PAST WEEK'S NEWS (Feb 21– Feb 27, 2022)

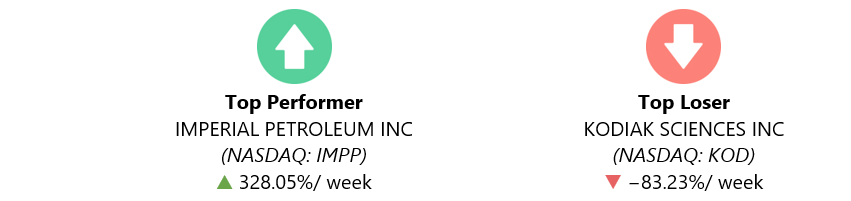

Imperial Petroleum Inc. jumped as crude oil prices rose above the $100-mark after Russia’s attack on Ukraine ratcheted up concerns over supply disruptions. Imperial Petroleum, last month, announced pricing of upsized $12 million underwritten public offering.

Shares of the clinical-stage biotech Kodiak Sciences plunged for the week, in response to its lead product candidate, KSI-301, failing to meet the primary endpoint of a combined phase 2/3 trial as a treatment for wet age-related macular degeneration (wet AMD).

Stocks Performance

Equity markets struggled to find direction this past week as tensions between Russia and Ukraine continued to take center stage, driving market volatility and a flight to safe-haven assets. These heightened geopolitical risks come on top of a market already grappling with ongoing elevated inflation pressures, and rising Fed rate-hike expectations.

Volatility spiked last week as Russia launched a full invasion of Ukraine on Thursday, and Western countries responded with sanctions. Although a Russian incursion into Ukraine had been widely anticipated, investors appeared surprised by Russian President Vladimir Putin’s decision to launch a broad-scale invasion beyond the breakaway Donbass region. Over the previous weekend, Putin recognized the independence of the so-called Luhansk and Donetsk People’s Republics in eastern Ukraine and announced their occupation by Russian “peacekeeping” troops. The sell-off intensified on Thursday after Russia launched what Putin called a “special military operation” to “demilitarize” Ukraine. Russian forces, striking from Russia, Belarus, Crimea, and the Black Sea, attacked military targets in a number of Ukrainian cities. The events represent a major escalation in the conflict, marking the worst security crisis Europe has witnessed in decades.

Stocks rallied at the end of the week after Russian government spokespersons stated that Russia was ready for negotiations with Ukraine and that it was prepared to send a delegation to Minsk—the capital of Belarus—for talks. Investors may have also been reassured that Western sanctions against Russia were not as severe as some feared, particularly regarding its energy sector. The U.S. and other Western countries imposed sanctions, targeting Russia's major banks and restricting exports of technology. Yet the sanctions stopped short of removing Russia from the SWIFT payment system and cutting off energy purchases from Russia.

Several favourable corporate earnings reports and upside surprises in economic data may have also fostered the rebound on Friday. The Federal Reserve’s preferred inflation gauge, the core personal consumption expenditures price index, rose 5.2% over the year ended in January, up from the prior month’s pace and in line with estimates. Pending home sales tumbled to a nine-month low in January and IHS Markit’s flash PMI revealed that the U.S. manufacturing and service sectors were growing at a faster pace.

In sectors, the defensive-oriented health care, real estate, and utilities sectors led gains for the week. Resilience in Internet giants Alphabet and Meta Platforms supported communication services stocks. The consumer discretionary sector meanwhile underperformed as the turmoil in Europe weighed on travel-related shares. Consumer staples and financials sectors also closed lower.

Indices Performance

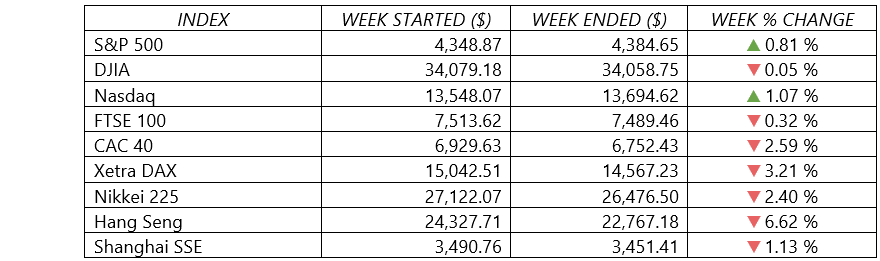

The major U.S. stock indexes made a huge comeback, after selling off early in the week on a worsening Russia-Ukraine situation. The S&P 500 ended the week with a 0.8% gain after being down as much as 5.4% from last Friday's close. The volatility pushed the S&P 500 Index into official correction territory. This marks the first full correction since the pandemic low of March 23, 2020. The Nasdaq Composite gained over 1.0% after being down as much 7.1% and the Dow Jones Industrial Average ended essentially flat after being down 5.3% intraweek.

Shares in Europe fell as Russia’s invasion of Ukraine fuelled fears of higher inflation and an economic slowdown. Germany’s DAX Index, one of the most exposed to Russia, declined more than 3%. Ongoing caution about the conflict between Russia and Ukraine also weighed on Asian stocks.

The impact of the Russian-Ukrainian war and resulting international economic sanctions weighed heavily on Russia’s stocks and its currency. A Russian equity index tumbled 33% on Thursday but climbed about 19% the next day. The ruble shed about 8% on Thursday before gaining around 3% on Friday.

Crude Oil Performance

The price of U.S. crude oil briefly topped $100 per barrel on Thursday morning—the first time that threshold has been reached since 2014. The spike came in the hours after the Russia-Ukraine war broke out. The energy markets are likely the most exposed to the conflict, given the fact that Russia’s single largest export is crude, while being the world’s third largest producer, with 10% of global supply.

At the same time, the potential return of more than 1 million bpd of crude from Iran to the market kept a lid on prices.

Other Important Macro Data and Events

For much of the week, investors rushed into perceived safe havens, driving longer-term U.S. Treasury yields lower and the U.S. dollar higher, particularly against the Russian ruble and other emerging markets currencies. Gold closed above $1,900/oz for the first time since last June, as investors sought a safe haven from geopolitical risk.

Various nations around the world condemned Russia’s actions, and the U.S., the UK, and other European powers made good on their promise to implement new sanctions in response. The EU and the UK began imposing sanctions included export controls on certain technologies and financial penalties on parliamentarians, the defense minister, wealthy individuals, and banks. The UK also said it would stop Russian companies from raising capital in Britain and banned Russian airline Aeroflot. Germany halted approval of Gazprom’s Nord Stream 2 pipeline, which would transport natural gas from Russia.

In the U.S., there is a ban on American firms and individuals trading and investing in the secondary market of new Russian government debt. However, Russia, so far, has not been cut off from the Society for Worldwide Interbank Financial Telecommunication (SWIFT), an international banking and messaging network.

Japan meanwhile adopted a first set of sanctions on Wednesday, addressing the issue in cooperation with the international community. This comprised visa suspensions and asset freezes for individuals connected to Donetsk and Luhansk, a ban on imports and exports from these regions, and the prohibition of the offering and issuance of new sovereign bonds by the government of Russia in Japan. A second set of sanctions, more stringent and closely coordinated with the U.S. and Europe, was announced on Friday, following Russia’s invasion of Ukraine. This included export controls on semiconductors and other high-tech products, a freeze on some Russian banks’ assets, and a suspension of visa issuance for certain Russian individuals and entities.

The week’s earnings reports and economic data meanwhile seemed to take a back seat to the geopolitical tensions. A measure of inflation that the U.S. Federal Reserve uses to help set monetary policy climbed at the highest monthly rate since 1983. The government on Friday said core personal consumption expenditures price index rose at an annual rate of 5.2% in January. The same report showed that consumer spending rose 2.1%.

Pending home sales tumbled to a nine-month low in January amid historically low inventory and eroding affordability in the housing market as mortgage rates rise. IHS Markit’s flash purchasing managers’ indices (PMIs) for February revealed that the U.S. manufacturing and service sectors were growing at a faster pace following an omicron-related lull in January.

What Can We Expect from the Market this Week

A busy week is setting up for investors as they monitor the impact of the war in Ukraine on global markets, energy prices and commodities, adding to investor anxiety over the pace and impact of interest rate hikes and inflation trends. While confidence gets shaken, markets also tend to gravitate toward the more sustainable drivers of returns, such as economic and earnings growth. Fundamental conditions remain supportive enough to prevent the current correction from becoming worse.

Important economic data being released this week include the unemployment rate and hourly earnings growth. The monthly U.S. labor market update due out on Friday will show whether the strong growth recorded in January carried over into February.

The oil market will also be in the spotlight as Russia-Ukraine developments play out and the prospect of higher production out of Iran is weighed. And one of the biggest wildcards of the week will be the decision on Wednesday by OPEC on production boosts.

Companies heading into the earnings confessional amid the tense geopolitical backdrop include HP, Lucid Group, Target and Costco. There is also a heavy roster of FOMC speakers and Fed Chairman Jerome Powell will be giving testimony on Capitol Hill.