PAST WEEK'S NEWS (Nov 15 – Nov 21, 2021)

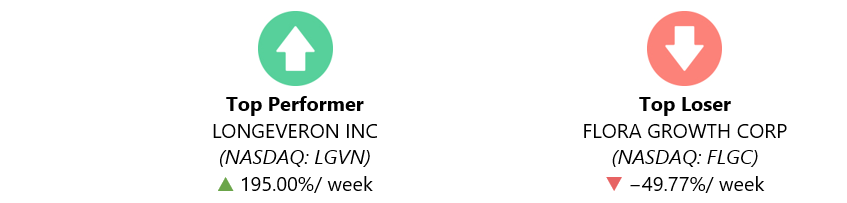

Shares of Longeveron Inc. rocketed on very active morning trading Thursday, after the biotechnology company said its Lomecel-B for the treatment of a congenital heart defect in infants was granted approval by the FDA. Trading volume exploded to 112.0 million shares, compared with the full-day average of about 110,000 shares. The stock, which went public in February, was both the biggest gainer and most active on major U.S. exchanges.

Cannabis company Flora Growth Corp. stock plummets on announcing pricing of $30 million IPO.

Stocks Performance

The major indexes ended the week mixed as investors weighed strong economic and profits data against inflation fears, ongoing supply strains, and a rise in coronavirus infections in some regions.

Several signs that the economic expansion was regaining momentum seemed to support sentiment early in the week. On Tuesday, the U.S. Commerce Department reported that retail sales jumped 1.7% in October, the biggest gain since March. President Biden’s two major economic packages also supported momentum. On Monday, he signed into law a $1.2 trillion measure to upgrade traditional infrastructure. While on Friday, the House passed a larger package addressing human infrastructure needs. That proposal now heads to the Senate, which is expected to trim the measure in terms of price and policy scope.

Rising COVID-19 cases in parts of Europe, the United States, and elsewhere meanwhile weighed on financial markets. In Europe, Austria initiated a national lockdown, while Germany said it may consider a similar move to combat the surge in new cases.

From a sector perspective, the information technology, consumer discretionary, retail trade and utilities sectors were the only sectors that closed higher. A solid gain in Amazon.com shares and a partial rebound in Tesla boosted consumer discretionary stocks, while strength in Apple supported information technology shares.

The energy, financials, materials, and industrials sectors fell noticeably. Energy stocks dropped alongside oil prices after China and the U.S. discussed releasing strategic reserves and U.S. inventories rose for the first time in five weeks.

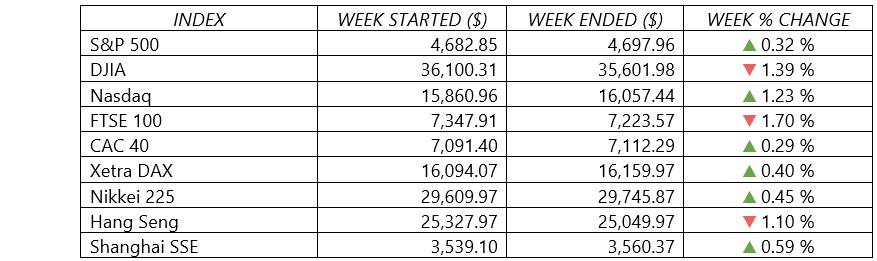

Indices Performance

The S&P 500 and Nasdaq Composite which have more exposure to mega-cap growth posted modest gains, recovering from their small losses in the previous week. While the Dow Jones Industrial Average, which are more exposed to cyclical names, ended the week lower.

Shares in Europe were little changed, as a surge in the number of coronavirus infections clouded the economic outlook.

Japan’s stock market returns were muted over a week that saw the government announce a larger-than-expected stimulus package, with the Nikkei 225 Index rising 0.46%. Prime Minister Fumio Kishida’s government approved a larger-than-expected stimulus package, with record fiscal support of JPY 55.7 trillion (around $490 billion).

Chinese markets ended mixed for the week. Disappointing earnings and revenue from e-commerce giant Alibaba Group Holding for the September quarter topped off a week that saw more negative headlines on the economy amid a scramble from real estate firms to raise funds.

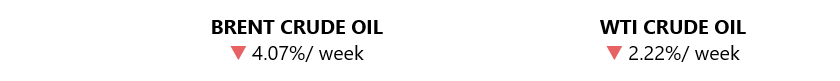

Crude Oil Performance

U.S. crude oil prices fell for the fourth week in a row, on concern about an impending oversupply and debate about the United States and other major economies potentially tapping oil reserves has been among the factors that have sent prices lower.

On Thursday, oil fell to six-week lows after the U.S. reportedly asked some of the world's largest oil consuming nations - including China, Japan, India, and South Korea - to consider releasing crude stockpiles in a coordinated effort to lower global energy prices and help with economic recovery.

The U.S. move reflects frustration with the OPEC and allies such as Russia who have rebuffed Washington's requests to speed up oil production as the world economy rebounds from the pandemic. The OPEC+ for now is maintaining an agreement, gradually unwinding record production cuts made in 2020 by raising output by 400,000 barrels per day per month.

The release of the weekly U.S. EIA report showing a large fall in inventories did little to stop the selling. U.S. crude oil inventories fell by 2.1 million barrels last week, government data showed, running against analyst expectations for a build of 1.4 million barrels.

Other Important Macro Data and Events

U.S. Treasury yields ended Thursday little changed relative to last week’s levels but decreased Friday morning on concerns that Germany could follow Austria in implementing another nationwide lockdown to fight COVID-19. The 10-yr yield declined four basis points to 1.56%. The U.S. dollar index rose 1.0% to 96.03.

The economic data, meanwhile, was encouraging. Retail sales for October, industrial production and capacity utilization for October, the NAHB Housing Market Index for November, and the Philadelphia Fed Index for November were each better than expected. Weekly jobless claims also showed continued improvement.

Despite inflation concerns and the Delta variant’s spread, U.S. shoppers continued to spend at an increasing pace in October, extending a recent run of strong retail numbers. Sales at retail stores, restaurants, and online sellers rose a seasonally adjusted 1.7% compared with the previous month—the biggest such monthly gain since March of this year.

Earnings wrap - Figures from the just-completed quarterly earnings season show that profits at S&P 500 companies climbed an average 39% compared with the same quarter a year earlier, according to FactSet. That’s the third-largest quarterly increase since 2010. Materials posted the strongest earnings growth at the sector level, surging by 90%.

Rising COVID-19 cases in parts of Europe, the United States, and elsewhere weighed on financial markets. European countries began reimposing stricter restrictions to curb the spread of the coronavirus. Last week, Austria had initiated a national lockdown, while the Netherlands announced a three-week partial lockdown of its population. Germany, which is suffering from a record increase in infections, introduced a three-step system of progressively tougher controls depending on hospitalization rates in each region. Health Minister Jens Spahn said a lockdown could not be ruled out. Belgium mandated a wider use of masks and enforced working from home, as did Ireland. Meanwhile, the UK, which has one of the highest infection rates, expanded its vaccine booster program to people over 40 years old.

Core eurozone bond yields fell on dovish comments from ECB President Christine Lagarde. She pushed back against interest rate increases on the grounds that inflation would fade and indicated asset purchases could continue beyond the expiry of the Pandemic Emergency Purchase Programme. Further coronavirus restrictions in Europe also added to downward pressure on core yields. Peripheral eurozone bonds broadly tracked core markets. UK gilt yields ended the period broadly unchanged following the ECB’s dovish signals.

UK GDP growth slowed to a 1.3% rate in the three months ended September 30, down from 5.5% in the Q2 and below the 1.5% forecast by the Bank of England. Shortages of goods, labor, and components and rising coronavirus cases weighed on activity. However, the monthly rate of expansion in September was 0.6%—an improvement from 0.2% in August—due to increased health care activity, although data for previous months were revised lower.

What Can We Expect from the Market this Week

Wednesday will yield a large number of economic reports in a holiday-shortened week, as the Thanksgiving holiday approached. Releases are scheduled on everything from quarterly GDP to U.S. Federal Reserve meeting minutes, weekly unemployment claims, the PCE index, the PMI composite and more.

U.S. markets will be closed Thursday due to the Thanksgiving holiday, and markets will close early for the day on Friday.

Wall Street also seemed to be on the lookout for the announcement of the next Federal Reserve Chair—in particular, whether President Joe Biden would reappoint current Chair Jerome Powell or instead promote Fed Governor Lael Brainard, who is widely viewed as among the most “dovish” of Fed officials. While many continued to view Powell’s renomination as the most likely outcome, the growing chance of Brainard’s appointment may have weighed on financials shares by lowering interest rate expectations and, therefore, banks’ lending margins. Some also believe that Brainard would pursue more stringent bank regulations.