel decline in daily crude output.

China’s government decision to release crude from its strategic reserves in an unprecedented intervention in the global market meanwhile weighted on the price.

Market-Moving News

Modest Retreat

While none of the daily declines exceeded 1%, the S&P 500 and the Dow on Friday fell for the fifth trading session in a row and ended the week down around 2% overall. The NASDAQ posted a slightly smaller decline.

Small-Cap Stall

An index of small-cap stocks continued to slip in the latest week, extending a recent run of underperformance versus their large-cap peers. The Russell 2000 Index surged nearly 20% in the first two and a half months of 2021 but has declined nearly 6% since achieving a record high in mid-March.

Value's Stumble

While both benchmarks fell for the week, an index of U.S. large-cap growth stocks outperformed a value stock index by a substantial margin for the fourth week in a row. The recent results have moved the growth style back into the performance lead over value year to date.

European Policy Shift

The European Central Bank cut back on its stimulus program amid a recent acceleration in the pace of the continent’s economic recovery and a surge in inflation. The bank kept interest rates unchanged but will slow its emergency bond purchases in this year’s Q4.

Labor Market Gain

New filings for federal unemployment benefits dropped to a pandemic-era low, with 310,000 claims submitted in the latest weekly count. That’s down from the previous week’s 345,000 figure and the lowest since March 2020.

Jobs Openings

The government reported on Wednesday that U.S. employers had a record 10.9 million job openings in the latest monthly count, exceeding economists’ expectations. July’s job openings total exceeded the 8.7 million Americans who were unemployed and seeking jobs.

Inflation Moderates

A measure of U.S. price trends at the wholesale—rather than consumer—level continued to rise at a historically high rate but slowed somewhat from the prior month’s gain. The government’s PPI rose 0.7% in August compared with the previous month, down from two straight month-to-month jumps of 1.0% in June and July.

Other Important Macro Data and Events

The 10-yr yield increased two basis points to 1.34% amid some hot PPI data for August and continued improvement in the weekly initial and continuing claims report.

On Friday, the Labor Department reported that PPI rose 0.7% in August, a slowdown from July’s 1.0% gain, but above consensus expectations for a 0.6% increase. The tight labor market signaled further profit margin challenges for firms. According to the JOLTS data released Wednesday, there were a record 10.93 million positions waiting to be filled in July, almost 1 million more than consensus estimates. Weekly jobless claims also fell more than forecast to a new pandemic-era low of 310,000.

Cryptocurrencies sold off, remind some investors about reducing their risk exposure.

Core eurozone bond yields ended slightly higher, paring earlier gains, after ECB President Christine Lagarde said the decision by the central bank to trim its emergency bond purchases was not tapering. Peripheral eurozone bond yields broadly followed yields in core markets. UK gilt yields rose amid growing expectations that the BoE may start raising short-term interest rates.

The ECB said, after its latest policy meeting, that it had decided to move to a “moderately lower pace” of bond purchases under its PEPP for the rest of the year, after a rebound in European growth and inflation. Lagarde said that the central bank was not tapering its stimulus. The ECB also raised its forecast for 2021 economic growth to 5.0% from 4.6% and its inflation projection to 2.2% from 1.9%. The central bank’s projections showed inflation peaking at 3.1% in the fourth quarter and then slowing to 1.7% in 2022 and 1.5% in 2023.

What Can We Expect from the Market this Week

A government report scheduled to be released on Tuesday will show whether the recent spike in consumer prices carried over into August. The CPI released last month showed that prices surged 5.4% for the 12-month period that ended in July. While high, that figure was in line with expectations and lower than June’s rise on a seasonally adjusted basis.

Another important U.S. economic data being released this week include retail sales growth, the Michigan Sentiment index, and Treasury budget. Also scheduled for the week is the IEA oil market report and OPEC monthly report.